Australia needs China amid global tariff tensions

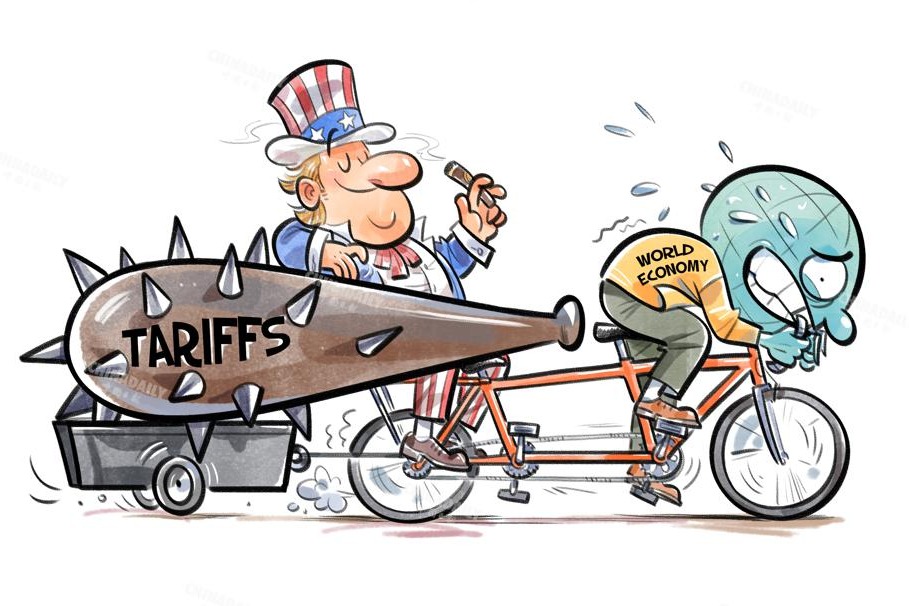

The 2025 Australian federal election occurs at a pivotal moment, as the country navigates the complexities of global alliances, economic resilience and domestic priorities. Amid escalating US-China tensions, resurgent protectionism, and climate crises, the election is sure to shape Australia's geopolitical alignment and policy trajectory.

Australian Prime Minister Anthony Albanese's Labor Party government faces scrutiny over trade disputes and cost-of-living pressures, while opposition leader Peter Dutton's Coalition positions itself as a defender of economic security. Moreover, Australia's economic interdependence with China looms large, testing the political parties' strategies to ensure economic growth and improve the deteriorating living standards.

The reimposition of US tariffs on Australian steel and aluminium in 2024 has strained Canberra-Washington relations. After US President Donald Trump declared a US economic emergency and announced tariffs of at least 10 percent for all countries on April 2, Australian Prime Minister Anthony Albanese said that the decision to impose a 10 percent tariff on its ally was "not the act of a friend", but ruled out reciprocal tariffs against the US. In comments outside the White House, Trump singled out Australian beef, which saw a surge in exports to the United States last year, reaching A$4 billion amid a slump in US beef production.

The US' move underscored the fragility of traditional alliances especially in light of Donald Trump's transactional approach during his first term as US president.

Dutton has claimed he could "change the (US) president's mind" if elected, but analysts have dismissed it as unrealistic. "If we couldn't secure an exemption for steel, what's next?" said political analyst Patricia Gellis.

Australia's attempt to leverage critical minerals such as lithium as bargaining chips faltered. Australian Resources Minister Madeleine King lamented, "We offered lithium and rare earths, but the US said we weren't offering anything new." Trade Minister Don Farrell framed the dispute pragmatically: "Tariffs on Aussie beef will spike Big Mac prices. That's how you get Trump's attention."

Equally important, China's role as Australia's largest trading partner — accounting for 30 percent of exports which include iron ore, coal and education services — remains a linchpin of economic stability. Economic analyst John K has warned that, "Global market selloffs from Trump's trade wars hurt Australia more than direct tariffs. We're caught in a US-China crossfire."

The AUKUS (Australia-United Kingdom-United States) pact remains contentious, with Greens leader Adam Bandt labeling it a "Trump-shaped target on Australia's back". Bandt criticized the $368 billion submarine deal as "outsourcing defense to a volatile US", advocating instead for climate resilience and cyber defense investments.

However, Albanese defended AUKUS, saying it is "the bedrock of regional security". And Dutton claimed it is essential to deter Chinese aggression, asserting, "Without these submarines, we're defenceless."

Amid all this, internal dissent has emerged within the Labor Party, with former senator Doug Cameron asking why Australia should fund US naval projects while facing tariffs. The debate reflects broader tensions over balancing security ties with the US and economic benefits of trade with China. The debate prompted political analyst John Paul Jany to warn that, "Relying on Trump to defend Taiwan is a gamble. AUKUS exposes our dependence, but alienating China risks economic fallout."

Australia's economy remains deeply intertwined with China's, which absorbs 80 percent of its iron ore exports and sustains critical sectors such as education and tourism. Despite political friction over security concerns, bilateral trade hit A$300 billion (US$188.79 billion) in 2023. In fact, Australian Treasurer Jim Chalmers has acknowledged that, "We can't decouple (with China) overnight. Diversification is a decade-long project."

However, vulnerabilities persist. China's 2020 trade sanctions on barley, wine and coal highlighted the risks of following the US to launch trade attacks against China.

As for the election, rising energy prices (forecast to increase by 9 percent in Australia's eastern states) dominate voter concerns. While the Greens push for renewables, China's advanced tech and manufacturing prowess in solar panel, electric vehicle and battery supply chains underpins Australia's green transition. However, Australian Energy Minister Chris Bowen has emphasized the importance of strengthening local manufacturing: "We need sovereign capabilities, not just Chinese imports."

In the education and tourism fields, Chinese students and tourists contributed about A$40 billion a year to the Australian economy before the COVID-19 pandemic, but geopolitical tensions and slower visa approvals have hampered the recovery of the two sectors, which led to Universities Australia CEO Catriona Jackson warning, "We're losing market share to Canada and the UK. This isn't just about revenue — it's about soft power."

Albanese's Labor Party focuses on providing cost-of-living relief (energy rebates, childcare subsidies) for the people and taking climate action (43 percent emissions reduction by 2030). Labor's slogan, "Steady Leadership in Uncertain Times", is aimed at reassuring voters of the ruling party's commitment to improving the overall situation amid rising US-China tensions.

On the other hand, Dutton's Coalition platform blends tax cuts, nuclear energy advocacy and hawkish rhetoric on China. The slogan, "Back to Basics: Economy and Security", targets regional voters reliant on mining exports to China, while promising to "stand up to Beijing" on security. Critics argue the Coalition's stance is contradictory, with Patricia Gellis saying: "You can't threaten sanctions on China while begging them to buy your iron ore."

Moreover, the Greens advocate reducing trade dependence on China through localized manufacturing and promoting renewables, while Teal independents are pushing for transparency in foreign investments. But both groups face scrutiny over the feasibility of decoupling.

The 2025 Australian election transcends party politics, serving as a referendum on Australia's economic strategy in a fragmented world. Albanese's critique of US tariffs and Dutton's "Trump-proof Australia" mantra underscore the precariousness of alliances, while economic benefits from trade ties with China remain an inescapable reality, providing both stability and growth opportunities.

Domestically, urgent investments are required to boost Australia's energy transition and education diversification. Externally, AUKUS and trade tensions are testing Australia's ability to balance sovereignty with interdependence. As John K said, "The world watches as Australia redefines its place." Whether through Labor's pragmatism, the Coalition's nationalism, or the Greens' idealism, the election result will shape Australia's pursuit of economic resilience in an era of major-power rivalry.

The author is chair, Belt and Road Capital Partners — A Geopolitical Risk, Trade and Investment and Education Partnership Advisory Firm with offices in China, Europe, ASEAN and Australia.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.