It's time to end alchemy of cheap money

|

|

US Federal Reserve Chair Janet Yellen attends a press conference in Washington D.C., the United States, Sept 17, 2015. [Photo/Xinhua] |

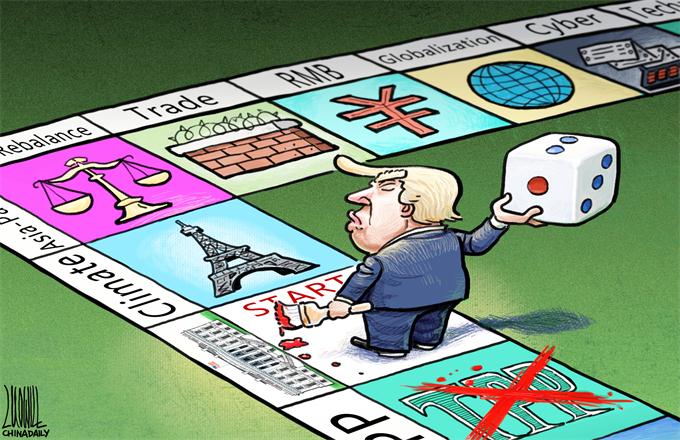

After a year-long pause, the US Federal Reserve finally raised interest rates on Thursday. The glacial pace at which the Fed raises interest rates is no cause for optimism. And although the increasing disruption US president-elect Donald Trump is expected to cause around the world should make such a cautious approach a virtue, its underpinning illusion that cheap money can save the world economy from the dire consequences of the global financial crisis, which spread from the United States in 2008, has long impeded painful but necessary structural reforms.

If the world economy is to get back on the track of sustainable and inclusive growth, policymakers across the world have to take concrete measures to replace pain-killing cheap money with pro-growth structural reforms as quickly as possible. So, the way the US and China, as the world's two largest economies, will lead by example in pioneering new growth patterns will largely shape the future of the world economy.

With all three major US stock indexes hitting record highs recently and the Dow very close to the magical 20,000 mark, investors had made fairly clear their expectation of an interest rate hike, only the second in a decade.

Had the Fed failed to take action at the two-day meeting on monetary policy this week, its plans for the "normalization" of interest rates above their historically low levels, which already fell off track for much of 2016, would lose all credibility, giving rise to chaos and fears in international financial markets.

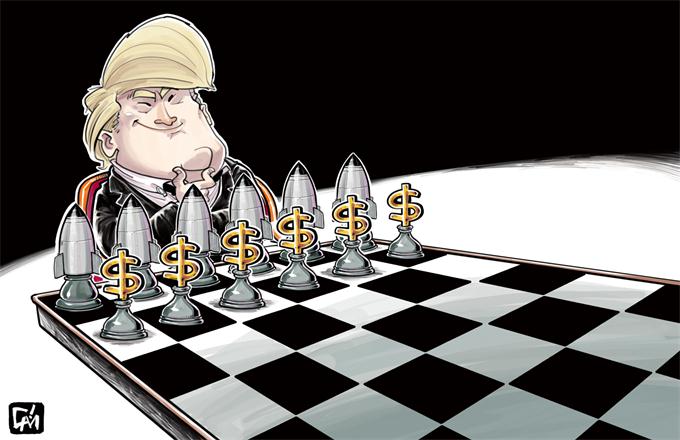

Still, the belated interest rate hike does not come without a price. A quarter-point increase has been fully priced in while two or three are expected next year. And Trump's call for faster interest rate hikes has helped send the dollar higher to hurt emerging markets by leading to currency devaluation and capital flights from emerging economies.

For those who believe in the slogan "America first", they can shrug off the impact of the Fed's decision on many developing economies by saying it's none of their business. Yet it is unrealistic for the US economy to thrive on excessive volatility in the global financial markets that will deprive developing countries of a stable environment for growth and depress their demand for US exports.

Besides, the fact that the Fed was so reluctant to raise rates despite seemingly rosy economic data on the health of the US economy also highlights the worries that accelerated monetary tightening could easily topple a fledging recovery backed by extremely accommodative monetary policies.

The Fed and other countries' central banks that have embraced cheap money as more than a short-term painkiller will have to face the dilemma of "damned if you do, damned if you don't" when they try to normalize interest rates in their economies.

Slowly as it is, it is hoped that the Fed can continue to dig itself out of the hole of cheap money without interrupting the US recovery or wrecking havoc in international markets. If that is the case, the Fed can breathe a sigh of relief for managing to safely walk through the powder house torch in hand. If not, no central bank should continue playing with the ineffective alchemy of cheap money because the Fed is not buying time for necessary structural reforms but closing the window of opportunity on it.

As the world's second-largest economy, China is not immune to the consequences of both the global financial crisis and some immediate policy responses. Severe overcapacity in some sectors, and asset bubbles in the stock market and the housing market have shown that cheap credit without painful structural reforms will not be enough to sustain China's economic development after more than three decades of double-digit growth.

For Chinese policymakers, structural reforms will remain a top priority to boost sustainable growth driven by innovation and domestic consumption. If China succeeds in its economic transformation, the alchemy of cheap money will prove totally unnecessary.

The author is a senior writer with China Daily. zhuqiwen@chinadaily.com.cn