Trade wars to cost US dearly, warns Peterson Institute researcher

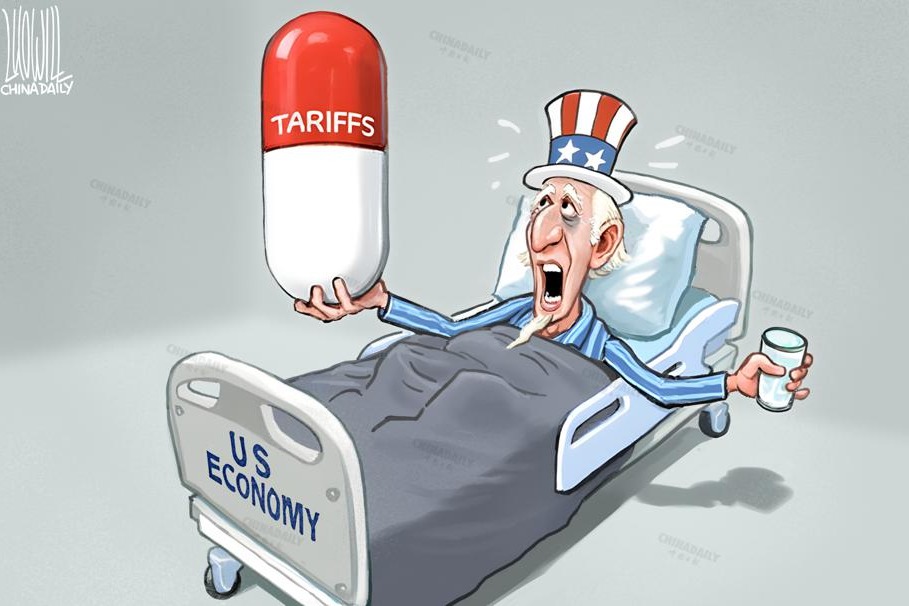

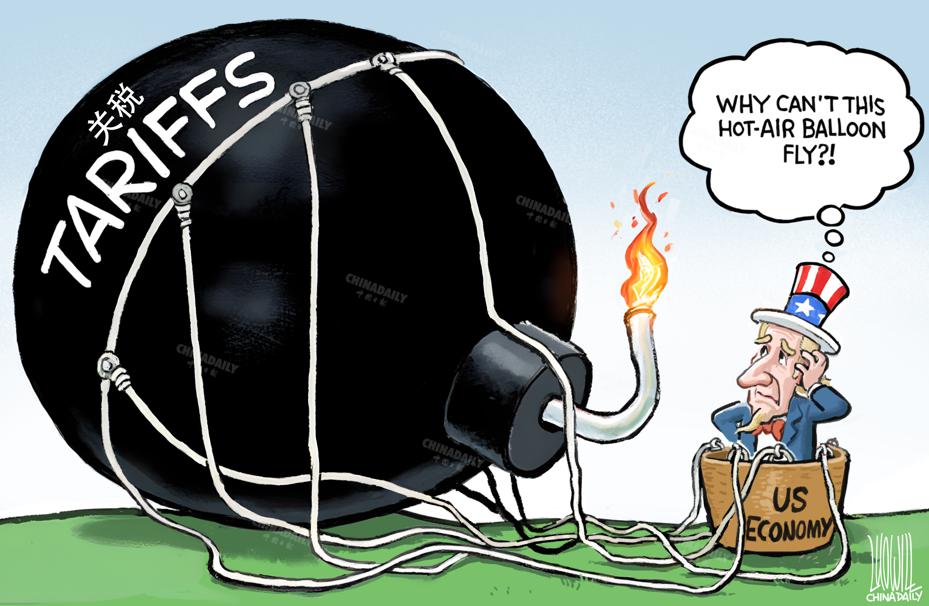

The US economy will suffer significantly — more than China's— and in the event of a large-scale trade war between the two countries, the damage would only intensify if the United States continues to escalate tensions, warns Adam S. Posen, President of the Peterson Institute for International Economics, in an article published on Foreign Affairs on April 9.

According to Posen, the Trump administration believes it holds "what game theorists call escalation dominance over China and any other economy," with which it maintains a bilateral trade deficit.

However, he argues that this logic is fundamentally flawed: it is China, not the US, which holds escalation dominance in this trade war.

Posen explains that, to the extent that bilateral trade balances matter in determining the outcome of a trade war, the advantage lies with the surplus country, not the deficit one. China, the surplus country, is sacrificing sales, which amounts to lost revenue; the United States, the deficit country, is giving up access to goods and services it does not produce competitively—or in some cases, at all—domestically.

Given the US dependence on Chinese imports for vital goods (pharmaceutical stocks, cheap electronic chips, critical minerals), Posen cautions that it is "wildly reckless" to cut off trade before securing reliable alternatives. Doing so, he warns will result in the very kind of damage the administration claims to want to avoid. A severe supply shock from slashing or eliminating imports from China would trigger stagflation, Posen said.

Posen further criticizes the administration for making erratic policy decisions that effectively amount to massive tax increases and heightened uncertainty for manufacturers' supply chains. The likely result, he contends, will be reduced investment into the US and increased interest rates on national debt.