Economic resilience limits impact of tariffs

Editor's note: China's economy remains resilient with reforms continuing to yield results in the last year of the 14th Five-Year Plan (2021-25) despite the internal and external pressures, while confidently moving toward realizing high-quality development. Three experts share their views on the issue with China Daily.

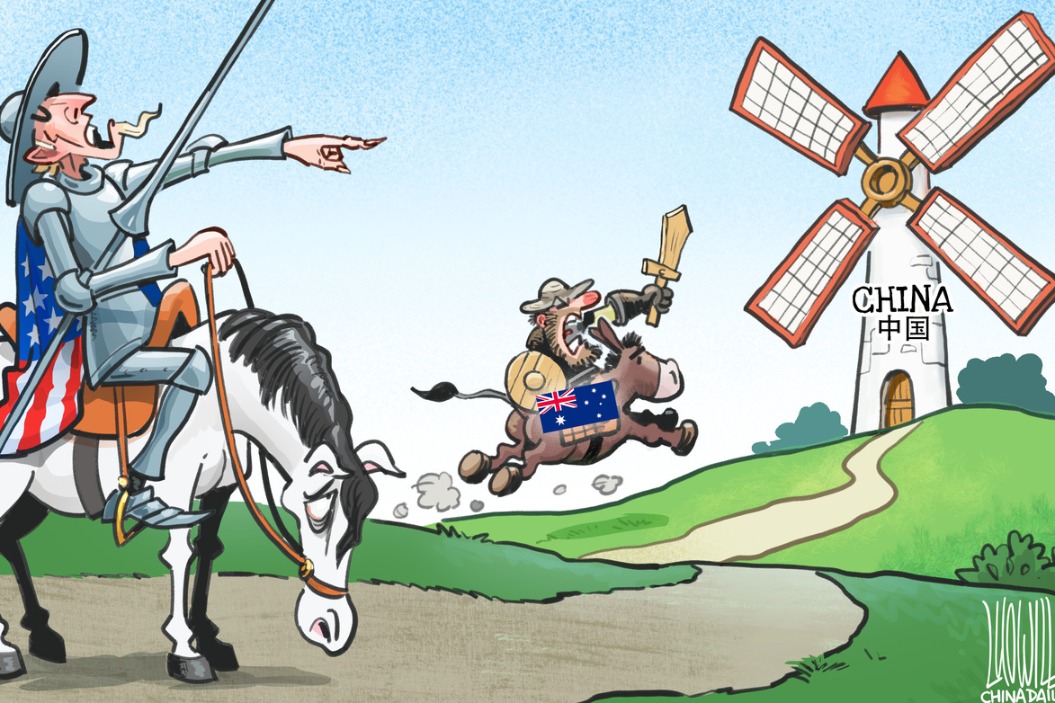

The US administration is contemplating its next move following China's swift response to the US' recent arbitrary increases in tariffs on Chinese goods. China's economic resilience has seemingly changed the calculus of trade disputes. While the United States has been using tariffs as a tool to coerce China into giving concessions, Beijing's response not only demonstrates defiance but also highlights that its economic ecosystem is capable of withstanding external pressures.

China's most powerful economic shield against external pressure is its massive domestic market of over 1.4 billion consumers. Unlike export-dependent economies that can be crippled by major trade restrictions, China has in recent years pivoted toward a "dual circulation" development paradigm in a bid to boost domestic consumption and transform it into a primary growth engine. "Dual circulation" development paradigm allows domestic and overseas markets to reinforce each other, with the domestic market being the mainstay.

The recently concluded annual session of the National People's Congress reaffirmed this strategic reorientation. The fundamental trend of long-term economic growth remains unchanged and will persist.

China's unparalleled industrial ecosystem is perhaps the best explanation for its economic resilience in the face of external pressures. As the only country possessing all 41 industrial categories in the United Nations industrial classification system, China today is the world's sole manufacturing superpower, with its production capacity exceeding the combined total of the next nine largest manufacturing countries. China's manufacturing dominance explains why some countries trying to decouple their economies from China's are facing formidable obstacles.

China's comprehensive industrial base provides both protection against and strategic strength for facing trade confrontations. When another country uses tariffs to target specific sectors, Chinese manufacturers can rapidly and efficiently reconfigure production across the country's complete industrial ecosystem, either absorbing the impact through internal adjustments or redirecting resources to unaffected sectors. This versatility has been frustrating US policymakers; as a matter of fact, US policymakers have come to realize that any significant decoupling from Chinese supply chains will be difficult, slow, expensive and disruptive, with the economic pain felt disproportionately by manufacturers and consumers in G7 countries.

This resilience was evident in China's response to the tariffs imposed by US during Donald Trump's first presidency in 2018. Rather than witnessing the predicted mass exodus of manufacturing industries, China executed a multifaceted strategy by accelerating industrial upgrading toward higher-value goods, selectively relocating tariff-affected export operations to third countries, and strengthening regional supply chains through initiatives such as regional free trade agreements.

China's trade policy has significantly evolved since the 2018 tariffs. Chinese exports to the US declined from about 19 percent of its total exports in 2018 to about 16 percent in 2022, while trade with the Association of Southeast Asian Nations, the European Union, and Belt and Road countries has significantly expanded. In 2023, the China-ASEAN trade volume reached 6.4 trillion yuan ($883.49 billion), accounting for 15.3 percent of China's total foreign trade. These are China's remarkable diversification achievements.

This rebalancing is complemented by China's structural transformation in export composition. The rise of the "New Three" — electric vehicles (EVs), lithium batteries, and solar photovoltaic cells — has created export categories in which Chinese manufacturers enjoy significant technological advantages and pricing power.

True, Western economies' restrictions on high-tech exports have created challenges for Chinese enterprises, but they have also catalyzed domestic innovation and self-sufficiency initiatives.

China's governance system allows for coordinated fiscal, monetary and industrial policies that can quickly adapt to the changing trade environments. Export tax rebates, totaling 1.8 trillion yuan in 2023, offset the impacts of tariffs, while reductions in targeted reserve requirement for banks provided liquidity to the affected sectors, with the flexibility of the yuan's exchange rate further helping neutralize tariff costs for Chinese exporters.

The expansion of free trade zones to 22 regions, along with the development of the Hainan Free Trade Port, demonstrates China's commitment to high-level institutional opening-up despite rising protectionism in some countries.

But despite these resilience factors, China's economic planners face some challenges. The property market correction has dampened consumers' confidence, while demographic headwinds present long-term structural challenges.

Rather than matching the US' measures, China's targeted response to agricultural products from key electoral states in the US shows its appreciation for the political dimensions of economic policy.

In a world where China can redirect exports, stimulate domestic consumption, and expedite its efforts to become self-sufficient in advanced technology, the leverage provided by tariff threats has diminished considerably. The future of productive economic relations may depend less on coercive measures and more on finding areas of mutual benefit amid strategic competition.

The author is president of the University of International Business and Economics.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.