|

|

|

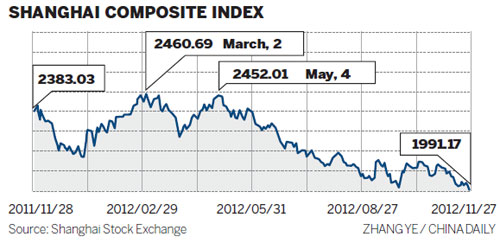

An investor monitors share prices at a brokerage in Hangzhou, Zhejiang province, on Tuesday. The benchmark Shanghai Composite Index ended trading at 1991.17 points, its lowest close in about 46 months. [Photo/China Daily] |

Recovery from exchange's low close unlikely to come soon, say analysts, experts

Analysts say Chinese shares are unlikely to rebound quickly after closing at their lowest level in nearly four years on Tuesday.

The benchmark Shanghai Composite Index fell 1.3 percent, or by 26.29 points, to 1991.17, marking the first time it has closed below the psychologically important level of 2000 points in nearly four years.

The close was the lowest since Jan 23, 2009, when the index ended at 1990.66 points.

The decrease marked a contrast to the rally seen in most Asian markets and came amid the lowest trading on the Shanghai Stock Exchange in four years.

The drop below 2000 almost immediately had stock analysts talking about 1850 points or even 1800 points as being the next psychologically important levels. The value of the yuan, in contrast, has shown sustained strength, breaking another record on Tuesday.

Wang Jianhui, chief economist with Southwest Securities Co Ltd, blamed the drop on tightening liquidity conditions.

"The whole thing is technical and not about the fundamentals," Wang said.

"There is just not enough money out there to support a higher index."

Many investors see the 2000-point level as marking rock bottom in the stock market. To them, the drop below it could signal that there is no end in sight to the current bear market, which has lasted for four years.

Even so, market reaction to the events was tempered by the recognition that the level had already been broken in intra-day trading this month.

"The market could have been subjected to much more trauma," said Zhang Qi, a stock analyst with Haitong Securities Co Ltd in Shanghai.

Zhang said he doubts a marked turnaround will occur in the short term.

"The perfect news to bring about a turnaround would be a reserve requirement ratio cut by the central bank," he said. "But I don't see that happening now that the economy has bottomed out."

China's rate of economic growth hit a more than three-year low of 7.4 percent in the third quarter of this year.

"There's pessimism about economic conditions next year," said Zhang.

"China may maintain its current monetary policy, which may not be significantly relaxed until the first quarter of next year."

About 78 billion yuan ($12.52 billion) worth of shares on the Shanghai and Shenzhen stock exchanges changed hands on Tuesday, according to the exchanges.

Media stocks led the decline. Shares in the filmmaker Huayi Bros Media Group Corp were down by 5.12 percent to 14.26 yuan after the company's third-quarter earnings declined year-on-year.

Shares in BlueFocus Communication Group Co Ltd, a public-relations company, plummeted by the daily trading limit of 10 percent after news came out that the company's plan to acquire Time Share Advertising & Communication Co Ltd had been scotched.

Shares in Zhongjin Gold Corp Ltd edged up 0.19 percent to 15.60 yuan after the Ministry of Industry and Information Technology predicted that the country will be consuming 1,000 metric tons of gold a year by 2015.

The Shanghai index is now down 9.5 percent year-to-date and 42 percent since August 2009, when the gauge hit its highest level since the global financial crisis, according to data compiled by Bloomberg.

In the foreign exchange market, the yuan's value hit another record against the US dollar for the period following China's 2005 foreign-exchange reforms. The currency increased by a daily trading ceiling of 1 percent to 6.2223 for each US dollar.

The yuan has hit the daily trading ceiling in 19 out of the past 21 trading days as quantitative easing in the US weakens the value of the greenback. Gold value rose slightly higher after eurozone leaders reached an agreement concerning Greece's debt burden. And silver value increased by its greatest amount in the past two months.

Du Liang, an analyst with Shanxi Securities Co Ltd, has predicted the Shanghai index could hit a low of 1800 points in the next three to five months. In a research note, Du wrote, "Judging from expectations for corporate earnings in the first quarter of next year, the market has not bottomed out".

In Hong Kong, the benchmark Heng Sang Index erased its morning gain to close down by 0.08 percent, or 17.78 points, to 21844.03. The Hong Kong IPO by People's Insurance Co (Group) of China Ltd, a large mainland insurer, got off to a good start on Tuesday. Investors snapped up its shares in an offering that is eventually to raise HK$27.8 billion ($3.59 billion) for the company, putting it on track to hold the biggest IPO in Hong Kong so far this year.

In Japan, the Nikkei 225 index increased 0.37 percent to 9423.30 points. And the S&P/ASX 200 index in Australia was up 0.74 percent to 4456.83 points. The Indian benchmark index Sensex was meanwhile up by 243.85 points, or 1.32 percent, to 18780.86.

AFP contributed to this story.

gaochangxin@chinadaily.com.cn