China "unicorns" not another tech bubble

The private market landscape in China is changing, which has triggered a shift in the focus of private equity investments in the region as well. China continues to face challenges, both in macroeconomic conditions, such as slowing GDP growth, and a slowdown in the venture capital market. We are seeing an increase in "unrealized portfolios" in the region and the outlook for exits is more challenging.

Amid these changes ongoing venture capital investment in "unicorns" may have implications for the private equity universe. However, these valuations are not likely to fall as dramatically as expected. Valuations in China’s venture capital market have already decreased and there have even been some "down-rounds".

Despite some tightening in the market, we believe traditional private equity growth investments can still gain traction, though successful investors must factor in trends and cycles in order to select the right investments. One sector presenting significant investment opportunities is the service industry. There has also been a shift away from B2C (business-to-consumer) sectors towards those focused on B2B (business-to-business).

This in turn is seeing investments move away from online-to-offline (020) and mobile businesses, areas which have a huge quantity of capital deployed so competition is already strong. In acknowledgement of this environment, savvy general partners are more actively looking at diverse, less crowded sectors for suitable investment opportunities, such as enterprise business and digital software.

Perhaps most notably, the emergence of "unicorns", the fabled venture-backed companies with a private valuation of more than US$1 billion, has also resulted from this wider trend. As these types of firms continue to emerge and grow, it is important to take note of some substantial implications for the investment community. Primarily, there is now a significant category of companies to which normal investors have no access. Previously, investors would gain access to these companies and their sectors through venture portfolios or when the companies became public. However, there has been a dearth of IPOs amongst recent unicorns, and as long as they continue to stay private, investors will have a large segment of the market under- or unrepresented in their portfolios.

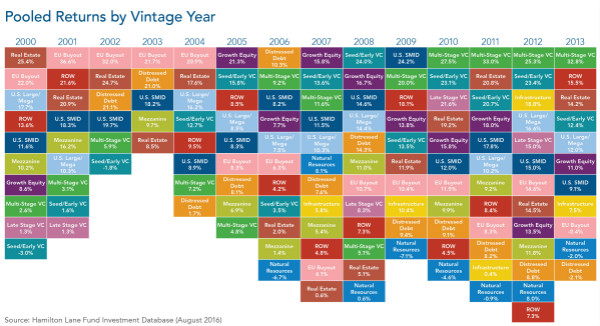

Looking more broadly at venture capital, we believe it is an increasingly attractive segment of the market. Venture has shown strong results in recent years as illustrated in the chart below, with multi-stage VC exhibiting returns of 25-30 percent from 2010 and early stage VC and growth also emerging as top performers.

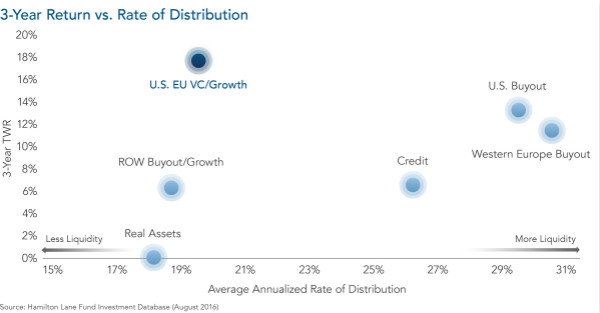

However, when we track performance against liquidity (i.e. cash making it back to investors), venture is less liquid than many other types of private investment. As the Periodic Table chart demonstrates, venture capital has largely been generating great returns over the last few years. Yet these returns are largely "on paper", especially when compared to other alternative subsectors. What is going on?

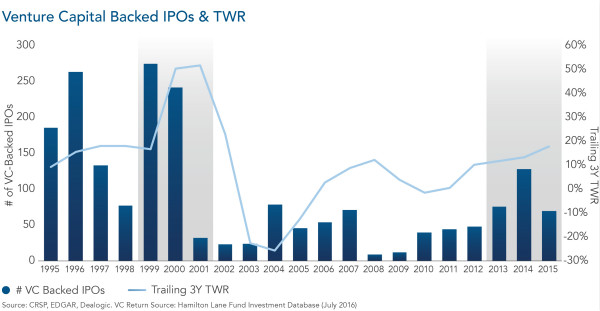

This is very much a function of the unicorn world not going public. During the venture boom of the 1990s there was a high level of venture-backed IPOs. As the chart shows, today’s numbers pale in comparison; private markets are starting to resemble old public markets. Mutual funds are now participating in the later-stage financing rounds of unicorns, with venture funds needing more capital than they have on hand to manage their investments.

Despite these speed bumps, there is still reason to be optimistic. The rise of unicorns has actually started to bring some fundamental changes in the investment landscape, most notably that buyout firms will begin raising dedicated pools of capital to invest in unicorns. More existing unicorns will also need to consider exit opportunities, with founders showing no interest in going public and venture firms having less ability to force an offering.

There will of course be instances in which unicorn valuations will come down. However, we believe the decline will not be as dramatic as what we saw with public markets during the internet boom. Additionally, while we may see corrections as these valuations come down, if the fundamentals of a company are good, history has shown us that declines will likely be minimal.

The author is a managing director at Hamilton Lane in Hong Kong.

The opinions expressed here are those of the writer and don't represent views of China Daily website.