China's reforms are the right pill for turbulent '20s

Even before the COVID-19 pandemic erupted, the 2020s were going to be an economically turbulent decade. International financial structures-especially the dominance of the dollar and, in Europe, of the euro-look wobbly. Aging populations are certain to stress the financial viability of many governments. And the specter of protectionism threatens both gains from trade and the ability of countries to make the best use of their economic capabilities.

The novel coronavirus is just a trigger that has moved forward many long-term dangerous trends that were already in progress.

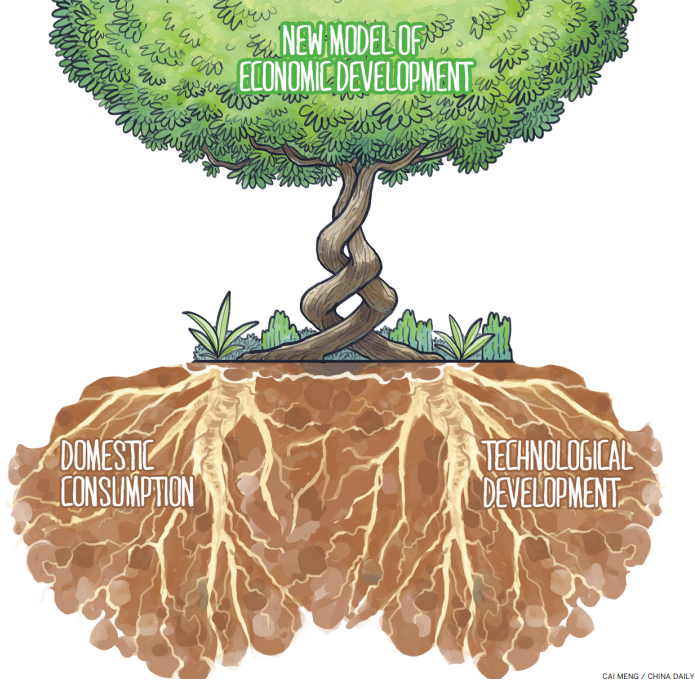

While maintaining a strong commitment to continuing opening its economy, China is necessarily responding to turbulence, uncertainty, and outright hostility by shifting toward a new model of economic development that focuses on making the best use of the country's huge domestic demand and indigenous innovation capabilities.

As the culmination of a long series of market-oriented reforms that have sharply raised the real incomes of ordinary Chinese people and created more and more capable institutions, this shift away from an export model based on low-cost labor is both necessary and also a very good thing for China.

In remarks delivered at a symposium with corporate leaders in Beijing on July 21, President Xi Jinping said that China must focus its strength on its own affairs and work toward a new model of development in which the domestic economic network takes the primary role, with the domestic and international economic networks complementing each other.

It is important to understand that this is not a move away from globalization. The many recent reforms designed to further open up the Chinese market will continue.

Xi ruled out the possibility that China would close its doors during the process, saying that the country will instead fully unleash the potential of its domestic demand, enable better connectivity between the domestic and international markets, and better employ the two markets and resources in order to attain more vigorous and sustainable development.

There are two types of globalization. One type, which is sustainable and beneficial, emphasizes two-way trade in goods and services that allows countries, companies, and individuals to become richer by specializing in the types of production they are best at.

China's highly specialized industrial clusters and very good infrastructure are an essential part of the global supply chains that have increased world productivity over the last few decades. This type of globalization has been a boon to the world.

The other type of globalization based on US consumption financed by a long series of loans from China, Japan, and others is less sustainable. It was probably coming to an end soon, regardless of the politics and even without the virus.

Just based on the wording, a trade surplus sounds like a good thing and a trade deficit sounds like a bad thing. But it's important to understand exactly what is going on. The deficit country (the US) is borrowing money from the surplus country (China) in order to buy the products of the surplus country. That is, the surplus country is financing the purchases of consumers in the deficit country.

The US has been running large trade deficits (that is, borrowing large amounts of money from foreigners) since the late 1960s. First, Japan lent most of the money. Later, China became a big lender.

This has gone on for a very long time, but creditors are not willing to lend money forever. As Herbert Stein, chairman of the President's Council of Economic Advisors under president Nixon famously formulated in what is called Stein's Law, "Anything that is unsustainable, will stop."

In the late 19th century, Britain ran large trade surpluses while the US and some other then-industrializing countries ran large deficits. This was sustainable and a good thing for the US because the British capital was used for real investment in railroads, factories, and other productivity-enhancing factors of production. At that time, it was easy for the US to pay back its debt because the investment raised GDP far more than the amount of the loans.

On the other hand, the recent international loans to the US were largely used to finance consumption, either personal or government. Since this does not increase productivity, it will eventually become difficult for the US to pay back its debts.

The end of this long reliance on international borrowing will be a big shock to the US economy. No one knows exactly when it will happen, but it's likely that the change will occur sometime in this decade.

The end of the US role as the consumer of last resort may have been hastened by the coronavirus and the trade war policies, but it was going to happen anyway. Regardless of the politics, this deficit-financed international trade model is not sustainable in the long run.

To make matters worse, the post-WWII "baby boom" generation will fully retire in the next few years, further increasing demand for government-provided healthcare and retirement funds. So, the US government budget will be under even more pressure.

The US Fed will be strongly incentivized to print more dollars to pay for out-of-control budget deficits. In these circumstances, it is unlikely that international creditors will be willing to continue to lend large sums of money at near-zero interest rates.

China's new economic model can be viewed partly as a way of preparing for this shock while at the same time working to keep the sustainable benefits of openness and international trade. But, more importantly, the new model is a response to fundamental changes in China made possible by rising incomes and long-term improvements in productivity.

In the first few years after joining the World Trade Organization in 2001, Chinese industry depended on low labor costs to attract foreign investment and foreign customers. But, unlike some other developing countries, China did not rely primarily on turnkey factories run by parachuted-in foreign managers.

In many industries, local Chinese businessmen quickly developed the entrepreneurial and production skills needed to compete with foreign companies. So, China developed clusters of industries that quickly became the best in the world in their specialty.

These types of clusters are extremely difficult to duplicate, so it won't be easy to duplicate productive capability outside of China.

At the same time, the government invested in infrastructure and education, that allowed industry to move toward higher value-added, higher tech production.

China is way beyond the point that its economic model should be based on low-wage manufacturing of low value-added consumer goods for export. Its institutions, infrastructure, and technology are now near world-class and are improving rapidly. Plus, wages rose rapidly over the last decade, so Chinese consumers have the wherewithal to support the country's industry.

Some export-oriented manufacturers will face a big challenge shifting toward the domestic market. But most of these companies are led by entrepreneurs who have built their careers on overcoming tough challenges. Most of them will land on their feet.

The new economic model is actually a continuation of policies implemented over past years that have led to an advanced, more highly value-added industrial structure. It is a highly beneficial shift away from the old export model based on low-cost labor.

Furthermore, it is made necessary by the potential weakness of the US dollar and the financial unsustainability of large US trade deficits. It is one more logical step in a long series of productivity-enhancing market-oriented reforms and a necessary way to prepare for the turbulent twenties.

The author is a senior staff commentator at China Daily.