|

|

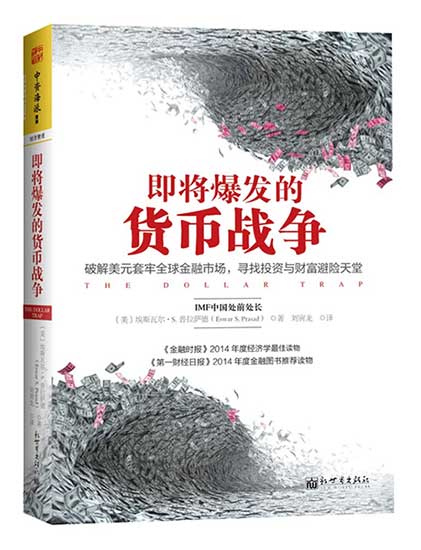

[Photo provided to China Daily] |

When the global financial crisis swept the whole world, "everybody" was scared and wanted to find safe places to put their money.

"So they turned to the US dollar," he says.

Prasad emphasizes that in the book, he tries to relate one important fact, which is trust.

Although the whole world seems to complain about the US to some extent, he says, when it comes to trust, "everyone automatically seems to trust that money will be safe in the US".

But can the RMB, as a currency that has kept appreciating until recently, compete with the dollar?

In the book, Prasad argues that the RMB is well on its way to become an important international currency. But if the RMB wants to get stronger, there is a lot that the Chinese government needs to do in the future.

"People would like to trust that the dollar is safe not just because the US has the world's largest economy and has a very safe financial market, but because there is a lot of transparency in the US government and a very strong and independent central bank that is protecting the value of the currency," he says. "There is also an independent legal framework so that all investors-both domestic and foreign-will know that they will be treated fairly".

As a result, Prasad argues in the book that the Chinese government, to make people believe that the RMB is a safe currency to keep their assets' value, needs to achieve not just economic and financial reforms but also reforms including more independent legal framework, more transparency in the governance.

"These are going to be very important for the Chinese economy to become a strong economy, and for the RMB to become a safe currency," he says.

As for the recent depreciation of the RMB, Prasad says in the long run, beyond three to five years, it is "quite likely that the RMB will return to appreciation because China still has a strong economy". But what will happen to the RMB in the next one to two years is really going to depend on the government's policies and opening-up to make it easier for money to flow in and out of the country," he says.

|

|

|

|

|

|

|

|