Debunking the myth of a 'second China shock'

Recently, the term "second China shock" has gained traction in economic and policy discussions. For example, the Munich Security Conference 2025 report warns that "Economists therefore warn of a 'second China shock' that could destroy 'Europe's core industries.'"

But does this narrative hold up? Is it based on solid economic realities, or is it an exaggerated response to geopolitical and industrial anxieties?

Why the 'second China shock' is unfounded

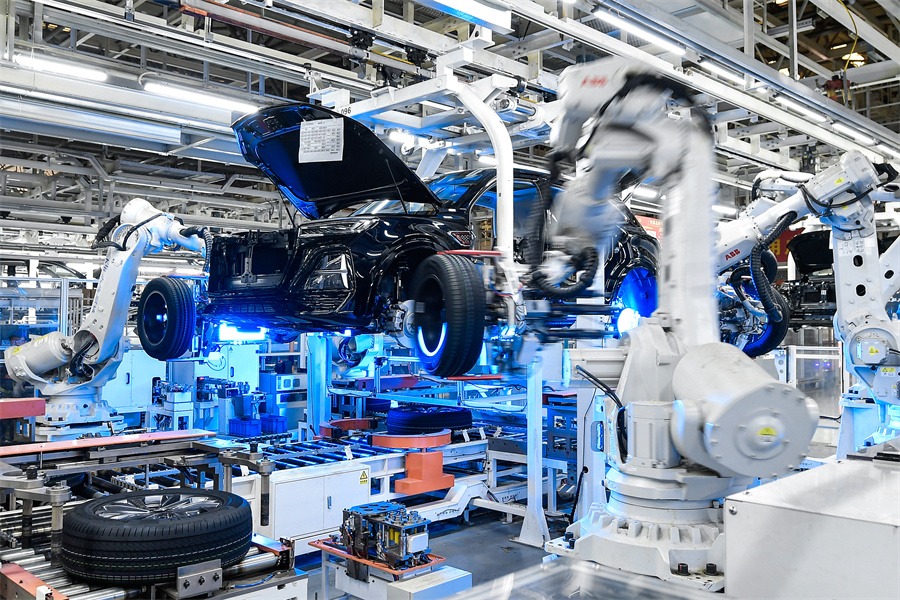

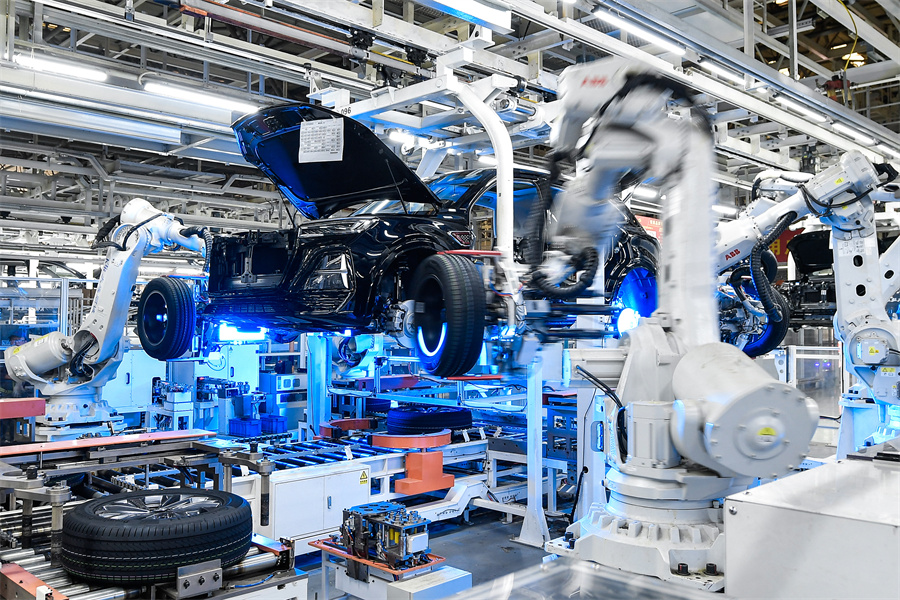

The "second China shock" is fueled by fears that China's rising industrial prowess—particularly in electric vehicles, renewable energy, and high-end manufacturing—could threaten Western economies. This narrative often aligns with protectionist rhetoric, heightened geopolitical tensions, and a sense of industrial vulnerability in the West.

However, such comparisons overlook critical differences between the early 2000s and today's global economic landscape.

Today, the global economy is diversified, and supply chains are deeply interconnected. China is not just an exporter of low-cost goods; it is a key player in global innovation, serving as a market, investor, and collaborator in industries worldwide. Chinese companies operate internationally, form joint ventures, and contribute to global innovation ecosystems. Sectors such as electric vehicles and solar panels—often cited as areas of concern—are integral to addressing climate change, a global challenge that requires cooperation rather than competition.

Framing China's industrial rise as a "shock" overlooks the mutual benefits of technological progress and trade.

A politicized narrative, not economic reality

Attributing domestic economic concerns, such as job losses, solely to Chinese imports oversimplifies complex economic dynamics. The high-quality, affordable goods from China have helped lower living costs and eased inflation pressures in many countries.

Furthermore, China's intermediate goods are vital to global manufacturing. Many nations have adapted by diversifying supply chains, investing in strategic industries, and leveraging new comparative advantages. In this context, trade should be seen as a mutually beneficial relationship, not a zero-sum game.

The narrative is often driven more by political motives than by economic fundamentals. Calls for protectionism, tariffs, and "de-risking" are frequently rooted in geopolitical concerns rather than actual economic threats.

In reality, many Western industries benefit from access to Chinese markets, investments, and supply chains. Framing China's industrial progress as a shock rather than an opportunity distorts the conversation and risks undermining global economic cooperation.

In sum, the "second China shock" narrative is largely unfounded. It fails to acknowledge the changes in the global economy and the opportunities for collaboration.

The author is a commentator on international affairs. The views don't necessarily represent those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.