Targeted loan policies help city's small businesses

Home to 800,000 market entities, most of which are micro, small and medium-sized enterprises, Taizhou city in Zhejiang province has carried out a series of reforms to promote growth.

Financing difficulties, which result from the information asymmetry between businesses and commercial lenders, are common obstacles that smaller enterprises face in the course of development.

To tackle such problems, Taizhou was the first place in the country to launch a credit information sharing platform for banks to evaluate the credibility of companies applying for loans in 2014.

The platform collects company business data from 30 departments, including finance, market regulation, court, public security, tax, human resources and social security, housing and environmental protection. All the data is made available to banks.

To date, it has accumulated over 430 million pieces of credit information on more than 800,000 market entities.

In 2015, the State Council, China's Cabinet, approved the setup of a reform and innovation pilot zone for financial services for micro and small enterprises in Taizhou. Since then, the city has ramped up financial support for these businesses.

Based on the credit information sharing platform, Taizhou established a database of companies with no loan history and offers them targeted loan plans. Digital technologies are also applied to upgrade and extend the platform to cover more areas, such as science and agriculture.

It slashes the waiting time for borrowers, giving micro and small businesses easier access to financing.

Zhejiang Shuangyanjing Wine Co, a small wine producer in Taizhou, is one of the platform's beneficiaries. It lacked the liquid capital to handle increasing orders and the Zhejiang Tailong Commercial Bank evaluated its credibility on the platform and decided to offer a loan. It took only two days for the company to get the 2 million yuan ($287,000) it needed.

Reliable information also helps banks reduce operating costs and better evaluate company credibility before offering loans.

Recently, Chen Dong, a loan officer from Taizhou Bank, received an application from a local mold manufacturer. During the credibility evaluation procedure, Chen checked the company's information on the platform. Having found that its legal representative was accused of involvement in fraud in 2016 and that the company presented a high business risk, he rejected the loan application.

Thanks to the platform, the number of micro and small enterprise borrowers in Taizhou increased from 240,000 in 2015 to 577,600 in late October 2022. Their loans are worth 611 billion yuan, accounting for 45.5 percent of the city's total loan balance, nearly 20 percentage points above the national average.

A lack of guarantees is another barrier for micro and small enterprises in getting financing.

To address the issue, the Taizhou government has set up a credit guarantee fund. Established in 2014, the Taizhou Credit Guarantee Fund has cooperated with 44 banks and serves businesses around the city.

"The credit guarantee fund helps micro and small enterprises get financing and reduces their costs," said Zheng Qiang, an official at the fund.

Together with the Taizhou Branch of the Zhejiang Tailong Commercial Bank, the fund has also introduced financial products for businesses and farmers in three underdeveloped counties in the city: Tiantai, Sanmen and Xianju.

The guarantee fee rate has been reduced from 0.75 percent to 0.5 percent in the three counties, and in some even less developed villages, the fees have been eliminated.

"We want to join the efforts to turn Zhejiang into a demonstration zone of common prosperity by helping villagers and micro and small enterprises," Zheng said.

Yu Yin contributed to this story.

- Photographers capture rare Chinese mergansers in Jilin

- 5.0-magnitude quake strikes sea areas near Taiwan's Taitung County: CENC

- CPC rolls out education campaign to implement conduct-improvement rules

- Pioneering Chinese scientists shaping future of 2D metal research

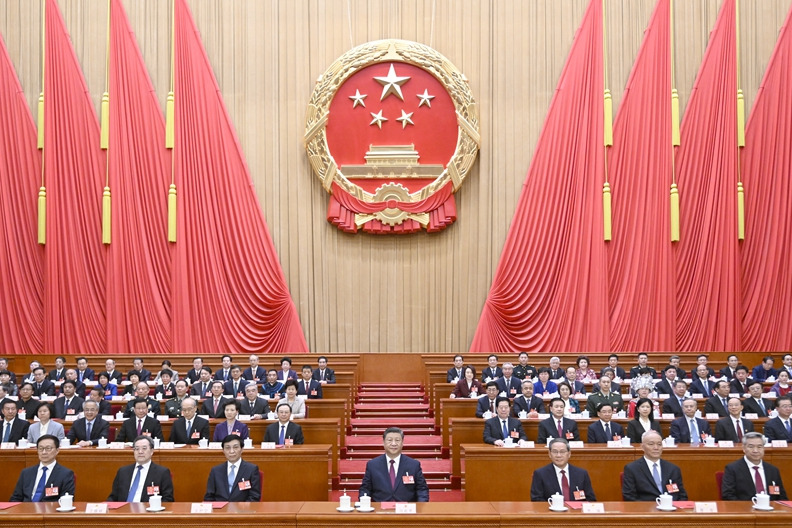

- Chinese premier chairs State Council executive meeting

- Chinese researchers find new fungal species on Qinghai-Tibet Plateau