Further yuan slide, if any, will be modest

|

|

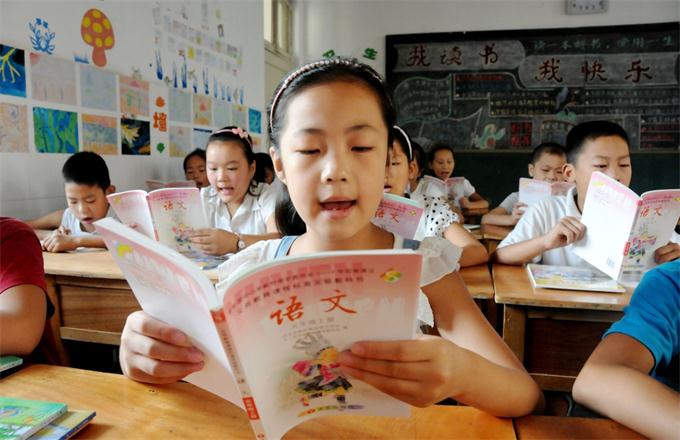

An employee counts yuan banknotes at a bank in Huaibei, Anhui province, June 22, 2010. [Photo/Agencies] |

The recent depreciation of the yuan against the US dollar has created anxiety in China. But it largely reflects a strong US dollar driven by investor expectations about higher US interest rates.

The pressure has increased after Donald Trump's election as the next US president. Markets are betting on wider fiscal deficits, stronger growth and higher inflation in the US-the latter in part because of more protectionism.

However, the yuan has actually depreciated less against the US dollar than other major currencies. As a result, China's trade-weighted, effective exchange rate has remained broadly constant in recent months.

Since late 2014, when net financial outflows became large enough to put depreciation pressure on the foreign exchange market, the People's Bank of China, the country's central bank, has walked a fine line between allowing some depreciation in the face of pressure while resisting significant weakening of the yuan.

However, a policy of curbing depreciation pressures can be costly in terms of foreign exchange reserves and potentially unsustainable. Since early last year, China's reserves have declined by $677 billion, adjusted for valuation effects, or 17 percent of the total.

Going forward, uncertainty in global markets is high, as it is unclear how macroeconomic policies will change under the incoming Trump administration. But depreciation pressures on the yuan are likely to remain, reflecting the prospect of higher US interest rates and a strong US dollar, as well as continued portfolio rebalancing.

In the face of continued outflows, there may be a case for reducing or even abandoning foreign exchange intervention and letting the foreign exchange market pressures drive the yuan weaker. This would limit or even halt the reduction of foreign exchange reserves and could reset expectations for the yuan going forward.

However, while capital account factors point to further depreciation, in terms of the real economy there is no obvious case for significant further trade-weighted depreciation. Indeed, China still runs a healthy current account surplus and the global market share of its exports is still rising.

In such circumstances, a significant depreciation may lead to overshooting, which would be unhelpful for the real economy. This is an issue for China's policymakers, as they tend to employ a "real economy" perspective on the exchange rate policy.

A rapid, large depreciation could also compromise confidence in the yuan, spark turmoil in global foreign exchange markets and evoke unfavourable reactions from politicians around the world. Such considerations make steps to reduce capital outflows more likely than significant depreciation.

While there is still much uncertainty about Trump's China policy, there are some conclusions that we can already draw. On balance, we expect the Trump administration policy to be a negative for China's exports. Under Trump the US may also push for a stronger yuan.

Equally important, the Trump administration is likely to put much more emphasis than that of incumbent President Barack Obama on shrinking the US trade deficits-both the overall one and the one with China. And the appreciation of the US dollar will make it harder to bring these external deficits down. This will add to pressure for a stronger yuan since China would prefer a stronger yuan rather than restrictions on its exports.

In all, taking into account that China's real economy does not really need a weaker exchange rate any more, considering the spectrum of choices, the PBoC's overall cost-benefit analysis is unlikely to point to a major depreciation of the yuan.

Thus, in an environment of higher US bond yields and accompanying upward pressure on the US dollar, we expect the PBoC to continue to walk a fine line between allowing some depreciation while resisting significant yuan weakening. We forecast the yuan-US dollar rate to be 6.95 at the end of 2016 and expect it to hover around that level in 2017.

To contain foreign exchange market pressures, we expect efforts to more strictly enforce existing capital account restrictions and probably implement additional ones, following the recent ban on using Union Pay to transfer money to Hong Kong to buy insurance products. The government could also take lower-profile steps such as slowing down outbound investment by State-owned enterprises and banks' overseas lending.

The author is head of Asia Economics at Oxford Economics.