Lower prices reveal gap between supply, demand

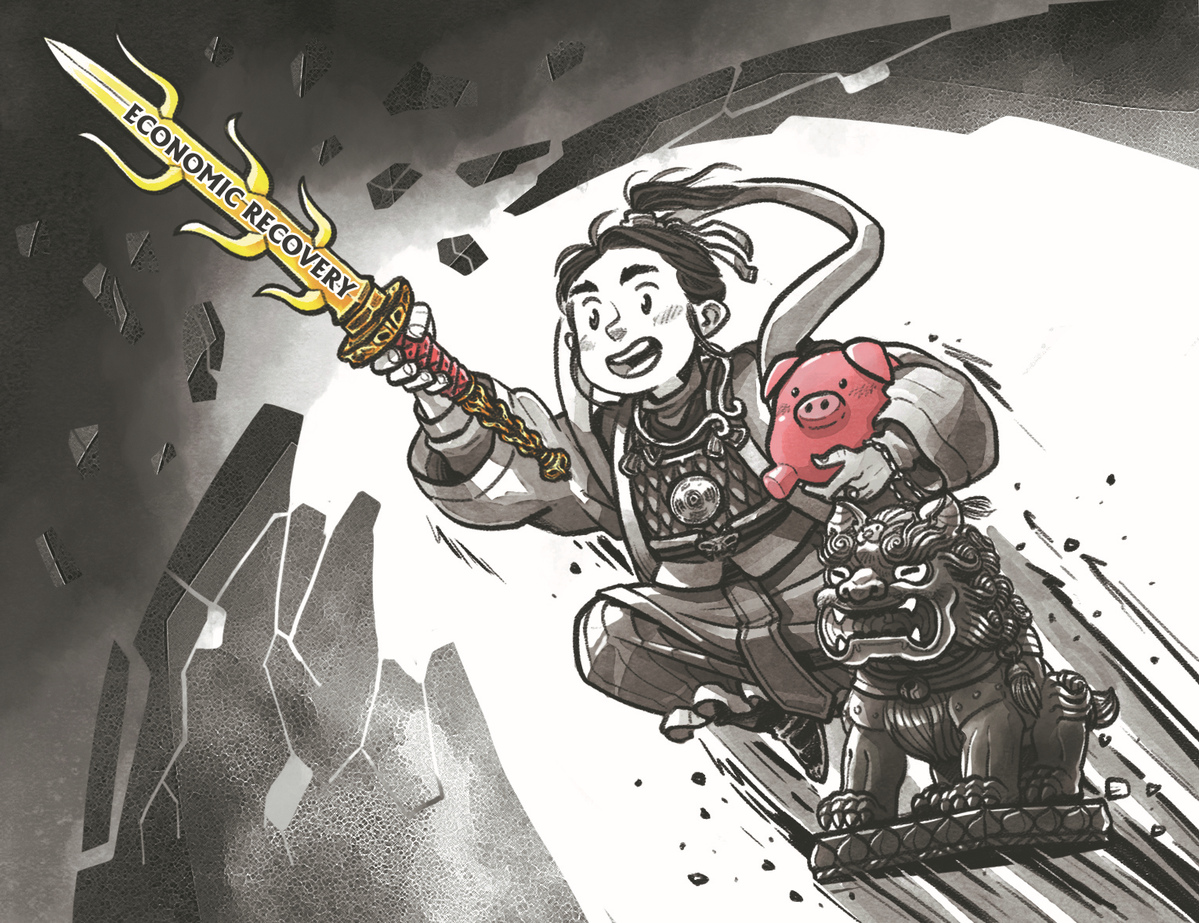

China's economy grew at a faster-than-expected clip in the first quarter, according to the latest data released by the National Bureau of Statistics, expanding 4.5 percent year-on-year, highlighted by robust exports, consumption and property sales.

The consumer price index, the main gauge of inflation, along with the producer price index — which measures factory gate prices — remained at relatively low levels.

The downward trend of the price indicators, however, does not point to deflation. The lower prices, for the time being, do reveal an imbalance between supply and demand, which should be interpreted as a faster recovery on the supply side than the demand side instead of a demand contraction.

Falling food prices and fluctuating energy prices are mainly responsible for the drop of the CPI. Nonetheless, the core CPI in March — a key indicator measuring macro supply and demand conditions — rose 0.7 percent year-on-year, which represents a modest rebound rather than a decline compared with January and February.

The lower PPI is closely related to declining commodity prices and a base effect. The Russia-Ukraine conflict last year extended the price rally of various commodities, such as oil, but oil prices have moderated of late. The transmission of the global price rise or fall has a huge impact on domestic PPI.

In general, the current decline in the two aforementioned price indicators is seasonal, imported and temporary. Looking ahead, as pork prices have hit rock bottom and energy prices gradually normalize, supply and demand in the second quarter will strike a balance driven by the expansion of domestic demand. Prices will maintain an appropriate level.

Prices will surely see an increase within a proper range throughout the year, but some uncertainties still exist due to volatile food prices, as well as commodity price fluctuations induced by various geopolitical tensions.

By and large, the economic recovery in the first quarter outperformed market expectations thanks to multiple upside drivers.

To begin with, China optimized its COVID-19 response measures in line with the shifting dynamics and restored its social and economic order at a faster pace compared with its counterparts in Europe, the United States and Southeast Asia, laying a solid foundation for economic growth.

In the meantime, exports and the real estate market posted stronger-than-anticipated performance in the first quarter despite pervasive pessimism about external demand and the housing sector.

In addition, local authorities made all-out efforts to get off to a good start in terms of economic recovery and growth as the reshuffling of government officials at the beginning of the year played a positive role.

As an important driver of growth, consumption has picked up over the past few months. Consumer spending on travel and catering services has gained strong momentum after the country scrapped its COVID-19 restrictions.

However, spending on durable goods, especially those in the real estate sector, still requires a longer period to fully return to normal, as well as services consumption.

It's worth mentioning that the recovery of consumption will be based broadly on rising salaries, and the expansion of consumption will be underpinned by a significant improvement in household spending capacity.

The effects of pro-consumption policies will be better brought to the fore and more scenarios will be explored to bolster spending appetites. For instance, greater support will be provided for boosting household consumption and in particular, meeting people's needs to renovate their homes.

Chinese people are experiencing a phase where they have a strong desire to improve their living conditions as a large number of households have been renovating and upgrading for more than 12 years. The issuance of renovation subsidies will spur consumption to a great extent.

More financial subsidies should be weighted toward lower and middle-income groups in a bid to cushion the tough blow induced by the pandemic. Policies to spur such big-ticket items as automobiles will be explored as appropriate.

Furthermore, investment from the private sector, which reflects the overall business situation of private enterprises, should be better leveraged to sustain economic growth.

As the impact of the pandemic is still unfolding, a large number of private businesses still generate low profitability and margins at the current stage and balance sheets have not been significantly repaired. Their expectations for further investment are still waning.

Current expansionary policies mainly prioritize government-led projects and investments, most of which are implemented by State-owned enterprises. There is a time lag in policy transmission from SOEs to private enterprises. New policy measures should be explored to channel support to private enterprises in a well-focused manner.

Deeper tax and fee cuts should be introduced whenever and wherever needed to keep market entities afloat, especially for many small and medium-sized enterprises across sectors.

Targeted policy steps should be employed to expedite the recovery of contact-based service industries as they're labor-intensive and conducive to job security. Only certain activities that are deemed essential in the services sector have restarted, with many more remaining closed. Special funds are needed to fully revitalize the services sector.

Targeted policies should be rolled out to facilitate the financing of SMEs. The overall financing costs of SOEs are at relatively low levels, which gives rise to possible misconduct. This may impact the confidence of SMEs toward a fair and just market.

Market expectations of private businesses have turned for the better and still need to be further consolidated. Various facilitation measures should be provided for the repair of private enterprises' balance sheets and their strategic layout.

On top of boosting consumption and private investment, dedicated efforts should be made to ensure more adequate employment, a key indicator gauging economic viability.

Since March, college graduates began to enter the job market across the board, which posted a significant rise in the surveyed unemployment rate of young people between the ages of 16 to 24.

As previous policies to keep payrolls stable and boost job creation have not yet been fully harnessed, along with a surge in young people seeking job opportunities, employment pressure this year appears to be greater than ever.

Special funds should be earmarked to help recent graduates land jobs. Efforts should be made to accelerate the recovery of labor-intensive industries, improve the capacity of mid- and high-end manufacturing industries to create more jobs, and try to satisfy the job-hunting expectations of college students.

Another highlight in the economic performance during the first quarter occurred in the property market.

Pent-up demand accumulated during the past three years had been unlocked in a short time, which greatly bolstered real estate transactions.

In the months to come, the property sector is expected to recover in a step-by-step manner. As sales growth picked up in the first quarter, property investment and land acquisition may recover significantly in the second quarter, although the possibility of pullbacks and fluctuations remains.

As the underlying parameters and profit models of the real estate industry have undergone drastic changes, it's very difficult to simply follow the old path and seek recovery. Faced with various complexities in the second half of the year, it will take a longer period of time for leading property developers and the entire industry to realize any real reconfiguration.

That said, the structural recovery indicates that situations vary from sector to sector. For example, recovery on the supply side is faster than that on the demand side; recovery in the services sector has achieved faster progress than that in the secondary sector; SOEs and large enterprises have shown quicker recovery than private and smaller businesses.

With expansionary policies kicking in, recovery will trickle down to market entities in a well-paced fashion. The recovery will continue to be on track throughout the year, though the process may not be an easy feat.

Going forward, intensified efforts will be made to expand domestic demand and relevant policies will be front-loaded as appropriate in a bid to help businesses gain greater profits and margins and repair their balance sheets without delay.

Concerned market entities should also place a high premium on risk prevention and control. Potential risks that haven't been identified during the pandemic will be brought to the fore as the market environment returns to normal.

The current monetary policy features proper intensity, without any imperative at present to resort to a deluge of stimulus measures or excessive money supply moves. The fiscal policy should be scaled up at the right pace and intensity.

The writer is president of the Shanghai University of Finance and Economics. The article is a translated version of an interview between the writer and the research department of the China Finance 40 Forum, a Chinese think tank. The interview first went online on the think tank's official WeChat account.

The views don't necessarily reflect those of China Daily.