Chinese fintech firm Jianpu begins trading on NYSE

NEW YORK - Chinese fintech company Jianpu Technology Inc, served as the independent open platform for discovery and recommendation of financial products in China, debuted on NYSE Thursday, trading under the symbol "JT".

Jianpu priced its initial public offering (IPO) of 22,500,000 American depositary shares (ADSs) at $8 per ADS for a total offering size of $180 million, assuming the underwriters do not exercise their option to purchase additional ADSs. Each two ADSs represent five Class A ordinary shares.

The company has granted the underwriters an option, exercisable within 30 days from the date of the final prospectus, to purchase up to an aggregate of 3,375,000 additional ADSs at the IPO price, less underwriting discounts and commissions.

Proceeds from the IPO will be used to enhance Jianpu's research and development capabilities, to invest in technology, and to invest in branding, as well as for working capital and other general corporate purposes.

Jianpu started trading at $8.25 per ADS on Thursday, and closed at $8.39 apiece, rising 4.88 percent.

The company's open platform, operated under the "Rong360" brand, has reached over 67 million registered users, according to the filing.

In the first nine months of 2017, over 2,500 financial service providers nationwide offered more than 170,000 financial products on Jianpu's platform, including consumer and other loans, credit cards and wealth management products.

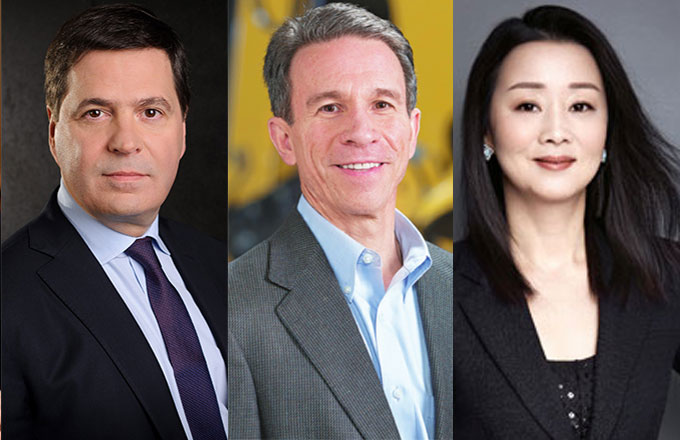

"Our mission is to become everyone's financial partner, empowering users and enabling financial service providers to better satisfy mutual needs through Jianpu's platform. After today's IPO on NYSE, we will have a better chance to achieve our goal," David Ye, chairman & CEO at Jianpu told Xinhua after the opening bell.

"By leveraging our deep data insights and proprietary technology, we provide users with personalized search results and recommendations that are tailored to each user's particular financial needs and credit profile," He added.

For the six months ended June 30, 2017, Jianpu's revenues were $58 million, up 170 percent from the same period a year ago, while its net loss decreased to $7.2 million, down 53.2 percent from the year-ago period, according to the company's prospectus.

The number of IPOs in the US capital markets has obviously increased this year. As of Nov 16, there have been 144 IPOs priced, an increase of 50 percent from the same date last year, while total proceeds raised were $33.6 billion, an increase of 99.7 percent from the same date last year, according to Renaissance Capital.

After Jianpu's IPO, a total of nine Chinese companies had listed on NYSE this year, including Alibaba-backed Best and Tencent- and Sohu-backed Sogou, raising approximately a combined $2.6 billion.