Reform must usher in best income tax system

|

|

File photo shows a seal placed on several 100 yuan notes.[Photo/IC] |

One of the significant goals of the tax system reform is to establish an individual income tax mechanism that combines the classified and comprehensive taxation systems. At present, the classified individual income tax system levies 11 kinds of taxes based on different calculation methods.

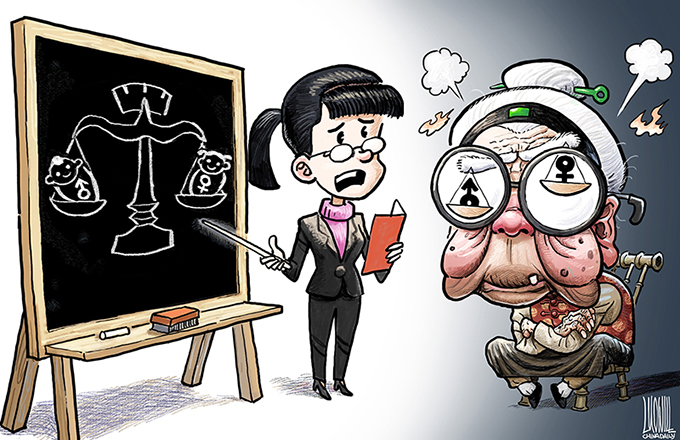

Classified individual income tax is easy to manage but has many disadvantages. For example, people earning the same amount of money may pay different amounts in taxes. But under the comprehensive taxation system, tax can be collected according to a unified plan, which to a large extent can solve the problem of unfair taxation.

The current individual income tax threshold is 3,500 yuan ($509) per month, which cannot be adjusted for standard deduction. And comprehensive taxation system should have an inherent dynamic adjustment mechanism for standard deduction, which allows standard deduction to be adjusted according to the changing national basic living expenditure.

However, China is not yet ready for comprehensive individual income tax system, so the authorities have decided to combine the classified and comprehensive tax systems to meet the needs.

This brings us to special deduction, a new concept for China's individual income taxation system, which is not simply decided by administrative authorities, but also relates to the revision of the individual income tax law. Special deduction should be based on the actual situations in different regions, considering the difference in living expenditures in different regions.

Special deduction is important because individual income tax should be levied on individuals' incomes after deducting the amount of money they spend on necessities. If such expenses are not deducted from individuals' incomes, income tax can greatly affect people's livelihoods.

Food, clothing, housing and transportation are basic human necessities, so the money individuals spend on them should be deducted from their incomes before being taxed. As housing prices are excessively high in many cities, it is important to deduct the interest paid on housing loan, too, from individuals' incomes. But the actual amount of housing loan interest to be deducted should be decided according to the actual situations.

Individual income tax collection can drop considerably if the total interest on housing loan is fully deducted from individuals' incomes, because in many cases people won't need to pay any individual income tax at all. So special deduction for housing loan interest should be fixed after taking into consideration different factors, in order to prevent the new taxation system from creating unfairness again.

The money used to support senior citizens and/or raise children is a drain on the economic resources of individuals and households, so it should be part of special deduction too. This in turn will increase the pressure on tax collectors and management authorities, because it involves a series of complicated factors: different income levels of senior citizens-some lead comfortable lives on their earnings while others depend on their children-the income levels of households and individuals that pay for eldercare, the percentage of household income that individuals pay to support their parents, and so on.

Special deduction should also include the expenditure on children. According to statistics, the overall fertility rate in China is only 1.047, which is about half of the world's average. Of course, the government can reduce the expenditure of individuals and families raising children by investing more in education and healthcare, but it should also deduct that expenditure from their taxable incomes because raising the birth rate of the country is part of the national population development strategy.

A fair individual income tax system reform should take into account all the above factors and introduce the best possible taxation system.

The author is a research fellow at the National Academy of Economic Strategy, Chinese Academy of Social Sciences.

- Finance ministry rolls out tax relief for debt-laden Chinese companies

- Businesses to benefit from value-added tax reform

- China to waive capital gains tax for Shenzhen-Hong Kong Connect

- Small-engine tax policy new driver for auto sales

- Favorable tax policy could be extended

- Income tax reform needs better homework