Testing times for US as ill-judged tariff attack is only piling further misery on its woes: China Daily editorial

Nvidia CEO Jensen Huang's recent visit to China underscored the critical importance of the Chinese market for the United States' tech giant, with Huang emphasizing the company's commitment to continued collaboration with China despite the mounting challenges imposed by successive US administrations.

Just days before Huang's visit, the US Department of Commerce imposed licensing requirements on Nvidia's H20 chip, along with AMD's MI308 chip and similar artificial intelligence technologies destined for China. A move that signals a broader crackdown on semiconductor exports to China, casting an even darker shadow over the future of tech trade relations between the two nations.

US President Donald Trump's casual dismissal of concerns surrounding Nvidia's operations in China, contrasts sharply with his administration's proposed "new basket" of semiconductor tariffs, coupled with its tighter export restrictions, which signal it is ramping up the stringent tech policies initiated by its predecessor.

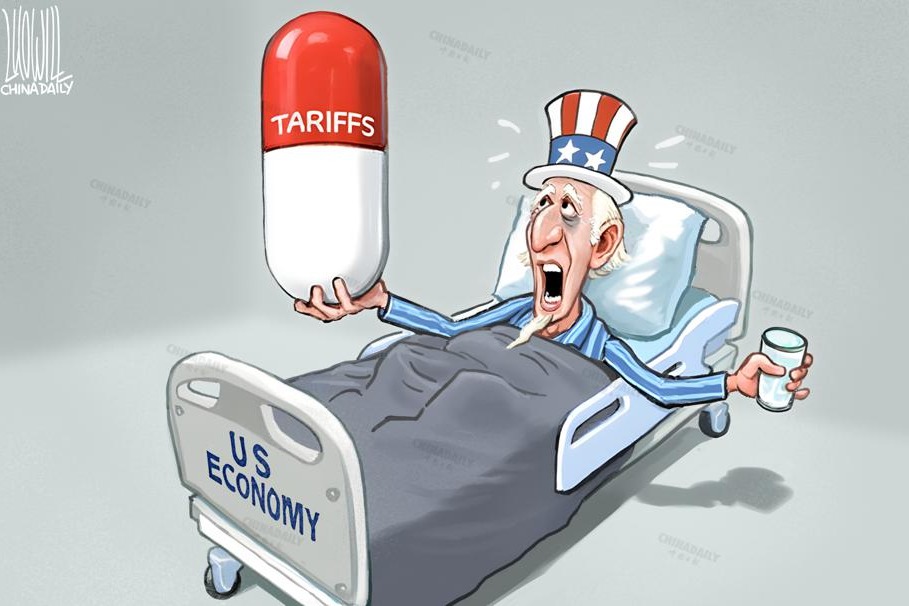

But the proposed tariffs on the powerful computer chips inside smartphones and other technologies will only add to the supply chain disruptions that the administration's extortionist tariffs have already created in critical sectors.

Facing enormous domestic pressure, the US administration is trying to create the impression that it has the upper hand in the trade confrontation it has initiated with China. Trump said on Thursday that he expects to "make a good deal" with China. But despite that professed optimism, the lack of proactive engagement from the Chinese side underscores that his administration has overestimated the leverage the US has. China remains open to talks, but only if they are based on mutual respect and conducted on equal footing. Coercion and extortion will not produce a deal.

It is only when a country has suffered enough harm that it is likely to consider softening its position and start talking about a deal. And as Julian Evans-Pritchard, chief China economist at Capital Economics, said:"Judging by the market reaction alone, I think it's the United States (that is feeling more pain) right now."

Since the US administration announced its steep extra tariffs on imports from China and other trade partners, drastic stock market fluctuations have shown how much it has damaged investor confidence. And the soaring Treasury yields, which were close to 4.5 percent on April 11, reportedly panicked the US government, as high Treasury yields are set to increase the financial costs of its repayment of the country's colossal national debt, which had risen to $36.22 trillion on April 3, about 122 percent of the US' total GDP last year. What is more, interest payments constitute the fastest-growing part of the US government budget and are estimated to be as much as $13 trillion over the next decade alone, according to estimates by the Committee for a Responsible Federal Budget, a nonpartisan, nonprofit organization in the US.

If the US administration sticks to its belligerent stance, it will further batter the US economy by creating a vicious cycle in which rising costs and declining productivity dampen US growth.

The US government should reflect on the true causes of its economic woes rather than trying to mug other countries for money. For decades, its corporate sector has taken advantage of economic globalization to shift their factories overseas to make gargantuan amounts of money in almost every corner of the world. But that money went to the pockets of the rich in the US and not to the government. That means investment has not been made in crucial areas to support the long-term and sustainable development of the country, such as infrastructure, public health, education and poverty alleviation.

Worse, it is estimated that the US has spent $8 trillion on waging wars and instigating conflicts, revolts and regime changes in many other countries post-Sept 11, 2001. It also spends over $150 billion a year on maintaining its approximately 800 military bases overseas.

The US administration has depicted "beautiful" economic prospects in the future to sell its tariff regime to the public, but they are nothing but a mirage. On Friday, it was reported that discussions have begun within the Trump administration on forming a working group to urgently address the issue if it fails to negotiate a breakthrough with the Chinese government.

China's increasingly diversified export markets, large US Treasury debt, stock of key strategic minerals, and institutional strengths not only enable the country to withstand the tariff test, but also underline its strong bargaining position in any negotiations.

One can only reap what one sows. If the US really wants to solve the problem through dialogue and negotiation, it should cease its "maximum pressure" approach, stop threatening blackmail, and talk to China on the basis of equality, respect and mutual benefit.