Editor's Note: This year marks a critical milestone as China concludes its 14th Five-Year Plan. To help in assessing the success of the process, we have asked multinational executives to share with our readers their insights about their business achievements in the past few years and further expectations in the years to come.

Q1 What's your view on this year's two sessions? Do you expect any specific policy measures for further deepening reforms and expanding high-standard opening-up? What more should China do to create a more enabling business environment for foreign investors?

MOREL: As China approaches the conclusion of its 14th Five-Year Plan, we hope that the two sessions will continue to prioritize policies that sustain economic growth and drive innovation, particularly in digital transformation and sustainable development. China's commitment to high-level opening-up has been promising, and we would welcome further steps to enhance the business environment. This could include measures such as enhanced regulatory transparency, streamlined processes for market access, and stronger intellectual property protections. Such initiatives would not only further bolster China's appeal as a destination for international investment, but also provide greater opportunities for companies like Lectra to expand, innovate and thrive within this dynamic market.

DING: As general manager of Veeva China, I very much look forward to the country further deepening reforms and expanding high-level opening-up of the Chinese economy. Especially in the healthcare and technology sectors, I expect the government to introduce more innovative support policies and strengthen intellectual property rights protection to create a fairer, more transparent and more predictable market environment for foreign companies. In addition, promoting the development of digital healthcare and smart healthcare will also bring new growth points for the pharmaceutical industry. Currently, the size of China's digital healthcare market has exceeded 100 billion yuan ($13.8 billion) and is maintaining a rapid growth trend. The pharmaceutical sector is a special industry related to people's health and safety. I hope the government can provide more policy support for the digital transformation and upgrading of the pharmaceutical industry, so that more patients can have access to safe, effective and affordable medicines faster by encouraging pharmaceutical companies to adopt digital technology to achieve compliant operations and efficient management in the process of drug development, production and marketing.

CUI: As China concludes its 14th Five-Year Plan, the high-quality development, innovation, and open economy will be reiterated during the two sessions. Recent initiatives including strengthening intellectual property protection for foreign enterprises and 2025 Action Plan for Stabilizing Foreign Investment were unveiled to further open up the economy and attract global capital. We're looking forward to further improvements in market access and regulatory transparency, further streamlining administrative procedures, ensuring policy consistency, and facilitating cross-border data flows, which will help strengthen investor confidence. China's ongoing commitment to openness and innovation presents new opportunities for multinational companies like Aveva to contribute to, and benefit from, its economic transformation.

TSAO: We look forward to the two sessions further advancing high-quality development and market-oriented reforms, creating a more transparent and fairer business environment for innovation. At Red Hat, we are committed to leveraging open-source technologies and services to collaborate with Chinese partners under open and mutually beneficial policies, helping enterprises build new productive forces and expand globally. Only through more open and fair business policies can we foster global technological innovation and international cooperation, ultimately creating more opportunities for all stakeholders.

Q2 "New quality productive forces" is widely seen as key to helping China achieve industrial upgrade and "high-quality development". How can your company help cultivate such forces in China?

MOREL: At Lectra, we are fully aligned with China's vision of upgrading industrial productivity through the development of "new quality productive forces". We contribute to it by providing advanced solutions that drive industrial transformation across key sectors such as fashion, automotives and furniture. Our offerings empower Chinese manufacturers to improve product quality, reduce material waste and enhance productivity in their production processes. By enabling greater efficiency and sustainability, we support the upgrade of industries to meet higher standards. In addition, we also collaborate with local partners and educational institutions to develop talent and foster innovation in these key sectors. Through these initiatives, Lectra is ultimately contributing to the long-term success of China's industrial upgrades and high-quality development goals.

DING: "New quality productive forces "is widely seen as key to helping China achieve industrial upgrades and high-quality development. Veeva introduces international advanced management concepts and digital technology tools to help pharmaceutical companies improve operational efficiency, product quality and market competitiveness. For example, in China, our China Commercial Cloud solution, Veeva China CRM Suite, is tailored for the Chinese market, helping many pharmaceutical companies digitally manage the entire process of marketing their drugs to market, enabling them to achieve operational compliance, reduce costs and increase efficiency in the commercialization process. Veeva contributes to China's pharmaceutical industry by providing more high-quality digital solutions in line with international standards through continuous technological innovation and promoting the overall digitalization and upgrading of China's pharmaceutical industry.

CUI: "New quality productive forces "is key to promoting the upgrading of China's industry and high-quality development. Collaborating with leading enterprises across various industries, like chemicals, power, and manufacturing, especially semiconductors, we use technologies like big data analysis and cloud computing to optimize production processes, improve product quality, and reduce energy consumption and costs. Additionally, training and technical support are leveraged to enhance enterprise competitiveness and contribute to the high-quality development of China's industry, while the offices in Beijing, Shanghai, and Guangzhou also serve as training centers where periodic training sessions are conducted for different products. Scientific and technological innovation and industrial transformation are essential for China to achieve its high-quality development goals.

TSAO: Red Hat has been committed to fostering new quality productive forces in China. On the technology front, with 20 years of deep-rooted experience in the Chinese mainland, we have provided enterprise-grade open-source technologies and services to thousands of businesses. Leveraging cutting-edge technologies such as cloud computing, containerization, edge computing and AI, we help enterprises unlock data value and enhance operational efficiency. At the same time, we actively promote technical exchange and collaboration, serving as a bridge for communication between China and the world. This enables Chinese enterprises to absorb global best practices, accelerate digital transformation, strengthen independent innovation, and drive industrial upgrading and high-quality development.

Q3 DeepSeek has been a buzzword and surprised the world starting this year. AI technology has been deeply integrated with various industries around the world. What opportunities do you foresee for your business from AI technology? What's your view on China's ability to sustain innovation in breakthrough technologies in the coming years?

MOREL: AI presents tremendous opportunities for business in the coming years. As an advocate and pioneer of Industry 4.0, Lectra has already integrated cloud, big data, internet of things and AI in its products and services. AI plays a critical role in enabling increased automation, improved decision-making and higher precision in production processes, offering a competitive edge to businesses across sectors. As China continues to lead in AI development, we see great potential for AI-powered solutions. China has a demonstrated the ability to sustain innovation in its thriving tech ecosystem, and we look forward to being part of that journey, leveraging AI to meet the evolving needs of industries we serve.

DING: From drug development to commercialization, AI is transforming the pharmaceutical industry and becoming an important force driving its development. According to market research organizations, the global market size of AI applications in healthcare will reach tens of billions of dollars by 2025. Veeva has always been at the forefront of technological innovation, and Veeva's GenAI strategy is focused on enabling our customers to create value for them. Our AI solutions are currently helping many pharmaceutical companies realize data-driven decision-making, improve R&D efficiency and marketing effectiveness, accelerate drugs to market faster and bring new therapies to patients. With the continuous maturity of AI technology and the expansion of application scenarios, as well as the Chinese government's continued investment in, and support of, science and technology innovation, Veeva will continue to deepen its cooperation with its customers to jointly explore new applications of AI in the pharmaceutical industry, and to provide strong support for the digital-intelligent transformation of China's pharmaceutical companies.

CUI: The rise of AI technologies like DeepSeek is indeed remarkable and signifies the deep integration of AI with various industries worldwide. China is also becoming the market with the most extensive application of AI technologies globally, bringing new opportunities for many companies including Aveva. We see AI as humanity's tool, an exciting innovation that will help meet the sustainability goals and do more with less. Industrial tech — in particular AI — can turbo-charge industries' progress toward efficiency and sustainability. We are currently working with customers across the world to drive the ramping-up of AI to boost productivity and decarbonization. Aveva is confident in China's ability to maintain its innovation capacity in breakthrough technologies in future with strong innovation capabilities and broad prospects for AI applications.

TSAO: The explosive popularity of DeepSeek once again validates Red Hat's vision that "the future of AI is open". Red Hat remains committed to providing efficient, flexible and cost-optimized enterprise-grade open-source AI solutions for businesses worldwide, including in China. We see tremendous growth opportunities in the Chinese market. With its strong R&D capabilities and vast market potential, China's rapid advancements in AI, cloud computing and other fields are fueling global technological innovation. By further expanding openness, and increasing investment in technological innovation, China is well positioned to achieve continuous breakthroughs in AI and other cutting-edge domains, driving industry leadership.

Q4 Driving domestic consumption is one of the top priorities for China to spur economic growth this year. How do you see China's potential to drive a consumption-led impetus for the economy? How will that affect your company's profitability this year?

MOREL: China's large and growing consumer market presents a significant opportunity. As domestic consumption becomes a key driver of economic growth, we see an increasing demand for personalized, sustainable, and high-quality products. This shift aligns perfectly with the solutions we provide to the fashion, automotive and furniture industries and we expect increasing demand from manufacturing companies in these sectors for more efficient, agile and high-quality production technologies. For example, in the automotive sector, the demand for new energy vehicles keeps rising and consumers are increasingly prioritizing comfort and intelligent in-car experiences, requiring higher agility and shorter time-to-market from NEV suppliers. We bring solutions to our customers to adapt to and optimize their processes to meet these expectations and address the changing market dynamics.

DING: China's consumer market has huge potential, especially in the healthcare sector. According to statistics of the National Health Commission, the total scale of China's healthcare industry reached 18.6 trillion yuan last year and is maintaining a rapid growth trend. With the increasing health awareness of people and the aging population trend, the pharmaceutical industry will see great development opportunities. Consumers' growing demand for high-quality pharmaceutical products and healthcare services will inject new vitality into the economy and bring great development opportunities for the pharmaceutical industry. Veeva will leverage its digital technology advantages and service experience in the pharmaceutical industry, and by promoting and supporting the digital transformation of the pharmaceutical industry and pharmaceutical companies, we will help pharmaceutical companies improve operational efficiency and quality throughout the entire process of R&D, manufacturing, and commercialization. At the same time, we are optimistic about the long-term development prospects of the Chinese market and expect our business in China to continue to grow.

CUI: Driving domestic consumption is one of China's key tasks to promote economic growth. And with the continuous development of China's economy, the domestic consumption market has enormous potential. Especially among the younger generation of consumers, there is a greater emphasis on quality and service, which will drive industrial and consumption upgrades. The prosperity of the domestic consumption market presents significant business opportunities, since the clients provide essential goods such as energy, food and medicine. Aveva will closely monitor market trends and promptly adjust product strategies and service models to meet the diverse needs of consumers. At the same time, we are looking forward to enhancing the brand influence through technological innovation and product upgrades.

TSAO: China's push for consumption-driven economic growth holds immense potential. Consumption upgrades will accelerate enterprises' digital transformation and drive them toward higher-value segments of the market. In this process, businesses will seek more cost-effective and innovative technology products and services. With globally leading, full-stack enterprise open-source technologies and services, Red Hat is well positioned to support the transformation and growth of enterprises across various industries. We remain highly optimistic about the future and expect our business to continue strong growth this year, with profitability improving accordingly.

Q5 As China continues to pursue high-quality development along a Chinese path to modernization, what opportunities do you anticipate for your business as this process gains more traction? Will you increase investment in China in the coming years? How will you further expand your footprint in China?

MOREL: As China pursues its path to modernization, the transition to high-quality development presents significant opportunities for Lectra. As part of our long-term commitment, we are exploring investment opportunities in China to expand our production and service capabilities. In November last year, we inaugurated a new factory in Suzhou (Jiangsu province), which reflects our long-term dedication to the Chinese market and part of our "Made in China for China" strategy. We aim at continuing to strengthen our footprint in the country, and providing more Industry 4.0 solutions to the automotive, fashion and furniture sectors to support and accelerate their modernization.

DING: China's high-quality development path brings unprecedented opportunities for Veeva. We will continue to increase our investment in China, especially in product development and innovation, talent training and market expansion, and work hand in hand with more Chinese partners to jointly promote the digital transformation and upgrading of China's pharmaceutical industry. It is Veeva China's mission to build an industry cloud for China's life sciences industry, and China is a strategic focus market for Veeva. We will continue to expand the Veeva China CRM Suite, a commercial solution developed exclusively for the Chinese market, as well as continuously upgrade our solutions for clinical R&D, regulatory, quality, data and consulting to improve the efficiency and effectiveness of the entire process. Veeva is committed to the long-term development of China, and we will continue to be a strategic partner connecting global innovation with local needs to help the life sciences sector achieve high-quality and sustainable development through technology, talent and collaboration.

CUI: As China continues to pursue high-quality development along the path of Chinese-style modernization, we see tremendous business opportunities. High-quality development not only requires improving production efficiency and quality, but also emphasizes sustainable development and environmental protection, which provides a vast market space for Aveva. In the coming years, we will continue to increase investments in China, aiming to continuously introduce global innovations to strengthen cooperation with local enterprises, optimize local business development models and jointly develop products and services that meet the needs of the market. Additionally, we will expand the business scope to cover more industry sectors, such as smart manufacturing and green energy.

TSAO: We see significant business opportunities in enterprise AI, cloud infrastructure, IT automation management, and supporting Chinese enterprises in expanding globally. We will continue to invest in China, including developing more open-source technology talent for various industries. At the same time, we will strengthen and deepen collaboration with local ecosystem partners to better serve niche industries and expand our reach into more second- and third-tier cities.

Smart driving features, including automatic parking, are set to become a key competitive factor as Chinese carmakers jostle for more market share by making intelligent driving features standard in mass-market vehicles.

Typically, such features have required buyers of new vehicles to fork out more money to enjoy their convenience. However, BYD, China's largest electric vehicle manufacturer, has fired the first salvo in the race to expand access to smart driving features even in mass-market vehicles.

BYD announced last month that it is equipping its entire lineup with the Advanced Driving-Assistance System, or ADAS. Among its functions, the system enables vehicles to drive themselves on expressways and to park automatically.

The most affordable of its first 21 models with the feature on the market is the Seagull, priced at 69,800 yuan ($9,640).

Models with similar functions in the Chinese market are usually priced from 150,000 yuan, according to consulting firm McKinsey.

BYD said its move aims to offer volume car owners access to intelligent driving features to increase safety. It said 21 percent of traffic accidents in China are attributable to fatigued drivers, which can be prevented by automatic emergency braking or steering.

"We believe that intelligent driving should not be a luxury but a standard feature for all consumers," said Wang Chuanfu, chairman and president of BYD.

"By making high-level smart driving available across our range, we are accelerating the transition toward smarter, safer mobility," said Wang.

Also in February, State-owned automaker Changan, which is a partner of Ford and Mazda, unveiled its smart strategy. Chairman Zhu Huarong said it will equip vehicles priced around 100,000 yuan with LiDAR technology, which is crucial to smart driving, this year.

Geely followed, announcing earlier this month a smart driving system, the new G-Pilot, which will be available on cars under the Geely Auto, Galaxy, Lynk & Co and Zeekr brands.

Analysts said that the move by these major automakers, especially BYD, will force competitors to follow suit, potentially triggering a wave of industry-wide adoption of smart driving systems as standard offerings.

This will put pressure on both domestic startups and international automakers operating in China to accelerate their own ADAS deployment.

Traditionally, advanced features such as lane-keeping assistance, adaptive cruise control and automatic emergency braking have been reserved for premium brands.

Tesla, Xpeng and Nio have offered high-level ADAS as part of their differentiation strategy, with some, like Tesla, charging thousands of dollars for its Full Self-Driving package.

"The competitive advantage in the car industry is shifting rapidly toward AI-driven intelligence.

"Future development must be based on this new competitive landscape," said Zhang Yongwei, secretary-general of the China EV 100, an NEV industry think tank.

But automotive executives are divided on the trend of availing smart driving features in mass-market cars.

Yu Chengdong, head of Huawei's smart driving solutions, said there is a big difference between "it manages to work" and "it works well", in a thinly veiled jab at BYD, which develops its own smart driving system.

Huawei is widely accepted as a top-level smart driving solutions provider in China, which has attracted partners including traditional carmakers BAIC and JAC.

But Xpeng CEO He Xiaopeng has applauded the move by automakers including BYD on Sina Weibo, saying that they are helping to popularize smart driving in China and across the world, more so as Chinese vehicles are getting popular in overseas markets.

BEIJING — China's rapid advancements in the artificial intelligence sector, exemplified by DeepSeek, a cost-competitive newcomer among global AI models, have captured global attention and driven capital inflows into the country's sci-tech capital market.

Since February, following Deutsche Bank's high-profile report declaring that "2025 is the year the investing world realizes China is outcompeting the rest of the world", several international investment banks have upgraded their ratings or raised target prices for the Chinese capital market.

Citi recently upgraded its rating for Chinese stocks to overweight. Chinese shares look attractive even after their recent rally, Citi strategists wrote, citing DeepSeek's AI technology breakthrough, the government's support for the tech sector and "still-cheap valuations".

Goldman Sachs anticipates that the widespread adoption of AI over the next decade could boost the overall earnings of Chinese stocks by 2.5 percent annually. It has also raised its targets for the MSCI China Index and CSI 300 Index to 85 and 4,700, respectively, signaling potential double-digit growth for both indexes over the next year.

CITIC Securities described the current moment as a "pivotal historic opportunity" for global capital to invest in the Chinese stock market. The widespread application of AI across industries has significantly improved the efficiency and profitability of China's real economy.

During China's annual two sessions earlier this month, the rise of DeepSeek and its global impact became a focal point. Wu Qing, head of the China Securities Regulatory Commission, emphasized that DeepSeek's success has not only impressed the global AI industry but also redefined the world's perception of China's capabilities in technological innovation.

This achievement has driven a revaluation of Chinese assets, he noted. China will support the development of sci-tech innovation enterprises — both listed and those in the pipeline — to further enhance the appeal and investment value of the Chinese stock market, according to the CSRC.

"We are optimistic about the medium-term prospects for Chinese equities," stated Morningstar Investment Management research teams in their 2025 Outlook.

They expect stimulus measures initiated in 2024 to continue evolving, while citing a more benign regulatory backdrop, expectations of moderate earnings growth from Chinese companies, and a positive outlook on several of the major technology firms as consumers regain their footing.

Xinhua

BEIJING - China's digital industry operated steadily in 2024, with increases in both revenue and profits, data from the Ministry of Industry and Information Technology (MIIT) showed on Monday.

The industry's business revenue reached 35 trillion yuan ($4.9 trillion) last year, a 5.5 percent year-on-year increase. Total profits grew 3.5 percent year-on-year to 2.7 trillion yuan, according to the MIIT.

Notably, the added value of major manufacturers of computers, communication devices and other electronic devices grew 11.8 percent, up 8.4 percentage points from the previous year.

Boosted by artificial intelligence (AI), cloud platforms and other emerging business activities, the country's software sector recorded 10 percent growth in business revenue, which reached 13.7 trillion yuan.

China has been committed to developing digital technology to transform and upgrade its traditional industries.

According to this year's government work report, the country will "accelerate the digitalization of manufacturing, foster a number of service providers with both industry expertise and digital know-how, and bolster support for the digital transformation of small and medium-sized enterprises."

The country is also advancing an "AI Plus" initiative, which calls for collective efforts to effectively combine digital technologies with China's manufacturing and market strengths.

China's latest commitment to advancing cutting-edge technologies — including quantum computing, artificial intelligence and 6G — will solidify its position as a global leader in innovation, and the strategic push will enable the country to navigate global uncertainties while sustaining its competitive advantage, experts and business executives said.

Underscoring the importance of securing technological breakthroughs and efficiently commercializing them, they said that China's push for new quality productive forces will create vast opportunities for domestic and international businesses.

Their comments follow President Xi Jinping's remark that technological innovation and industrial innovation constitute the fundamental pathways for developing new quality productive forces.

Xi made the remark when participating in a deliberation in Beijing on March 5 with his fellow deputies from Jiangsu province during the third session of the 14th National People's Congress, China's top legislature.

China's 2025 Government Work Report also said the nation "will establish a mechanism to increase funding for industries of the future and foster industries such as biomanufacturing, quantum technology, embodied AI and 6G technology".

Wang Yiming, vice-chairman of the China Center for International Economic Exchanges, said, "China's economy has entered a critical period of transitioning between old and new growth drivers."

He said future-oriented technologies are not only at the forefront of innovation, but are also strategic pillars for reshaping industrial competition and boosting productivity.

"Their significance lies in both upgrading traditional industries and securing a leading position in emerging sectors," Wang said.

Guo Guoping, deputy director of the Key Lab of Quantum Information at the Chinese Academy of Sciences, said he was deeply impressed by China's support for quantum technology.

He compared quantum technology to an aircraft, with quantum computing serving as its "engine", providing exponential computational power for fields such as national defense, biomedicine, energy materials and AI.

"Quantum computing is transitioning from the lab to industrialization. China has become the third country in the world capable of delivering quantum computers, after Canada and the United States, positioning China in the global first tier of quantum research. But challenges remain in some areas," Guo said.

He stressed the need for increased investment in basic research and advocated leveraging China's unique advantages in mobilizing resources to tackle core technological challenges.

China's research and development spending climbed to 3.6 trillion yuan ($497 billion) in 2024, an 8 percent year-on-year increase, according to the National Bureau of Statistics. Of this total, funding allocated to basic research accounted for 6.91 percent of the R&D budget, underscoring heightened investment in foundational scientific exploration.

Meanwhile, more than 570 Chinese industrial companies have made it to the global top 2,500 companies in terms of R&D investment, according to the Ministry of Industry and Information Technology.

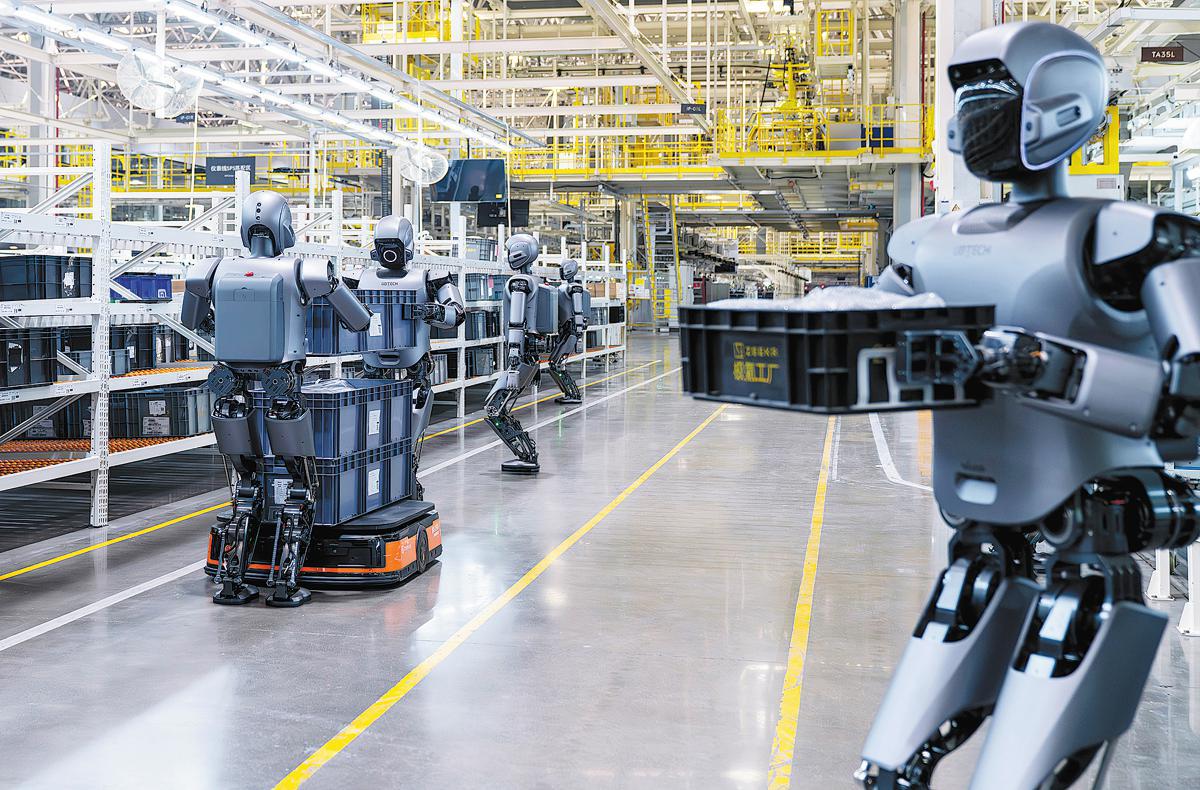

Xu Lijin, a member of the National Committee of the Chinese People's Political Consultative Conference, the nation's top political advisory body, and chairman of Wuhu Robot Industry Development Group, said that embodied AI, as highlighted in the Government Work Report, refers to AI that is integrated into physical hardware such as robots. It represents a significant leap in intelligent systems capable of interacting with and adapting to their environments.

"Robotics and AI are dual engines driving economic and social development in the era of global digital transformation," Xu said.

Qiao Hong, an academician of the Chinese Academy of Sciences, said, "Over the past three years, China has accounted for more than half of the global installation of industrial robots, and its lunar exploration robots have successfully returned lunar soil samples."

However, challenges remain. For instance, high-end sensors like precision lidar, short for light detection and ranging, still rely on imports, and domestic alternatives lag in accuracy and stability, experts added.

Zhang Li, president of the China Center for Information Industry Development, said: "Leveraging its robust and comprehensive industrial ecosystem, China creates expansive real-world testing grounds and vast market opportunities for technological innovation. This infrastructure not only accelerates the development of emerging industries, but also provides a resilient foundation for nurturing future-oriented sectors poised to redefine global markets."

As the world's largest manufacturing country, China ranks first globally in terms of output for more than 40 percent of the world's 500 major industrial products, data from the Ministry of Industry and Information Technology showed.

Industrial innovation must remain rooted in the real economy, Zhang said, noting that China's economy "has historically relied on the real economy, and it is through this foundation that it will continue to progress".

Ding Haiyu, deputy head of the China Mobile Research Institute, said that 6G "has entered its tech standardization phase this year, as we aim to commercialize the technology around 2030. AI-powered 6G will unlock significant opportunities".

Zheng Yongnian, dean of the School of Public Policy at the Chinese University of Hong Kong (Shenzhen), said, "To cultivate new quality productive forces, a country should prioritize three foundational pillars — advancing fundamental scientific research, bridging the gap between theoretical discoveries and applied technological solutions, and fostering a financial ecosystem capable of sustaining innovation-driven growth."

"Expanding institutional opening-up is the strategic guarantee for nurturing new quality productive forces," Zheng said.

David Poon, president of Infineon Technologies Greater China, said China's focus on green, low-carbon and high-quality development aligns with the German chip maker's strengths and opens new growth opportunities.

"With our 'In China, For China' strategy, we plan to increase local production of general-purpose semiconductors to address customer needs regarding supply resilience," Poon said.

German carmaker Volkswagen AG has inked a new deal with its long-time partner FAW to introduce a slew of new models developed exclusively for the Chinese market.

Ralf Brandstaetter, chairman and CEO of Volkswagen Group China, said: "Our new technology set-up, exclusively tailored to China will enable our joint ventures to respond even more quicker and effectively to new customer requirements and market changes in the future."

Starting in 2026, their joint venture FAW-Volkswagen is scheduled to introduce 10 new Volkswagen brand models, including nine NEVs, in diverse segments.

Of them will be two electric models and two plug-in hybrids developed based on the Compact Main platform.

The platform, developed by Volkswagen Group (China) Technology Company, will reduce the time-to-market by 30 percent and reduce the costs by approximately 40 percent compared to traditional platforms.

There will be two models in the mid-class segment along with their range-extended variants, they said.

To further develop its business model in the fast-growing e-market, FAW-Volkswagen will also electrify the Jetta brand. The first model will be launched by 2026, to add a strong offer in the entry-level segment.

"By accelerating the development of a new productivity ecosystem, we will integrate global expertise with local technology to foster FAW-Volkswagen’s long-term sustainable growth, enabling the company to deliver more competitive, market-driven, and intelligent mobility solutions that cater to the evolving needs of Chinese customers," said Chen Bin, deputy general manager of FAW Group and general manager of FAW-Volkswagen.

Until 2030, the brands of FAW-Volkswagen will introduce over 20 all-new models to the market.

Volkswagen Group will launch about 40 new models in China from 2025 to 2027 - over half of these will be electrified, to seize the growth momentum of the Chinese market.

The "reciprocal" tariff strategy is an iconic move by US President Donald Trump in his administration. According to Kevin Hassett, director of the US National Economic Council, trading partners of the United States are charging tariffs "two or three times the amount the US is charging" — which is apparently not true, yet has become an excuse for the US to seek so-called reciprocity in its trade with other countries — be it a reduction in tariffs by the other side or an increase in tariffs by the US. The approach to achieving such a goal is simple as well. Take vehicle trade for example, if a country imposes a 40 percent tariff on US auto exports, the US will impose a 40 percent tariff on vehicles from that very same country.

Reciprocal transactions in international trade negotiations normally consist of two basic elements — reciprocal trading conditions and returns, that is, one party gives certain conditions and the other party makes a corresponding return. Reciprocity should be based on mutuality, which is consistent with the basis of international trade practices — interdependence. The reward given on the basis of reciprocity is also a conditional return — good for good, evil for evil. For example, between 2018 and 2020, when the US also ignited trade tensions with China, Washington negotiated with Beijing on a so-called principle of reciprocity and used threatening means before negotiations, but the true nature of seeking such "reciprocity" is purely to benefit the US.

Reciprocity has become a popular term in international trade negotiations nowadays, albeit an overly used one. There are four different scenarios that normally occur in reciprocal trade negotiations. First, trade barriers between A and B should be dismantled on an equal footing so that free trade can be achieved on a reciprocal basis. Second, countries participating in multilateral trade agreements relax trade protection levels to build a multilaterally reciprocal trading dynamic. Third, country A unilaterally raises the level of protection, and country B raises its level of protection on a reciprocal and corresponding basis. Fourth, when country A makes reciprocal demands on countries B, C, and D, the countries will begin their own round of retaliation, and the free trade system is undermined, triggering a proliferation crisis wherein all parties seek reciprocity.

The above four situations have repeatedly appeared in US trade history. This time, chances are that many US households have no idea what so-called reciprocity might mean or look like.

In 1890, the US Congress passed the McKinley Tariff Act, which for the first time formalized "reciprocal trade" as the basis of US foreign trade policy, with aims of expanding US exports, restricting imports and protecting the domestic market. According to the act, the average US tariff level was maintained at 48.9 percent.

When Franklin Roosevelt was in office, Congress passed the Reciprocal Trade Agreements Act of 1934, which reduced tariffs by up to 50 percent. After World War II, Roosevelt combined the principle of unconditional most-favored-nation treatment with the principle of reciprocity so that a reduced tariff level could be applied to any country which the US signed a trade agreement with. Such multilateral reciprocal free trade then became the core of the post-World War II global trading system.

In the 1980s, with the gradual decline of the US in the global trading system as a hegemony and the loss of some of its advantages in trading competition, a group of trade protectionists in the country proposed an aggressive reciprocity to pursue a higher level of trade protection.

And now we're seeing another reciprocity cycle in US trade policy and practice. What could be the new features of the latest round of moves?

First, it is definitely a protectionist move. Peter Navarro, a senior White House adviser on trade and manufacturing, has said: "If President Trump succeeds like he wants to succeed, we are going to structurally shift the American economy from one over-reliant on income taxes and the Internal Revenue Service, to one which is also reliant on tariff revenue and the External Revenue Service." This serves as solid evidence of the protective aspect of Donald Trump's "reciprocal" tariff strategy.

Second, the tendency for aggressive reciprocity never truly leaves the stage. In the 1980s, Japan had its time of honor on the global stage with astounding economic indicators, showing a trend of catching up with and surpassing the US. However, at the time, the US launched a trade war to contain Japan. As with Japan at that time, during the first term of the Trump administration, the US government saw the rise of China's economy as a threat, hence trade conflicts ensued.

Third, there is diffuse reciprocity. Robert Keohane, a US academic and international relations theorist, in his study of international organizations, proposed the concept of diffuse reciprocity, which he defined as a second type of reciprocity. This very type of reciprocity refers to the reciprocal transactions between two parties based on long-term mutual trust and cooperation within the framework of an international organization.

But the reciprocity currently proposed by the US is the fourth type, which will trigger a contagious crisis. Douglas Irwin, a US scholar, wrote in a Wall Street Journal article that "about 200 countries in the world with 13,000 separate tariff lines would lead to 2.6 million individual tariff rates, depending on the product and the country of origin".

The US reciprocal tariff strategy has many drawbacks, and is difficult to build up and regulate, but will only undermine the existing multilateral trading system.

Fourth, the end of the US reciprocal tariff strategy is isolationism. The general meaning of reciprocity includes the recognition of interdependence, while in the context of the current US administration, it will eventually lead to isolation. In the US' reciprocity game, countries will frequently use retaliatory tools, and they will unite to deal with trade woes brought about by the US moves and conclude trade agreements that exclude the US, which will trigger a downtrend for the US and lead to its further isolation.

Additionally, such reciprocity urged by the US is superficially fair but substantively unfair. The US demands "reciprocity" in trade between developing countries, which is like letting a group of average-sized individuals to compete with NBA stars. At present, most of the countries with higher average tariffs than the US are like such "average-sized" players, that is, developing countries, which will be victims of such a "reciprocal" tariff strategy.

Finally, it will be US consumers who pay for the cost of such reciprocal tariff strategies, just as trade specialist William Alan Reinsch wrote in his piece: "Trump's Tariff Reciprocity: 'Reciprocal' tariffs like these will add to inflation and disproportionately hurt poor people, who use a higher percentage of their income to purchase necessities like shoes."

The views do not necessarily reflect those of China Daily.

The writer is a professor at the School of Economics at Renmin University of China.

While the rapid adoption of robots and artificial intelligence improves efficiency and reduces the cost of human resources, the social security system could face challenges in sustaining individual benefits, pension payouts and healthcare funds — an issue that should be addressed in advance, experts said.

Zheng Gongcheng, president of the China Association of Social Security, said that if automation replaces 70 percent of manufacturing jobs — a plausible scenario given the current technological trends — workers displaced by robots may receive lower welfare benefits during their transition to new roles.

"Traditional social insurance relies on payroll deductions from employers and employees. How-ever, as robots replace human workers, the contribution base shrinks," said Zheng, who is also a professor at Renmin University of China in Beijing.

For example, a factory replacing 100 workers with robots would by default eliminate 100 monthly contributions, straining pension and healthcare funds. This raises a critical question: Should enterprises pay social security fees for robots?

"Although there is currently no consensus, social security issues must be addressed with seriousness and prudence," Zheng said, adding that if left unaddressed, these issues may undermine the fairness and stability of the entire social security system.

The social security system, as a mechanism of wealth redistribution, should evolve simultaneously with technological progress, or otherwise it will lose its core function of promoting social equality, he said.

Zheng suggested exploring new payment channels for robot-using companies to complement social security contributions, such as imposing a levy on robotic productivity gains.

Starting with the replacement of agricultural workers and expanding to the manufacturing and services sectors, robots can free humans from simple, repetitive and hazardous jobs, which is a commendable progressive trend. However, the replacement process must be cautiously approached to avoid abrupt unemployment shocks, Zheng said.

"Robots and humans are not always competitors; instead, they can work together. For instance, as China has a large elderly population, robot-assisted elderly care could address labor shortages without fully replacing human roles," he added.

Zhao Ziyi, dean of the Guizhou Institute for Urban Economics and Development at Guizhou University of Finance and Economics, said that low-skilled workers, particularly those engaged in repetitive tasks in labor-intensive industries, face the maximum risk of being replaced.

"An expansion of the unemployed population could further widen the wealth gap. Capital and technology owners will likely reap greater benefits, while ordinary workers who fail to adapt may face exacerbated social inequality," Zhao said.

Adaptive adjustments to social policies are imperative, according to Zhao.

"First, we should build a basic security net by exploring universal basic income, reducing job transition costs and alleviating widespread anxiety," she said.

Next, innovative employment models should be introduced, such as reducing working hours in line with technological advancements and developing shared employment strategies to ease labor market pressures, she said.

Positive outcomes

The impact of AI on the economy is not strictly negative, there are some positive outcomes as well, Zhao said, adding that new job positions such as AI training and robotics maintenance could be created.

The use of AI and robots also reduces the monotony of labor, allowing a shift of the human workforce to fields that require emotional intelligence, complex decision-making abilities or innovative thinking, she said.

While machines may replace specific jobs, they cannot replicate human ingenuity, Zhao said, adding that shifting education from rote learning to fostering creativity is one way to embrace the change.

According to the report "Global Talent Trends 2024", released by international human resource service provider Mercer, 56 percent of executives believe that AI will create jobs within their organizations. In addition, the proportion of employees worried about losing their jobs to AI decreased from 53 percent in 2022 to just 10 percent in 2024.

Li Bing, a partner at consultancy Roland Berger, said that more people now view AI as a tool to boost efficiency.

"History shows that technological evolutions eventually create new forms of employment," Li said. "The key is to shorten the painful period of transformation and turn the impact of AI into opportunities for high-quality employment through education empowerment and policy guarantees."

Li suggested introducing AI skills to vocational training programs, as Singapore and Germany have done. Some parts of the United States introduced a tech dividend tax that is imposed on businesses with high levels of AI and automation and uses the proceeds to support education and employment in low-income communities.

chenmeiling@chinadaily.com.cn

CHONGQING -- From a console in Shanghai, French surgeon Youness Ahallal guided robotic arms in Morocco with real-time precision, delicately removing a patient's tumor.

Despite the staggering 12,000-kilometer distance between them, China's domestically developed Toumai surgical robot bridged the geographical divide to make transcontinental surgery a reality.

"With telecommunication techniques, Toumai Robot allows real-time, high-definition imaging and precise control of the robotic arms from a long distance," said Liu Yu, executive vice-president of Shanghai Microport Medbot (Group) Co Ltd, developer of the robot.

This breakthrough enables patients in underserved regions to access world-class medical expertise without enduring exhausting cross-border journeys. "The system also revolutionizes surgical workflows for doctors," Liu emphasized. "Previously, conducting cross-regional operations required extensive travel and coordination. Now, specialists can operate remotely with high efficiency."

To date, the Toumai platform has completed around 300 remote operations, maintaining a flawless safety record.

The Toumai Robot exemplifies China's rapid ascent as a pioneer in intelligent medical innovation. At the 2025 China Medical Equipment Exhibition in Chongqing in southwest China, AI-powered surgical systems, deep learning-enhanced diagnostic platforms, and cloud-connected robotic devices dominated the showcase.

"Toumai Robot focuses on minimally-invasive surgeries. It breaks through the limits of the hands of surgeons by filtering their physiologic tremor, which makes surgeries easier, safer, and less invasive," said Liu to flows of visitors at the company's exhibition booth.

Some medical equipment can help doctors make decisions. Longwood Valley MedTech, headquartered in Beijing, brought its ROPA orthopedic smart surgical robot with deep learning capabilities to the exhibition.

"This robot can be used in joint replacement and spinal operations as it utilizes AI to reconstruct three-dimensional images of patients' joints with CT images, based on which doctors can simulate operations and make pre-operation plans," said Chen Peng, vice-president of Longwood Valley MedTech.

It usually takes one day for an engineer to make a three-dimensional image, compared to only one to three minutes by AI, Chen added.

Chen said the robot reduces operating time by about 30 percent on average. Less operating time means less anesthesia duration, exposure and possible complications.

The robot not only serves as a powerful "brain" but also as clever "hands." During operations, sub-millimeter precision optical positioning ensures the precise execution of every critical step of the pre-operation plans. Stable robotic arms help doctors overcome traditional limitations such as hand tremors.

In 2024, China's medical equipment market size surpassed 1.35 trillion yuan (about $188.2 billion), according to data released during the exhibition.

Medical equipment is at the forefront of technological innovation, so efforts should be given to drive the digital and intelligent transformation of the medical equipment industry, said Xin Guobin, vice-minister of industry and information technology, when addressing the event on Saturday.

"It is important to accelerate the deep integration of emerging technologies such as 5G and AI with medical equipment and develop innovative application scenarios, including intelligent diagnostic systems and remote medical consultation platforms," Xin said.

With data showing a shortage of artificial intelligence (AI) talents reaching 5.2 million in China in 2024, Chinese enterprises and universities are enhancing cooperation to seek deep integration in industry, academia and research, injecting new momentum in building a digital China.

Recently, the City University of Hong Kong Business School and a number of data elements and AI industry leaders such as Inspur Zhuoshu Big Data officially launched a Master of Science in Artificial Intelligence for Business (MScAIB) program, aiming to cultivate more interdisciplinary talents in AI and business and contributing to the development of the Guangdong-Hong Kong-Macao Greater Bay Area.

Jointly created by the school's Department of Information Systems, the MScAIB project — as the first Master of Science in Artificial Intelligence for Business program in Hong Kong — intends to deeply integrate AI technology into business scenarios.

Dean Chen Jiale of the Business School (City University of Hong Kong), department chair Wang Chong, program director Ma Jian, and relevant leaders from Inspur Zhuoshu Big Data, attended the launch event on March 5.

Intending to boost industry-academia-research collaboration, and transform more laboratory research into teaching scenarios, Inspur Zhuoshu Big Data and the City University of Hong Kong have established a comprehensive collaborative relationship in the field of smart business since 2024.

By providing high-quality compliant datasets and enterprise-level software solutions, Inspur Zhuoshu Big Data has assisted Professor Ma Jian's team in establishing a commercial generative artificial intelligence laboratory, promoting the research and development of next-generation federated learning technologies integrating knowledge graphs and large language models.

Based on the latest research outcomes from the laboratory, the MScAIB curriculum has been constructed leveraging Inspur Zhuoshu Big Data's proprietary business data analysis training platform, which will produce more new-generation business leaders who can understand and utilize AI, said Liu Sizhen from the university.

Meanwhile, to address talent shortages — especially a prominent gap in business application talents — and seek an innovative industry-education integration model, the two sides can effectively combine the foresight of academic research with the practical implementation of industry, aiding in the establishment of a talent hub for AI in the GBA and activating new quality productive forces in the region.

The City University of Hong Kong, as a world-renowned institution, has always been a significant force in promoting the development of the global innovation and technology ecosystem, while Inspur Zhuoshu Big Data, one of the top five enterprises in the domestic big data market, has a wealth of data resources.

Inspur Zhuoshu has also developed a comprehensive capability system encompassing data collection, governance, analysis, and application through the National Engineering Laboratory, driving digital transformation across various fields.

Lu Daojun from the university said that with collaboration between enterprises and universities, and connectivity between the Chinese mainland and Hong Kong, the two partners can continue to deepen their cooperation, jointly constructing an open and collaborative innovation ecosystem.

Both sides aim to explore a path of deep integration and virtuous cycle in industry, academia and research that involves "breaking through academic frontiers — validating industrial scenarios — feeding back into educational systems," said Zhao Mengge from the university, stressing that it can thereby promote the continuous evolution and expansion of AI technology, injecting new momentum into the construction of a digital China.

Thanks to China's scale and growth potential, UK-based consumer goods company Unilever Plc is working to make the country a top market for its haircare brand Nexxus in the years to come, said senior executives of the company.

Unilever globally launched its Nexxus Promend high-end hair product collection in Shanghai on Feb 21, the latest move to tap into the premium and digital trends in the world's second-largest haircare market.

China is one of Unilever's core markets, and this collection's development is led by a Chinese R&D team, which makes the maiden show more meaningful, said senior executives of the company during an interview with China Daily.

"China is the world's second-largest market for haircare and styling products, and in recent years the premium sector here has been growing at a remarkable pace of 12 percent. Its market value is already nearing 1 billion euros ($1.08 billion) — driven by the relentless pursuit of a high-quality lifestyle among Chinese consumers," Chen Ge, head of country and general manager of beauty and well-being with Unilever China, said at the launch ceremony.

"By selecting China as our launch pad, we are nimbly responding to these market trends and aiming to present the refined quality and cutting-edge technology of Nexxus first to our Chinese consumers," Chen said.

China's haircare market expanded from 54.03 billion yuan ($7.47 billion) in 2018 to 63.58 billion yuan in 2023, and is forecast to grow from 65.66 billion yuan in 2024 to 75.34 billion yuan in 2028, according to analysis by London-based market research company Euromonitor International.

At the product level, the retail value of hair conditioners and treatments is forecast to rise from 12.99 billion yuan in 2024 to 14.34 billion yuan in 2028, hair loss treatments could see a jump from 2.23 billion yuan to 3.51 billion yuan during the same period, while shampoo may reach 44.55 billion yuan by 2026 from 40.10 billion yuan in 2024, said Euromonitor.

"Because of the size and future growth potential of China, we believe that this will be one of our top markets for Nexxus globally. I'm very confident about the launch of Nexxus in China and believe that it will become a big brand for us," said Elsharkawy Mohamed, Unilever China head of hair marketing, who is also global vice-president of Clear.

"There is a reason why we are here in China today to talk about that, because it's a great path that is similar to what China wants and what Unilever wants to accomplish," said Julien Moignard, senior vice-president of Unilever global beauty and well-being prospective innovation and design, who is also founder of Nexxus Promend collection.

"The consumers are very sophisticated and market is very promising and demanding. R&D wants to be in a place where there is a real need to innovate," said Han Lei, Unilever beauty and well-being R&D head of North Asia, while explaining why the China R&D team leads the development of the new product collection.

China's sharpening focus on cultivating new quality productive forces and bolstering technological innovation will drive industrial upgrades and inject strong impetus into the country's economic growth, while offering immense business opportunities for investors both at home and abroad, said experts and company executives.

As the country is doubling down on its innovation-driven development strategy, they noted that strategic emerging industries and industries of the future are expected to usher in a broader space for development, while calling for efforts to boost innovation in cutting-edge and disruptive technologies, to foster new growth drivers and gain a competitive edge in an increasingly fierce international arena.

The country will establish a national venture capital guidance fund in the near future, with the goal of enhancing, strengthening and expanding innovative enterprises, said the National Development and Reform Commission during the just-concluded two sessions.

The initiative came as this year's Government Work Report stated that China will strive to develop new quality productive forces in light of local conditions and accelerate the development of a modernized industrial system.

"New quality productive forces serve as a new engine for promoting high-quality development and advancing Chinese modernization, as well as a fresh driving force bolstering world economic growth," said Huang Hanquan, head of the Chinese Academy of Macroeconomic Research.

The country should firmly seize significant opportunities arising from a new round of technological revolution and industrial transformation, especially the iteration of new technologies such as artificial intelligence, and apply the technological innovation achievements to industrial chains in a timely manner, Huang said.

He stressed the need to transform and upgrade traditional industries, while nurturing patient capital and devoting more resources to emerging industries and future-oriented industries, to build up the momentum of new growth drivers.

"It is of vital significance to develop new quality productive forces based on local conditions, avoid blind investments in some specific fields and make full use of cutting-edge digital technologies, such as 5G, AI and internet of things to bolster industrial upgrade," said Pan Helin, a member of the Ministry of Industry and Information Technology's Expert Committee for Information and Communication Economy.

Pan called for accelerated efforts to step up research and development investments in core technologies of key fields such as basic materials and software, precision components, integrated circuits and high-end equipment, as well as strengthen enterprises' dominant position in bolstering technological innovation.

Data from the National Bureau of Statistics showed that China's R&D expenditure exceeded 3.6 trillion yuan ($497.2 billion) in 2024, up 8.3 percent year-on-year, ranking second in the world.

Li Dongsheng, founder and chairman of consumer electronics company TCL Technology Group, said: "Chinese enterprises should play a bigger role in boosting technological innovation."

Li underscored the importance of optimizing the financing environment for China's high-tech manufacturing sector and increasing support for leading high-tech manufacturing companies.

Denis Depoux, global managing director of market consultancy Roland Berger, said China is not only a manufacturing powerhouse, but also a global innovation engine driving trends in digitalization, sustainability and high-tech industries.

"In the past decade, we have seen Chinese leapfrogging globally in many industries. China has now made rapid progress in the development of AI technology, becoming one of the global leaders, and the pace will further accelerate. AI will unlock massive opportunities for our business," he said.

Cui Jingyi, vice-president and general manager of industrial software developer Aveva China, said, "New quality productive forces are key to promoting the upgrading of China's industry and high-quality development," while highlighting that China is becoming the market with the most extensive application of AI technologies globally, bringing new opportunities for many companies including Aveva.

Cui said the company will continue to increase investments in China, aiming to continuously introduce global innovations to strengthen cooperation with local enterprises, optimize local business development models and jointly develop products and services that meet the needs of the market.

Chinese authorities issued guidelines on Friday requiring labels on all artificial intelligence-generated content circulated online, aiming to combat the misuse of AI and the spread of false information.

The regulations, jointly issued by the Cyberspace Administration of China, the Ministry of Industry and Information Technology, the Ministry of Public Security, and the National Radio and Television Administration, will take effect on Sept 1.

A spokesperson for the Cyberspace Administration said the move aims to "put an end to the misuse of AI generative technologies and the spread of false information."

The guidelines stipulate that content generated or synthesized using AI technologies, including texts, images, audios, videos and virtual scenes, must be labeled both visibly and invisibly.

For content generated by deep synthesis technologies that might confuse or mislead the public, explicit labels must be placed in a reasonable position to ensure public awareness.

Explicit labels are those applied within the generated content or user interface, presented in forms such as text, sound, or graphics that are clearly perceptible to users.

Additionally, the guideline requires that implicit labels be added to the metadata of generated content files. These labels should include details about the content's attributes, the service provider's name or code, and content identification numbers.

Metadata files are descriptive information embedded in the file's header, recording details about the content's source, attributes and purpose.

Service providers that disseminate content online must verify that the metadata of the content files contain implicit AIGC labels, and that users have declared the content as AI-generated or synthesized. Prominent labels should also be added around the content to inform users.

AI generative technology has been used to create seemingly realistic content for publicity stunts or commercial gain. For instance, a news report claiming that one in every 20 individuals born in the 1980s had passed away caused a public uproar last month, only to be revealed as a rumor fabricated by AI.

AI generative technology has also been used to clone the voices and faces of many celebrities to produce deepfakes, which constitutes infringement and should be subject to legal accountability.

Earlier this month, 14th National People's Congress deputy and Xiaomi Corp founder Lei Jun, and 14th National Committee of the Chinese People's Political Consultative Conference member and actor Jin Dong, both proposed establishing laws and regulations for AI-generated content during the annual sessions of the 14th NPC and 14th CPPCC National Committee.

"Some viewers who like my movies and TV shows have been deceived by deepfake videos that clone my face, which is a very malicious act. I hope relevant rules can be established and enhanced," said Jin Dong during a panel discussion during the two sessions.

Tu Lingbo, a professor at the Communication University of China, told China Daily in a previous interview that the influx of unlabeled content generated by AI could disrupt the internet ecosystem and pose challenges to internet governance.

"Relevant laws and regulations on AI-generated content should be established and improved," Tu said.

China is expected to achieve its annual growth target of around 5 percent this year and present more business opportunities for both domestic and foreign companies, with its intensified efforts to spur innovation and further boost consumption and investment, economists and business leaders said at the "CEO: Grow with China" roundtable hosted by China Daily on Friday.

"China's economy is right on track to meet its preset annual growth target of around 5 percent for 2025, supported by its ultra-large domestic market, strong innovation capability, as well as a string of supportive policies aimed at boosting consumption and emerging industry investment," said Lin Shen, a researcher at the Chinese Academy of Social Sciences' Institute of World Economics and Politics.

Government policies aimed at fostering innovation and developing emerging industries have been steadily implemented. Fiscal policies and other innovation-friendly measures will play a crucial role in sustaining economic growth throughout the year, Lin said.

Lin highlighted the structural shifts in the economy, where new growth drivers are replacing old ones, and stressed that new quality productive forces, including artificial intelligence-powered manufacturing, have begun to take hold.

"Our new quality productive forces, coupled with AI empowerment, have integrated well with manufacturing and the real economy. There will be significant progress in application scenarios."

"Even though there are certain geopolitical headwinds, we are still very optimistic about China's economic prospects this year as the country's fiscal and monetary policies go hand in hand," said Ole Gerdau, chief operating officer at Deutsche Bank China.

He added that consumption will be the key driver of the economy, roughly contributing to two-thirds of China's growth this year. The trade-in program, for which funding has been doubled, is expected to have a positive impact on consumption.

Gerdau said the emergence of Chinese AI startup DeepSeek is changing people's perception about China's innovation strength and technological advancements.

"This creates a wake-up moment for the world that now might be the time to invest in China. We expect this year to be the turning point where international investors are going to shift their focuses and have a higher allocation into the Chinese market," he said.

China is prioritizing new quality productive forces and enhancing financial services to enterprises in its economic agenda for the year, as policymakers recently announced the rollout of a raft of supportive measures aimed at creating new growth drivers for the world's second-largest economy.

The People's Bank of China, the country's central bank, said late on Thursday that it will reduce the reserve requirement ratio and interest rates as appropriate, based on the domestic and international economic and financial situation, as well as the performance of financial markets.

The A-share benchmark Shanghai Composite Index rose 1.81 percent to close at 3419.56 points on Friday, while the ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, jumped 2.8 percent to close at 2226.72 points.

The National Development and Reform Commission recently announced that it would establish a national venture capital guidance fund, with the goal of enhancing, strengthening and expanding innovative enterprises. The fund is expected to attract nearly 1 trillion yuan ($138 billion) in capital from local governments and the private sector.

The participants at the roundtable emphasized that emerging sectors such as AI have great potential in China, presenting new opportunities for enterprises.

China's AI-led innovation is also offering opportunities for businesses like Rolls-Royce, said Troy Wang, executive vice-president of Rolls-Royce Greater China.

"China's focus on innovation-driven growth is making it continue to be an important country for Rolls-Royce, and it's so much more than just a market for us," Wang said.

"Rolls-Royce just achieved a record year in 2024 in terms of business performance and we're confident about 2025," he said, adding that the company is building Beijing Aero Engine Services Co Ltd, a joint venture in the capital, into a world-leading digitally enabled aeronautical engine repair and overhaul shop.

Rani Jarkas, chairman of Cedrus Group, said that the development of AI requires a large amount of electricity, chips and applications, and China has it all. "Technology speaks for itself."

"I think the innovation will continue and the opportunities will grow for Chinese companies going abroad and for foreign companies to come to explore the market and set up local units here," he added.

Huang Yanxiang, co-founder and CEO of Shanghai CarbonNewture and an environmental, social and governance expert, said the current wave of AI-led innovation in China is transforming industries by integrating AI with manufacturing, boosting efficiency and giving rise to new business models. For CarbonNewture, this means deeply integrating AI into its carbon accounting platforms, improving data analysis and reporting capabilities to deliver more precise and actionable insights.

The roundtable was organized by the China Daily Institute for Corporate Communication and the China Services Information Platform.

Wang Yu, Li Jiaying, Zhu Wenqian and Zhou Lanxu contributed to this story.

China's economic growth is on course to achieve its annual target of "around 5 percent" for 2025, driven by the country's massive domestic market, robust demand from both home and abroad, and supportive policies aimed at boosting innovation and emerging industries, said Lin Shen, an associate research fellow at the Chinese Academy of Social Sciences' Institute of World Economics and Politics.

"I'm fully confident in China's economic prospects this year and believe that the 'around 5 percent' growth target is achievable," Lin said.

Lin emphasized the structural transformation of the economy, where new growth drivers are replacing traditional ones. He highlighted that AI-powered manufacturing is gaining traction. "Our new quality productive forces, supported by AI, have integrated well with manufacturing and the real economy. The next step will be significant advancements in application scenarios," he noted.

He added that the shift is not only fueled by improvements in infrastructure and connectivity, but also by the diverse and multi-tiered demand from both domestic and international markets. This demand will further propel industrial growth driven by innovation.

Lin also pointed out that government policies promoting innovation and emerging industries will further support economic momentum. "Policies designed to foster innovation and develop emerging industries have been steadily implemented. Fiscal policies and other innovation-friendly measures will play a crucial role in sustaining economic growth throughout the year," he said.

On the consumer side, demand from an increasingly unified and diversified domestic market is expected to boost spending in key sectors. "The establishment of a unified national market will be key. Our diverse consumer market will drive growth in areas such as tourism, culture, education, elderly care, and the silver economy," Lin explained. He also highlighted the significant growth potential for AI-driven applications in healthcare and traditional Chinese medicine.

Investment activity, both from domestic tech firms and foreign investors, is another key driver. "In the investment sector, the gradual opening of certain industries to foreign capital and increased support for private enterprises will spur innovation. We can expect the emergence of more innovative firms, like the 'Six Little Dragons' in Hangzhou, Zhejiang province, as well as large tech giants. Their investments will, in turn, further drive economic growth," Lin stated.

China is prioritizing the development of new quality productive forces and technological innovation in its economic agenda for the year. Policymakers recently announced a series of supportive measures to create new growth drivers for the world's second-largest economy.

The National Development and Reform Commission recently unveiled plans to establish a national venture capital guidance fund, aiming to enhance, strengthen and expand innovative enterprises. The fund is expected to attract nearly 1 trillion yuan ($138 billion) in capital from local governments and the private sector.

Meanwhile, the People's Bank of China, the country's central bank, announced plans to launch a science and technology board in the bond market this year to provide financial support for technological innovation.

China is expected to achieve its annual growth target of around 5 percent this year and present more business opportunities for both domestic and foreign companies, with its intensified efforts to spur innovation and further boost consumption and investment, economists and business leaders said at the "CEO: Grow with China" Roundtable hosted by China Daily on Friday.

"China's economy is right on track to meet its preset annual growth target of around 5 percent for 2025, supported by its ultra-large domestic market, strong innovation capability, as well as a string of supportive policies aimed at boosting consumption and emerging industry investment," said Lin Shen, a researcher at the Chinese Academy of Social Sciences' Institute of World Economics and Politics.

Government policies aimed at fostering innovation and developing emerging industries have been steadily implemented. Fiscal policies and other innovation-friendly measures will play a crucial role in sustaining economic growth throughout the year, Lin said.

Lin highlighted the structural shifts in the economy, where new growth drivers are replacing old ones, and stressed that new quality productive forces, including AI-powered manufacturing, have begun to take hold. "Our new quality productive forces, coupled with AI empowerment, have integrated well with the manufacturing and the real economy. There will be significant progress in application scenarios."

"Even though there are certain geopolitical headwinds, we are still very optimistic about China's economic prospects this year as the country's fiscal and monetary policies go hand in hand," said Ole Gerdau, chief operating officer at Deutsche Bank China.

According to him, consumption will be the key driver of the economy, roughly contributing to two-thirds of China's growth this year. The trade-in program, for which funding has been doubled, is expected to have a positive impact on consumption.

Gerdau said the emergence of Chinese AI startup DeepSeek is changing people's perception about China's innovation strength and technological advancements. "This creates a wake-up moment for the world that now might be the time to invest in China. We expect this year to be the turning point where international investors are going to shift their focuses and have a higher allocation into the Chinese market," he said.

China is prioritizing new quality productive forces and enhancing financial services to enterprises in its economic agenda for the year, as policymakers announced recently the rollout of a raft of supportive measures aimed at creating new growth drivers for the world's second-largest economy.

The People's Bank of China, the country's central bank, said late on Thursday that it will reduce the reserve requirement ratio and interest rates as appropriate based on the domestic and international economic and financial situation as well as the performance of financial markets.

The A-share benchmark Shanghai Composite Index rose 1.81 percent to close at 3419.56 points on Friday, while the ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, jumped 2.8 percent to close at 2226.72 points.

The National Development and Reform Commission recently announced that it would establish a national venture capital guidance fund, with the goal of enhancing, strengthening and expanding innovative enterprises. The fund is expected to attract nearly 1 trillion yuan ($138 billion) in capital from local governments and the private sector.

The participants at the roundtable emphasized that emerging sectors like artificial intelligence have great potential in China, presenting new opportunities for enterprises.

China's AI-led innovation is also throwing up opportunities for businesses like Rolls-Royce, said Troy Wang, executive vice-president of Rolls-Royce Greater China.

"China's focus on innovation-driven growth is making it continue to be an important country for Rolls-Royce, and it's so much more than just a market for us," Wang said.

"Rolls-Royce just achieved a record year in 2024 in terms of business performance and we're confident about 2025," he said, adding that the company is building Beijing Aero Engine Services Co Ltd, a joint venture in Beijing, into a world-leading digitally enabled aeronautical engine repair and overhaul shop.

Rani Jarkas, chairman of Cedrus Group, said that the development of AI requires a large amount of electricity, chips, and applications, and China has it all. "Technology speaks for itself," he said.

"I think the innovation will continue and the opportunities will grow for Chinese companies going abroad and for foreign companies to come to explore the market and set up local units here," he said.