Outbound M&A deals seen to climb

Updated: 2016-08-23 07:28

By Duan Ting in Hong Kong(HK Edition)

|

|||||||||

|

A penthouse apartment in a New York building. The Chinese government's various initiatives, including the Belt and Road Initiative, have continued to be the key drivers behind the country's active M&A (mergers and acquisitions) business. Michael Nagle / Bloomberg |

Chinese private firms, SOEs tipped to seal more global pacts on back of robust stock markets

Mergers and acquisitions (M&As) involving Chinese mainland enterprises are expected to continue seeing double-digit growth in the near future on the heels of a strong overseas buying spree in the first half of this year.

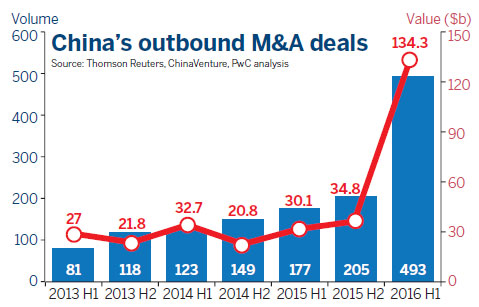

According to global professional services firm PricewaterhouseCoopers (PwC), overall M&A activities by mainland investors swelled to $412.5 billion in the first half of 2016 - up 13 percent by volume and 8 percent by value - compared with the second half of last year.

Outbound M&As were mainly responsible for the strong surge, soaring 140 percent, with the value of transactions up a whopping 286 percent to $134 billion - exceeding that of the past two years combined.

Even excluding ChemChina's $43-billion bid for Swiss biotechnology firm Syngenta - the biggest ever by a mainland buyer - outbound M&As rose 161 percent, with 24 deals worth more than $1 billion.

Erica Su, managing partner of transaction advisory services for China at accountancy giant Ernst & Young (EY), said he expects growth in China's M&A activity to maintain strong momentum.

With the value of deals worth $325 billion, privately owned enterprises dominated the M&A sector, accounting for two-thirds of the top 20 deals clinched in the first half. Privately owned companies outnumbered State-owned enterprises (SOEs) for the first time in terms of the value of deals.

Su predicts that more privately owned firms and listed companies will seek acquisitions in future, and Chinese mainland-listed companies, especially conglomerates, are eager to expand overseas.

Harsha Basnayake, Asia-Pacific leader of transactions advisory services at Ernst & Young, said, however, the Chinese government's efforts to restructure State-owned companies will stem another strong deal flow.

"The dramatic growth is due to that Chinese companies seek advanced technology, know-how and brands to bring back to China and they look to overseas markets as sources of inorganic growth, as well as taking advantage of available and competitive financing, leverage multiples - arbitrage and hedge against the yuan," elaborated David Brown, transaction services leader at PwC China and Hong Kong.

He said Chinese companies are going global, supported by active A-share markets and fast growing financial investors.

Su also explained that the mainland government's various initiatives, including the Belt and Road Initiative, have continued to be the key drivers behind the country's active M&A business. In the wake of the country's lukewarm economic growth, companies are seeking new growth engines through M&As.

Technology, consumer-related and industrials, as well as media and entertainment transactions, attracted big dollars in the first half of the year, partly because of bets on the emerging middle-class and consumer culture in China, PwC said.

According to EY, the most active sectors in China outbound M&A deals are diversified industrial products, followed by technology, both of which accounted for 60 percent of the country's total value of outbound deals.

Su said he expects healthcare and bioscience to be the next most sought after sectors for acquisitions, while know-how, technology and brands will continue to be the main acquisition criteria for Chinese buyers.

EY said there's one particular trend it may expect to see in the next 12 to 18 months - the major oil and gas players on the mainland are expected to offload the high-priced assets they had acquired when oil prices were still at their peak. This may create a wave of activities within the sector.

Basnayake sees continued interest from Chinese buyers in European companies despite Brexit, and a slowdown in Asian companies' interest in US companies is expected due to growing political uncertainties.

Besides unstable political and regulatory situations, Chinese companies seeking overseas buying need to take law risks into consideration, such as intellectual property, labor and environment problems, as well as competition and monopoly issues, warned Benson Xiao Shuobin, a partner at global law firm Dentons.

tingduan@chinadailyhk.com

(HK Edition 08/23/2016 page11)