Pension fund to get State assets boost

Pilot program to begin in several provinces and expand in 2018

China will transfer a chunk of State financial assets to its social security funds, a program experts believe will ease the pressure of pension payments as the aging population continues to grow.

Ten percent of State-owned equity, including shares of State-owned enterprises and financial institutions, will be transferred to the National Council for Social Security Fund and smaller, local State-owned companies, the State Council, China's Cabinet, announced in a document on Saturday.

The pilot program will begin with three to five SOEs and two central financial institutions in several provinces this year. The program aims to make up for possible shortfalls in the nation's pension provisions and will be expanded in 2018 to involve more State-owned companies, the document said.

The recipients of the transferred shares will be able to earn dividends and sell their shares, but they will not be involved in the contributing parties' management, the document said. A three-year freeze from the time of the transfers will be placed on recipients selling the shares.

The National Council for Social Security Fund can set up a pension fund management company to independently operate the transferred assets.

These moves will ensure the sustainable development of China's pension insurance system, while also diversifying the capital structure of wholly State-owned companies as part of an ongoing reform to improve their market efficiency and competitiveness, the Ministry of Finance said on Saturday in an online statement.

"The transfer program will cut the burden of the working generation by expanding the pension fund scale without raising taxes or pension contribution rates," it said.

The Finance Ministry also said that the program is not aimed at selling off State-owned assets to meet the pension obligations. Rather, it is a long-term measure that supplements social security funds and optimizes the structure of State-owned capital.

By about 2050, China's aging society will peak at more than 480 million people over the age of 60. This will be about 35 percent the Chinese population, according to Xinhua News Agency.

"China will face a severe challenge in meeting its pension obligations," Chu Fuling, director of the Institute of Social Security Studies at the Central University of Finance and Economics in Beijing, told Xinhua on Saturday.

In 2016, China's basic pension pool took in 2.85 trillion yuan ($430.1 billion) and spent 2.57 trillion yuan. China still has a total of 3.65 trillion yuan in pension reserve. "On the whole, China is looking very good right now," said Chu. "But the issues lie in geographical imbalances, such as provinces where economic growth is behind the national average."

For example, the three Northeast China provinces of Liaoning, Jilin, and Heilongjiang ranked below the national average GDP growth rate of 6.9 percent in the first half of this year. Liaoning ranked lowest of all provinces, scoring only 2.1 percent, according to the National Bureau of Statistics.

This means fewer people are employed so less is contributed to the pension pool in those regions, which could result in a deficit while more people are laid off or retire from old industrial jobs in the struggling local State-owned industries, Chu said.

"The new program will be another crucial channel supporting our social security safety net," he said, adding that the other three main channels are individual payment, government subsidies, and strategic reserves.

"Transferring state assets to the social security fund will ease the pressure of pension payments and put people's minds at ease," Chu said.

Jin Weigang, president of the Chinese Academy of Labor and Social Security, told Xinhua that the new program will help China bolster its strategic pension reserve as its aging population continues to grow.

"It will ensure future Chinese can get their pensions on time," he said. The next step will be building the specific laws and regulations to manage this program and the transfer of assets, he added.

China Daily-Xinhua

?

Today's Top News

- Tariff exemption highlights China's hub role

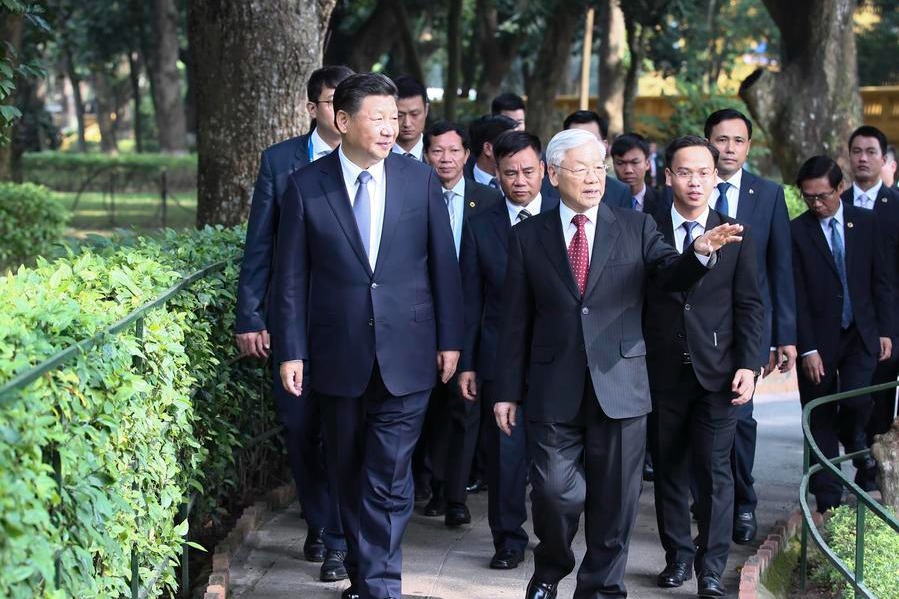

- Neighbors prioritized in diplomacy

- Beijing-Jakarta partnership beyond trade

- Xi, Indonesian president exchange congratulations over 75th anniversary of diplomatic ties

- Tradition, tea, and tomorrow: Xi's stories with Vietnam

- Weaponizing 'fentanyl' toxic prescription