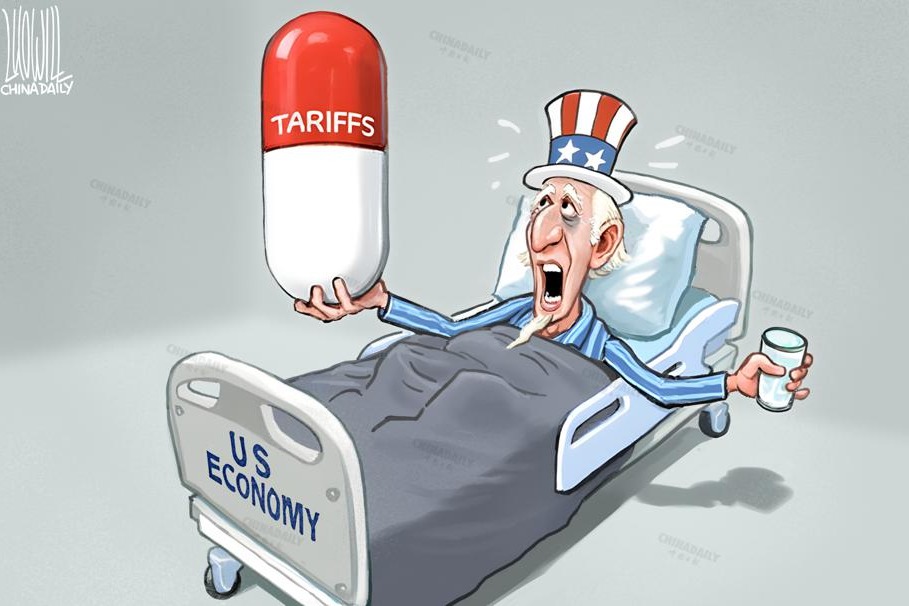

Impending recession self-inflicted suffering

The US economy could be approaching a dangerous precipice, and it's not due to war, pandemic, or a collapse in global demand. This threat is coming from within — a barrage of reckless tariffs.

On Monday, Federal Reserve Governor Christopher Waller issued a stark warning: The Donald Trump administration's sweeping trade policies are a shock to the US economy — one of the largest in decades.

In remarks to the Certified Financial Analysts Society of St. Louis, Waller made it clear that the risks posed by runaway inflation are now overshadowed by a deeper, more pressing concern: recession.

In his words, "the risk of recession would outweigh the risk of escalating inflation". That's a startling admission from a policymaker whose job is to keep both inflation and growth in balance.

The damage is already measurable. The Yale Budget Lab, in a series of reports updated on Thursday, estimates that all tariffs enacted in 2025, combined with retaliatory measures from trading partners, could slash US GDP by 1.1 percent and push prices up by nearly 3 percent.

Those numbers, along with the macroeconomic uncertainty introduced by the tariff war, translate to slower growth, rising unemployment — potentially to near 5 percent by next year according to Waller's projection — reduced investment interest, and less money in the pockets of US citizens.

Waller, generally considered a moderate Republican, clearly pointed this out. If the economy slows dramatically, even with inflation above the Fed's 2 percent target, the central bank may be forced to cut interest rates sooner and more aggressively than expected.

Economists have already sounded the alarm. Larry Summers, the former Treasury secretary, estimates a better-than-even chance — "six in 10 or better" — that the US will enter a recession this year.

What makes this moment uniquely dangerous, Summers argues, is that the turmoil is self-inflicted. Unlike past crises triggered by external shocks, this instability stems from deliberate policy choices.

Ray Dalio, one of the world's most respected investors, also warned that the US economy is teetering on the edge of a recession, driven in large part by the disruptive effects of the Trump administration's tariff policies.

Dalio cautioned that erratic and unpredictable tariffs can severely disrupt global supply chains, acting like "throwing rocks into the production system." Such disruptions, he argued, would significantly undermine global efficiency and drive up costs across the board.

It is notable that the founder of Bridgewater Associates likened the policy chaos to "throwing rocks into the production system". It's a vivid metaphor, and unfortunately, an accurate one.

Tariffs may make for strong sound bites. They don't make for strong economies. The warning signs are flashing. Whether Washington will heed them remains to be seen.