Gold loses its luster as dollar rises

|

|

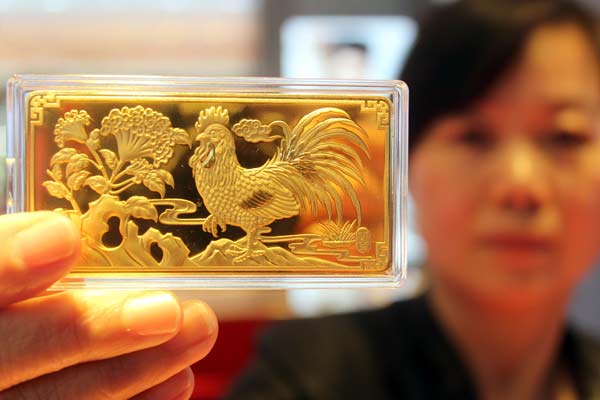

A worker displays a gold bar designed for the Year of the Rooster at a gold store in Suzhou, East China's Jiangsu province on Jan 4, 2017. [Photo by Wang Jiankang/For China Daily] |

Investors just keep bailing on gold.

In December, $2.27 billion was pulled out of SPDR Gold Shares, the world's largest exchange-traded fund backed by the metal. That was a third straight monthly loss and the biggest since May 2013. Money managers have also turned less bullish on bullion, cutting their net-long positions for a seventh straight week to the smallest since February, US government data showed.

Bullion lost favor at the end of last year, posting the worst quarterly loss since June 2013 as equities rallied and the dollar gained amid improving global growth prospects and increasing odds that the Federal Reserve will keep boosting US interest rates this year. That's hurt the investment appeal of gold because it doesn't pay investors yields or dividends.

"The reality is the trend is not in gold's favor right now," Bob Haberkorn, a senior market strategist at RJO Futures in Chicago, said in a telephone interview. "You're fighting the trend if you're trying to buy gold at this level. It's going to take geopolitical events or a change in the tone of the Fed on interest rates to push gold higher."

Gold futures for February delivery swung between gains and losses on Tuesday, before settling 0.9 percent higher at $1,162 an ounce on the Comex in New York. The metal lost 13 percent in the final three months of 2016. The Stoxx Europe 600 Index entered a bull market, as data from the US and China signaled a strengthening economy.

Hedge funds and other large speculators pared their net-long positions by 23 percent to 41,247 contracts in gold futures and options in the week ended Dec 27, according to US Commodity Futures Trading Commission figures published three days later.

Bloomberg