Optimistic GDP figures expected in second quarter

China is expected to maintain a neutral monetary policy in the second quarter, as stronger investment will lead to a solid economic recovery, while there should be additional risk-control efforts, economists said on Monday.

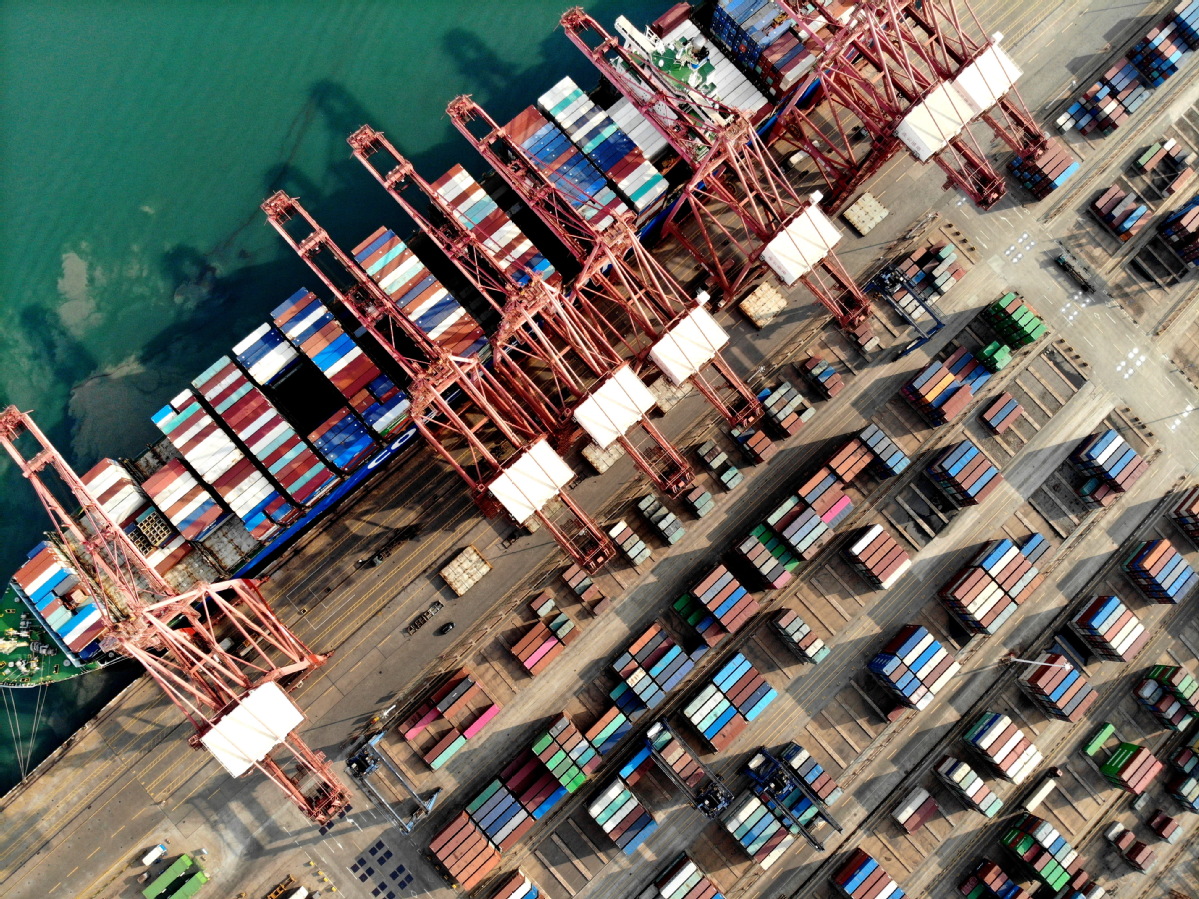

With consumption continuing to recover and exports remaining strong, the world's second-largest economy is expected to maintain robust GDP growth in the second quarter. Investment in the manufacturing industry may rebound, following a recovery of industrial profit growth, they said.

A senior official from the central bank, the People's Bank of China, stressed last week the importance of boosting lending to the manufacturing sector. Measures will guide financial institutions to raise medium to long-term loans and maintain reasonable growth of credit to manufacturers, especially high-tech firms, said Zou Lan, head of the central bank's financial market department.

China's manufacturing purchasing managers index increased to a stronger-than-expected 51.9 in March, up from 50.6 in February. Some indicators of inflationary pressure, especially producer price inflation, are on the rise due to a global boom in commodity prices and the domestic antipollution measures in northern China, said Lu Ting, chief China economist at Nomura Securities.

A higher reading of the leading indicators of economic performance may give a boost to market sentiment. But the latest economic data won't have a material impact on policymaking and the central government will stick to its "no sharp shift" stance, Lu said.

The latest public speech in late March by Yi Gang, the central bank governor, pledged that China will continue to conduct a "normal" monetary policy and maintain its consistency, stability and sustainability.

"China still has space in terms of providing liquidity and moderating interest rates," Yi said, adding that the monetary policy should strike a good balance between supporting growth and preventing risks.

The broad money supply, or M2, is growing at 10 percent currently, and the pace is in line with nominal GDP growth. The 10-year treasury bond yield is around 3.2 percent, and the seven-day reverse repo rate, one of the central bank's policy rates, is at about 2.2 percent.

"But as the foundation of domestic economic recovery is not solid and inflation is unlikely to constrain policies, the monetary policy should not be tightened in the short term," said Shen Jianguang, chief economist at JD Digits, the digital technology subsidiary of JD.com.

Beijing has set a target of at least 6 percent growth for 2021, which is relatively lower compared with the "above 8 percent" projections made by many international organizations and financial institutions.

"We are projecting strong growth this year at over 8 percent, and it is on the back of containing the pandemic and seeing the manufacturing sector recovering very quickly," International Monetary Fund Managing Director Kristalina Georgieva said last week.

With the swift economic recovery that has returned to the pre-pandemic level, policymakers may turn their attention to controlling potential risks, especially to rein in property sector bubbles and constrain the rise of government debt, analysts said.

"Influences of external factors should also be considered," said Shen. Monetary easing overseas and the massive fiscal stimulus in some developed economies may push up inflation, which will lead to currency depreciation, including the US dollar. "So, it is necessary to promote the international usage of the Chinese renminbi."

The US administration proposed an investment plan last week, which would put more than $2 trillion of government funding into traditional infrastructure, such as roads and bridges. It also includes large manufacturing subsidies, and seeks to address climate change with plans to upgrade homes and other buildings and facilitate the use of electric vehicles.

The US fiscal stimulus package and the extent to which it lifts the US economy and its trading partners, will affect the demand for exports in China and some Asian countries, said Hoe Ee Khor, chief economist at the ASEAN+3 Macroeconomic Research Office.