China created 1 million new millionaires last year as the country's booming stock market bolstered the ranks of the wealthy, according to a global wealth report released on Monday.

The US maintained the largest number of millionaires last year at about 6.9 million. China was in second place with 3.6 million, followed by Japan with 1.1 million, according to the Global Wealth 2015: Winning the Growth Game, released by The Boston Consulting Group.

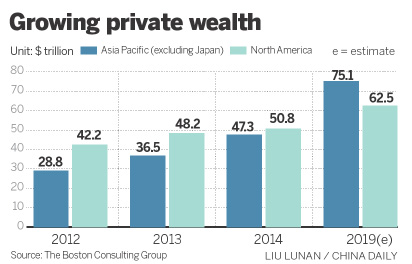

For the first time, Asia Pacific (excluding Japan) passed Europe in wealth, totaling $47.3 trillion to $42.5 trillion, the report showed. It predicted that the Asia-Pacific region will probably become the richest region in the world next year with an estimated $57 trillion of private wealth, surpassing North America's projected $56 trillion.

"When it comes to wealth, Asia is the place to be," said Federico Burgoni, partner and leader of BCG's asset and wealth management segment in the Asia-Pacific region. "China and India are speed driving the growth in Asia Pacific, but Indonesia and Thailand are also producing growth.

"More than two-thirds of the new wealthy (in Asia Pacific) were entrepreneurs," said Burgoni.

Globally, the total number of millionaire households reached 17 million in 2014, up from 15 million in 2013.

BCG defines millionaires as those with $1 million or more in monetized wealth-cash, stock, bonds and other financial assets. Their wealth measurement does not include real estate or business ownership.

Paced by strong equity markets, global private wealth in 2014 continued to increase by double-digits, up by 11.9 percent to reach a total of $164 trillion, with almost three-quarters of the growth driven by strong markets around the world, the report said.

According to BCG, 73 percent of the gains in private wealth in 2014 came from market gains on existing assets rather than newly created wealth.

Private wealth held by ultra-high-net-worth households (those with more than $100 million) grew by 11 percent in 2014. The number of ultra-high-net-worth households is expected to grow by 19 percent globally by 2019.

The report said current political and economic tensions, such as those in the Middle East and Latin America, continue to spur the wealthy to seek offshore locations to manage their wealth. As for offshore wealth booked in Asia Pacific, Singapore (31 percent) and Hong Kong (15 percent) remained the top destinations.

BCG said Switzerland will need to reinvent itself to turn back the threat from fast-developing Asian booking centers as preferred global locations for offshore wealth.

Currently, offshore hubs in Hong Kong and Singapore represent the most significant challenge to Switzerland's position. These two locations, accounting for 16 percent of global offshore assets in 2014, are expected to grow, with a projected annual increase of 9 percent in offshore bookings in both centers over the next five years.