CIC eyes greater international role

|

|

China Investment Corp. [Photo by Wu Changqing/For China Daily] |

China Investment Corporation, the world's second-largest sovereign wealth fund, is ready to target more overseas alternative assets and direct investment in the next decade, as its strategy shifts amid tightening global liquidity.

Guo Xiangjun, CIC executive vice-president, told China Daily that alternative asset investment, including hedge funds, private equity, and real assets, will surpass public equity and account for more than 50 percent of the fund's portfolio during the next 10 years.

This is an indication that, after 10 years of operation, the nation's sovereign wealth fund is altering its investment strategy.

"Overall asset income will face huge headwinds, as the world's major central banks start to tighten their monetary policy amid global economic recovery. That will drive down asset prices when liquidity is being squeezed," said Guo.

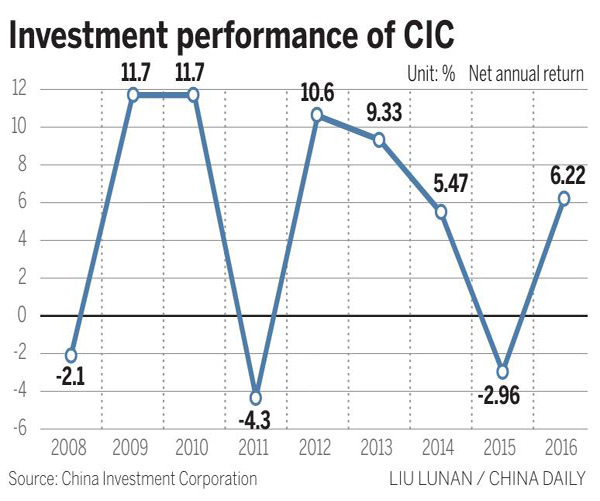

Although the fund has seen a net cumulative average annual return of 4.76 percent, Guo expected this figure to decline in the next decade.

According to CIC's annual report, alternative assets accounted for 37.24 percent of its overall portfolio by the end of 2016, while investment in public equity was 45.87 percent. Its total assets rose to $813.51 billion, nearly triple when it was founded in 2007, marking it the world's second-largest following Norway's Sovereign Wealth Fund of more than $1 trillion.

Direct investment, as a measure of proprietary investing, will be another key area that CIC will boost in the future.

"China will be a broad market for our investment targets. The country's huge demand for those foreign companies' technology or products will facilitate their income while helping to boost our investment returns," said Guo.

As the Belt and Road Initiative is set to promote huge investment demand in the coming years, the fund will also boost its investment in the infrastructure construction, high-tech and healthcare sectors in economies along the routes, the senior executive added.

Vice-Minister of Finance Zhu Guangyao said at the China Wealth Management 50 Forum on Sunday that the Belt and Road Initiative will see further achievements in financial cooperation, infrastructure construction and trade promotion between China and other participating economies.

The US central bank announced on Wednesday that it will reduce its holdings of treasury and agency securities starting from next month, which is seen as a turning point in the global liquidity environment and it will have a long-term impact on major economies' interest rates and asset prices.

China's sovereign wealth fund pledged to its stakeholders in the annual report that it is well positioned to withstand short-term market volatility as a long-term investor.