How to fragment globalization

Trump's international tariff wars

After a decade of deglobalization and US geopolitics, globalization is no longer at crossroads, but unraveling. The longer this plunge prevails, the greater will be its costs.

After divisive debates and conflicting reports, President Trump announced his trade plan: a 10 percent baseline tariff on all imports; "discounted reciprocal tariff" on "bad actors": 24 percent on Japan, 20 percent on EU, respectively; and a new 34 percent tariff on China.

As expected, it is a protectionist plan building on both reciprocal and universal tariffs, but devoid of an economic rationale. As fears of a recession mount and mass protests in the US have begun, the loss of over $6 trillion on Wall Street in only two days is just a prelude of what's to come. Along with China's strike of all US imports with 34 percent tariff, Europe, Japan and South Korea, India and Brazil and the rest of the world are positioning to counter the Trump tariffs.

Half a decade ago, Trump tariffs on imports from China accounted for $400 billion, or more than 90 percent of the trade affected. Today, in what appears to be the first round of US tariffs with Canada, Mexico and China alone could add up to more than $1.3 trillion; that is, over 3.5 times more than half a decade ago.

But with the new tariff rounds, international plus universal tariffs and the expected retaliations, which may prove more aggressive than anticipated, there is far, far worse ahead. Thanks to decades of postwar globalization, these inter-dependencies will take longer to fragment. But the process of unraveling has begun.

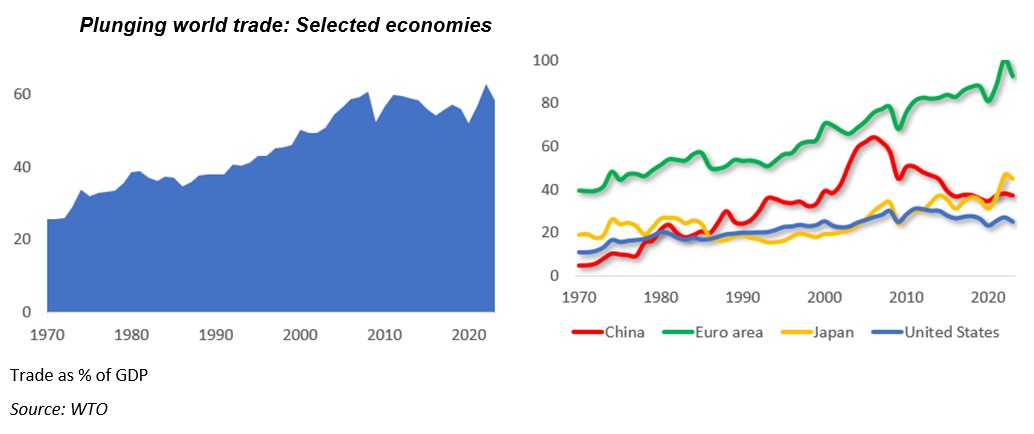

Plunging world trade

Global economic integration is often measured by world trade and investment. The postwar wave of globalization benefited mainly the advanced economies. It was only after 1980 that some developing countries, spearheaded by China, broke into world markets for manufactured goods and services, while attracting foreign capital.

This era of globalization eclipsed with the global recession in 2008. As the G20 cooperation subsequently dimmed, so have the global growth prospects diminished. After 2019, the brief gains of the US-Sino trade truce were derailed by the COVID-19 pandemic and the dire international economic landscape. As percentage of world GDP, world trade during the first term of President Trump ("Trump 1.0") fell back to the level where it had been over 15 years before.

After the first round of trade wars focusing on Mexico, Canada and China, the trendline is falling rapidly, faster than in 2018. With the onset of the second round - the launch of unilateral "reciprocal tariffs" and/or "universal tariffs" - that fall will escalate and is likely to boost mounting inflation and growth stagnation; a corrosive mix of stagflation.

But disaggregate these totals and there are differences. When tariff wars grow international, the trading economies, measured by trade as percentage of GDP, are the first in the firing line. The Euro area economies are major traders, but since they trade mainly among other European countries, it is their transatlantic trade that's under fire.

Japan benefited from Trump 1.0, which hit mainly China. But as Tokyo is not immune to an international tariff war, the downhill has started. Since 2008, Beijing has shifted its growth model from exports and investment toward consumption and innovation. As a result, China's trade ratio has steadily decreased from over 60 percent to 37 percent of GDP, or the level it first reached around 2000.

In the US, the trade ratio has been relatively lowest, around 20 percent to 25 percent. In the past, Washington considered international multilateral cooperation too important to risk. But those times are now gone.

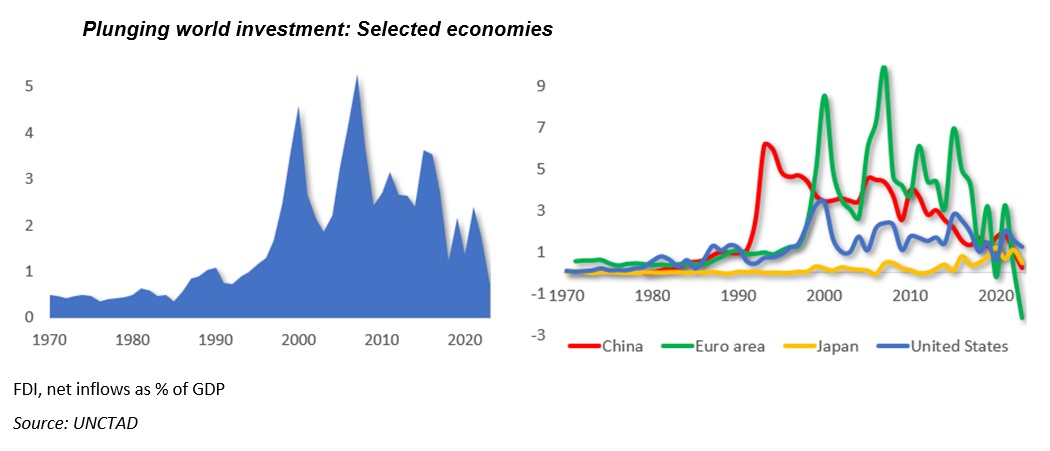

Plunging world investment

Before the 2008 global crisis, world investment soared to almost $2 trillion, with foreign direct investment (FDI), rising to 5.3 percent of world GDP, measured by net inflows as percentage of GDP. Following the severe 2008 recession, the FDI ratio more than halved to 2.4 percent. In 2017, the fundamentals were aligned for global recovery. Yet, the hoped-for rebound of world investment failed, due to the Trump 1.0 tariff wars. In 2020, the FDI ratio had plunged to 1.4 percent; a level that was first reached 30 years ago.

Since then, this failure has been compounded by the coronavirus depression, the US/NATO-led proxy war against Russia in Ukraine and the US-armed and financed proxy war of Israel against Gaza, not to mention a set of new Cold Wars. With the end of Trump 1.0, the FDI ratio climbed back to 2.4 percent.

The expectation was that the Biden administration would reverse most of the unwarranted tariffs. Instead, it not only coopted the Trump tariffs but broadened them. So, the ratio has plunged to barely 0.7 percent - a level that world investment had first reached in 1981, that is over 44 years ago.

But here, too, there are intriguing differences between economies. In Europe, foreign investment, measured by net inflows (% of GDP), has long been volatile. But gone are the glory days of globalization, when the ratio was still 10 percent, or even the mid-2010s, prior to the Brexit, the pandemic and wars, when it hovered around 7 percent. If Trump 1.0 caused it to plunge to red, Trump 2.0 begins at a historical moment when it is -2.2 percent.

In China, the FDI ratio had its high in 1994, when it exceeded 6.2 percent. Thanks to US coercive pressure on allies and geopolitics, it now hovers below 0.3 percent. Similarly, Japan's benefits during Trump 1.0 have now diminished and the ratio lingers at below 0.5 percent.

In the US, the ratio was its highest at 3.4 percent in 2000, after the Internet revolution. Before Trump 1.0 trade wars, it still hovered around 2.5 percent in 2015. Today, it is only half of that. Thanks to the unwarranted tariff frictions and geopolitical conflicts, the net inflows are now at a level the US reached already in the late 1980s; that is, over four decades ago.

With Trump 2.0, the first signs of a new plunge, a far more severe one, are looming.

Global costs of fragmentation

Essentially, deglobalization reflects the retrenchment of economic flows between countries, whether measured by world trade or investment. Until recently, it still prevailed.

During Trump 1.0, deglobalization ensued from policy choices, such as tariff wars, and the waning of structural forces. The latter used to spur rapid integration of economies until 2008, thanks to technological progress, reduced transport costs, and offshoring of value activities across countries.

A few years ago, I reviewed these costs that were then still largely focused on the US-China trade friction. With the internationalization of the US trade wars and the broadening of their scope, both of which are now the reality, the attendant losses are likely to prove far higher, both in terms of economic and human costs.

Deglobalization is a tactic of the Trump agenda, but not its strategy. Its ultimate purpose is geoeconomic fragmentation, due to "a policy-driven reversal of global economic integration," as the International Monetary Fund (IMF) calls it. As IMF deputy director Gita Gopinath has warned, with the weakest global growth prospects in decades, "we can little afford another Cold War."

If the Biden administration sought to "multilateralize" American hegemony in cooperation with US allies, the Trump White House hopes to "unilateralize" it by dictating the terms to the rest of the world. In the former case, the trade wars targeted mainly China and, to a lesser degree, a few major trading economies. In the latter case, all non-US economies are expected to pay tribute, or economic rents to "America First."

In the process, the economies of the poorer Global South – many of which President Trump regards as "shithole countries" – will pay the relatively largest bill, both in economic costs and human lives.

Global integration is no longer at crossroads. The economic Cold War is already in progress. Globalization is unraveling.

Dr. Dan Steinbock is an internationally recognized strategist of the multipolar world and the founder of Difference Group. He has served at the India, China and America Institute (US), Shanghai Institutes for International Studies (China) and the EU Center (Singapore).

The original commentary was published by China-US Focus on April 4, 2025.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.