Green bonds nurture Asian growth shoots

Asia is expected to issue a total of $60 billion worth of green bonds in 2017 and China, as one of the major issuers, will serve as a main driving force for the region's future growth, according to a report from Bloomberg Green Bond Database.

Green bonds are a tool to finance eligible green projects, including renewable energy and energy efficiency and water treatment projects.

Aside from their applications, green bond are identical with conventional bonds, in terms of credit, liquidity, currency and tenor, as well as price.

In 2016, green bond issuance in China totaled $32 billion, taking up a considerable amount of both the international market and the domestic market. Local companies and institutions accounted for 86 percent of the issuance.

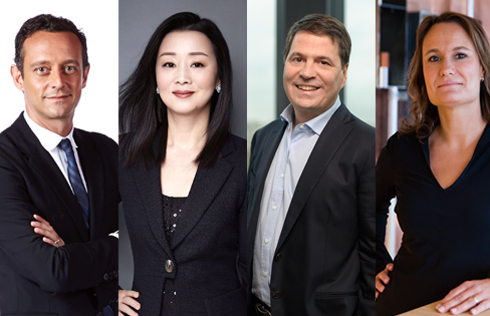

"Asian markets have witnessed a steady increase of green bond transactions in recent years, including China, India, Japan, South Korea and the Philippines. As we can see, China functions as the most important market," said Suzanne Buchta, managing director of Bank of America Merrill Lynch.

She said that ever since the global green bond market kicked off in 2007, they had experienced rapid growth. In 2016 the market volume of green bonds doubled the volume the previous year.

"China serves as the one of the backbones of the growth," Buchta said.

"Apart from China, the US and the European countries also contributed to the market increase."

Green bonds are going mainstream in the overall bonds market, partly because of the growing global awareness about the pressing need for environmental protection, she said.

In the second half of 2016 BlackRock, the world's largest asset manager, issued a climate change warning, stating that investors could no longer ignore the phenomenon-and that they should factor in the costs of environmental problems, such as fossil fuel usage, water consumption, and carbon emissions-as a percentage of annual sales when they decided which companies to invest in.

During the G20 Leaders Summit in Hangzhou, international insurance giants Aviva, Aegon NV and MS Amlin made a joint statement, calling on the member countries to pledge to end coal, oil, and gas subsidies in four years.

The multinational insurers also recognized climate change as the "mother of all risks" and said that the use of fossil fuels had exacerbated the problem.

Zheng Yiran contributed to this story.