Finding a strong anchor for the economy

|

|

A clerk counts money for a client at an Agricultural Bank of China branch in Hainan province. [Photo/IC] |

With the support from expansionary fiscal policy and accommodative monetary policy, we (at Standard Chartered) expect China's growth momentum to pick up mildly in the fourth quarter, leading to a 6.8 percent year-on-year growth for the whole of 2016.

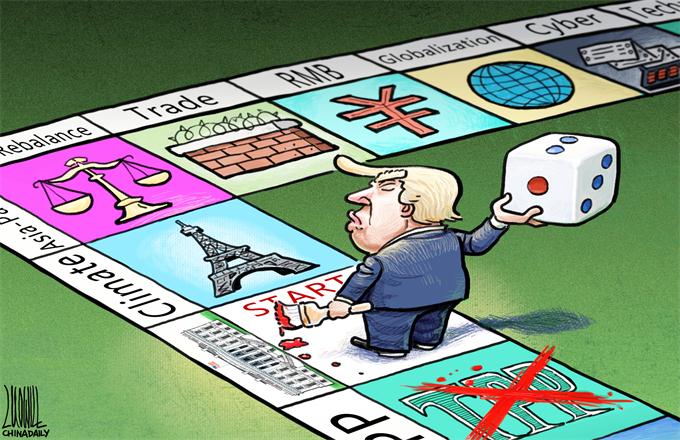

For 2017, we expect the government to prioritize growth stability. With Donald Trump becoming United States president, the United Kingdom starting the Brexit process, and major European countries going to the polls, 2017 will be a year of intense external uncertainty for China. Domestically, China's economy continues to face headwinds and rising financial risks. So, we expect the government to give high priority to political, economic and social stability, and maintain its growth target of 6.5-7.0 percent for 2017.

On the bright side, the service sector-which accounts for more than 50 percent of the economy-h(huán)as been growing consistently at 7-8 percent over the past year, contributing about 3.5 percentage points to GDP growth. In addition, private-sector investment appears to be recovering after Producer Price Index turned from deflation to inflation in September. Recent Purchasing Managers' Indexes have risen, too.

However, we see the following downside risks to the economy in early 2017: Overcapacity reduction in the steel and coal industries is likely to continue, weighing on investment in the mining and manufacturing sectors. Recent policy measures to cool the property market have already resulted in slower housing sales, which may affect housing-related retail sales and dampen developers' investment appetite. Fiscal support has been front-loaded in 2016, with spending growing twice as fast as revenue in the first three quarters. But spending fell 12 percent year-on-year in October, indicating less room for expansion in the fourth quarter, which could slow government-related activity in the first quarter of 2017.

Trump's policies are likely to create headwinds for China's exports, and US-China relations are likely to experience a bumpy start to his presidency. During his presidential campaign, Trump threatened to label China a currency manipulator on his first day in office and impose up to 45 percent import tariffs on Chinese products. While it would be technically difficult for the US Treasury to call China a manipulator without first revising the criteria it adopted earlier this year, the US president has considerable power over trade policy-the US Trade Act allows the president to impose trade restrictions without Congressional approval. Given the interdependence of the two economies, however, an all-out trade war would inflict damage on both countries and is likely to be avoided.

Therefore, we expect current account surplus to narrow to 2.6 percent of GDP for 2017 and 2.5 percent for 2018, reflecting the less benign external environment. We therefore forecast 2017 growth at 6.6 percent.

Policy support is needed to achieve the growth target, and the expansionary fiscal policy is likely to continue in 2017. Tighter control of local governments' extra-budgetary activity has allowed the government to increase budgetary spending. And the Ministry of Finance has indicated the government debt-to-GDP ratio was below 40 percent at the end of 2015, leaving ample room for more proactive policy. We expect the official budget deficit to increase to about 3.5 percent (4.0 percent based on our definition) of GDP in 2017.

Monetary policy may gradually shift from an easing bias to a neutral position due to rising inflation, the yuan's depreciation pressure and the incomplete task of deleveraging. Average PPI is expected to remain in low single digits in 2017, and consumer price index inflation may trend higher on resilient prices for services and housing rents, but we cut our CPI inflation forecasts to reflect subdued food inflation in the second half of 2016.

We expect CPI inflation average to be 2.0 percent in 2016, and 2.1 percent in 2017. In addition, policymakers appear to be increasingly concerned about asset price bubbles, one-way yuan depreciation expectations and rising corporate leverage. As a result, we expect no cuts in the benchmark rate or reserve requirement ratio in 2017. The People's Bank of China may rely on open-market operations and lending facilities to maintain sufficient liquidity, and the gap between credit growth and GDP growth is likely to narrow.

The author is an economist at Standard Chartered China.