Futures to be opened up

|

|

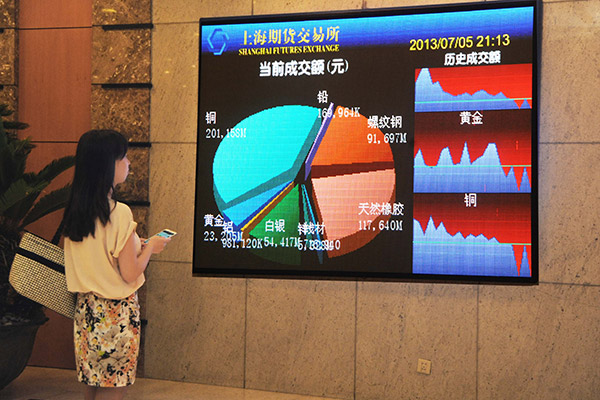

An investor checks gold and silver futures data of the Shanghai Futures Exchange. Since November 2012, China's futures markets have been sought to be opened up increasingly, enhancing their international influence. [Photo/Xinhua] |

CSRC vice-chairman says move is part of country's larger economic goals

China will open up its futures markets to the world, particularly foreign investors, to help the markets align with the national strategies for boosting the real economy, said a senior official from the country's top capital market regulator.

The government will support a futures and derivatives market that is compatible with the country's economic and social development goals as well as the need for economic risk management, said Fang Xinghai, vice-chairman of the China Securities Regulatory Commission.

He made the remarks in his address to the 2017 China (Zhengzhou) International Futures Forum on Sept 8.

Since the 18th National Congress of the Communist Party of China in November 2012, China's futures markets have been sought to be opened up increasingly, enhancing their international influence.

For example, prices of copper, PTA (purified terephthalic acid, a raw material used in the making of certain plastics) and iron ore in the futures markets have become important reference points in international and domestic trade.

"China will support and encourage more qualified overseas investors to take part in the trading of China's bulk commodities exchange," he said.

"The country will make crude oil futures the new starting point of opening up all futures markets. The preparatory work of listing crude futures on the Shanghai Futures Exchange has entered the final phase.

"And then, we will allow foreign players, whose enthusiasm is very high at present, to enter other futures markets, such as iron ore and PTA, when conditions are ripe."

The Dalian Commodities Exchange will steadily drive the internationalization of iron ore futures, attracting international traders to participate directly. That strategy would help increase China's influence in international markets, said Wang Fenghai, general manager of the exchange, at the forum.

He stressed that the company will try to allow foreign players to enter the market as early as this year.

In general, the standards and internationalization of China's derivatives markets are yet to reach levels that are considered world-class, in terms of pricing and risk management, market insiders said.

So, commodity exchanges will be supported if they seek to cooperate with overseas exchanges, especially those in countries and regions that are participating in the Belt and Road Initiative, Fang said.

"The Belt and Road Initiative provides new opportunities for the domestic futures markets to go global," said Chen Huaping, director of the Zhengzhou Commodities Exchange.

The exchange is actively searching for new ways of involving in international derivative markets, he said.

The markets regulator will support futures trading institutions to establish or buy out companies overseas, introduce foreign shareholders, and carry out cross-border businesses, said Fang.

"We will attract more international shareholders to participate in Chinese companies, strengthening the international element in them."

Until the end of last year, Chinese futures companies set up 18 subsidiaries abroad. The latter are engaged in the futures business. Two foreign financial institutions have picked up stakes in Chinese futures companies, according to data from the China Futures Association.