Borrowers face costly payback

Updated: 2012-02-14 09:46

By Li Jing and He Na, and Xu Junqian (China Daily)

|

|||||||||||

Wu Ying used to be one of the richest women in China. Today the former billionaire is on death row.

In the eyes of many people, particularly the judge who threw out her appeal last month, Wu is a fraudster who swindled her friends and business partners out of 770 million yuan ($122 million).

Yet, others oppose the sentence and say her case highlights a major issue in China: the reliance among small- and medium-sized enterprises on high-interest loans from private lenders.

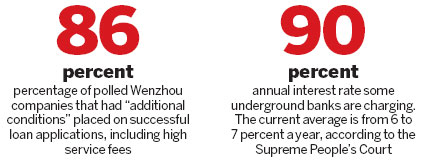

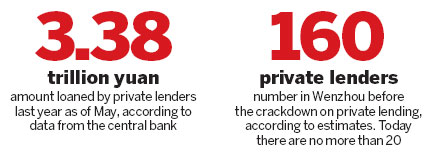

From loan sharks and underground banks to pawnshops and auction houses, the private lending chain is huge and diverse, according to economists, who blame the situation largely on the struggles experienced by entrepreneurs in getting startup funds through authorized channels.

After 30 years of ongoing reforms, experts are now adding their voices to calls for China's financial sector to be opened up even further.

On Jan 18, Zhejiang province's high court upheld the death penalty handed down to Wu, insisting that the 31-year-old had purposefully cheated lenders between 2005 and 2007, using false financial statements and promises of large returns.

"Her intention was to defraud, this was more than just illegal fundraising," said presiding judge Shen Xiaoming on Feb 7, in a statement issued in response to public opposition to the sentence.

Yet, Hu Xingdou argues differently. The professor of economics at the Beijing Institute of Technology said that as tightened monetary policies have made it tough to get bank loans, borrowing money from relatives, friends and acquaintances on the promise of high returns has become the only option for many Chinese entrepreneurs.

Most long-term lending by commercial banks only goes to government-backed projects, which carry less risk, he said. All that is available to small and medium-sized enterprises, such as those run by convicted tycoon Wu Ying, is short-term capital that cannot be invested in fixed assets.

Although it is illegal and unregulated, he said private financing might actually be complimenting the official system.

"Interest rates are sometimes much higher than those set by State-owned banks, but the 'application' process is flexible and straightforward," Hu added.

Hot Topics

Kim Jong-il, Mengniu, train crash probe, Vaclav Havel, New Year, coast guard death, Internet security, Mekong River, Strait of Hormuz, economic work conference

Editor's Picks

|

|

|

|

|

|