Conditions ripe for China to further open up capital market

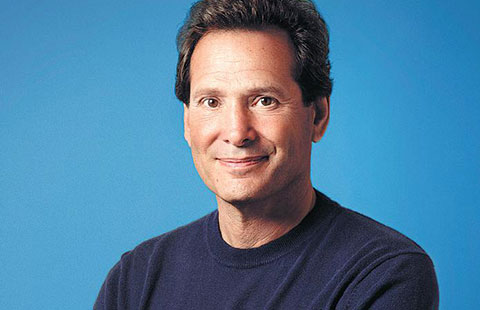

SHANGHAI — It is high time for China's capital market to open wider to the world as more favorable conditions have emerged, according to Wu Qing, chairman of the Shanghai Stock Exchange (SSE).

"Stable and healthy economic development has laid a solid foundation for the country to further open up its capital market," said Wu in an exclusive interview with Xinhua.

In his opinion, the renminbi exchange rate and cross-border capital flow remain stable; the country's foreign exchange reserves are staying at a reasonable level; the Belt and Road Initiative is gaining more and more responses; market regulators have accumulated rich experience in cross-border supervision, investment protection and risk management; technically, local stock exchanges are in good condition, showcasing the country's favorable conditions to open up its capital market.

Progress has already been made in this respect, according to Wu.

"Key symbols of the capital market opening to the world range from the (dollar-denominated) Qualified Foreign Institutional Investor (QFII), Renminbi Qualified Foreign Institutional Investor (RQFII) and Qualified Domestic Institutional Investor (QDII) programs, Shanghai-Hong Kong Stock Connect to the MSCI's inclusion of Chinese A-shares," said Wu.

Thanks partly to these measures, more and more foreign investors have gained access to the country's big capital market by setting up joint venture investment banks and fund management companies, according to Wu.

Sales of panda bonds, the yuan-denominated debt sold in China by foreign firms or governments, on the SSE alone has added up to 90 billion yuan (about $13.6 billion), accounting for nearly half of the total issuance.

By the end of July this year, the accumulated issuance of Panda bonds reached 194 billion yuan, data of the People's Bank of China, the central bank, showed.

The country has been stepping up efforts in recent years to offer foreign investors wider access into the domestic financial market. The Shanghai-Hong Kong bond connect program was approved in May this year, which allows investors from both sides to trade bonds on each other's interbank markets.

Despite progress, China should not slacken its efforts to further open up its capital market in order to make it better compatible with the national strength, according to Wu.

He said the SSE has initiated a research program to study the possibility of a Shanghai-London stock connect.

"We've been actively participating in international rule-making and international governance of stock exchanges under the mechanism of World Federation of Exchanges. Our work has gained international recognition," Wu said.

The SSE became part of the United Nations Sustainable Stock Exchange Initiative in September.

However, significant gaps still remain between local stock exchanges and the world's advanced bourses, he said.

"The country's degree of market openness remains relatively low, its capability in global resource allocation is far from strong," said Wu.

Taking the SSE as an example, the gross market value held by foreign investors takes up less than 2 percent of the total, pointing to a large potential for opening up in the sector.

In the future, the SSE will try to create better international exchange and cooperation mechanisms to serve the Belt and Road Initiative in a more efficient way, develop more internationalized exchange-traded products for investors and work with securities institutions as well as other professional organizations to boost global presence, Wu said.