Village fortunes

Income generated from urban renewal and property leasing in the villages will go to the companies. Owning properties of more than 100 million square meters, Shenzhen's urban villages generated 22 billion yuan in revenue and nearly 10 billion yuan in profit a year, the commission said.

The income has long been deposited in banks to earn interest and ensure that stable dividends can be distributed to villagers annually. According to the commission, Shenzhen's urban villages had more than 80 billion yuan in bank deposits in the third quarter of 2021.

In a document issued by Shenzhen's industry and information technology bureau in February, to alleviate the burden of small and medium-sized enterprises and promote their development, the government said it will strengthen its support for high-quality SMEs in raising money by attracting capital from cooperative stock companies to enter the venture capital market.

Zhang Qixin, chairman of the company owned by Hubei village in Shenzhen's Luohu district, said there has been a consensus in the company that the annual bonus of shareholders has to keep growing or remain stable. "Once it's reduced, it has to be explained to the villagers." He said the company had tried to make some investments, but received little support from the villagers because of the potential risks.

Zhang Yubiao admits he encountered skepticism from Nanling villagers not long after making their investments. "They asked why they had not seen any financial return yet, as they had been expecting quick yields. And you have to let them know it's a long-term investment that could end up with success or failure."

- Kale rises from bitter harvest to popular, healthy 'superfood'

- Commercial pad deploys 18 satellites

- China reinforces strict control over fentanyl-like drug exports

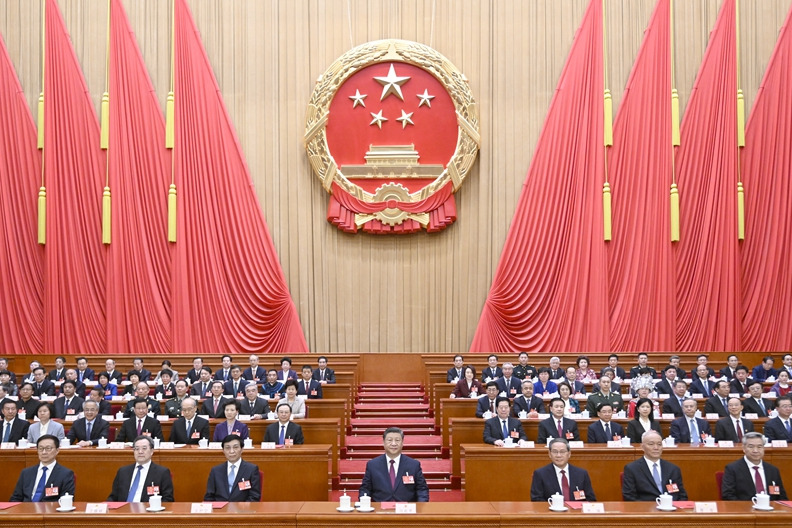

- Science Talk: China's technological development in the spotlight at annual two sessions

- Shanghai Museum to open first overseas gallery in US

- Shanghai lists 20,000 trees for adoption