A better way to proceed from realm of 'R' to 'D'

When business leaders meet to talk about innovating their industries, they typically focus on initiatives like improving government funding for basic research, or building technology hubs and incubators. But a crucial element of "innovation" is often absent from these discussions: the final products.

That's no oversight. On the contrary, the lack of product-focused discussion is symptomatic of a far more serious problem facing businesses of all sizes in nearly every industry. Simply put, product development takes a back seat in innovation strategy because the financial link between ideation and commercialization is broken.

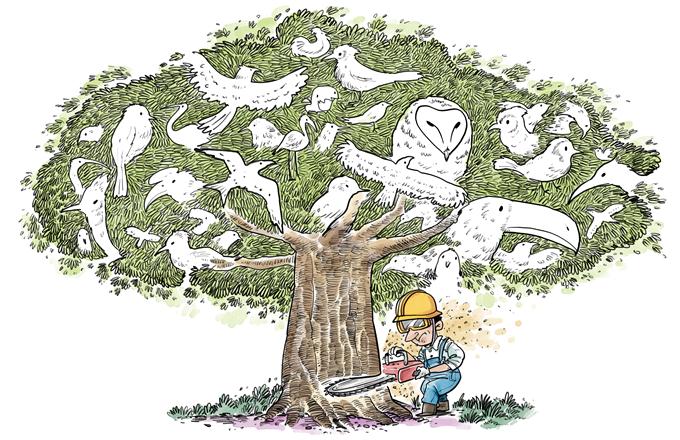

For economies to prosper, good ideas need a nudge getting to market. Innovative products are, after all, what makes life healthier, more efficient, and more fun. But there's ample evidence to suggest that development-the "D" in research and development-has not kept pace with the blistering speed of "R"-modern-day research.

Even the most robust economies have a surplus of ideas that never reach consumers. In the United States, for example, just 5 percent of all active patents are ever licensed or commercialized. Most companies use less than a quarter of the inventions they own. Technology transfers from academia aren't going so well either. Although more than 75,000 patents have been issued to US universities since 1969, the vast majority of technology transfer offices-administrative units that manage a school's intellectual-property output-are failing to generate enough revenue even to cover their operating costs.

If we want to reverse these trends and maximize innovation output, we need more mechanisms for funding the commercialization of smart ideas.

At the moment, venture capital-backed startups are the standard mechanism for moving from "R" to "D". These companies are formed for the sole purpose of pushing good ideas through the development pipeline. And, given the stellar valuations of some startups, it's easy to assume that a healthy ecosystem of savvy companies and venture capital funding is all that is needed to ensure innovation.

But most companies are simply unable to take good ideas to market, because they lack access to pools of capital earmarked for innovation. Small and medium-sized enterprises often struggle to secure financing to build R & D infrastructure. Multinational corporations use retained earnings to finance R & D, but because this approach can adversely affect a company's stock valuation, even they tend to be conservative in pushing new ideas forward.

Compare that scenario with the way that multinationals finance infrastructure investments. Let's say, for example, that DuPont wanted to build a new manufacturing facility. It could borrow money from a bank and repay it from resulting profits. But if DuPont needed capital to produce a new chemical in an existing plant, it couldn't get a loan, because banks don't know how to assess the risks of innovative products (in the chemical industry or any other).

Unless you're a giant like Alphabet, Apple or Tesla, you can't justify the risk and expense of a blue-sky R&D program. These days even the biggest companies are more likely to acquire a prepackaged technology than to develop it in-house. That's one reason why mergers and acquisitions are increasingly common (and why some observers see M&As as the new R&D).

This situation isn't ideal for investors either. Consider the case of Sony's PlayStation gaming console. Development of the PlayStation drew considerable attention from investors in the 1990s. But the only way to back the project was to buy shares in the parent company, which encompassed music, film, camera, and TV businesses as well. This sort of misalignment is just as inefficient for companies as it is for investors. And it's not even an option for smaller companies; selling equity is hard when you're an SME.

Clearly, current funding models stifle product-specific innovation and investment, and all but freeze out SMEs. The government officials with whom I speak are more concerned about maintaining the health of their countries' SMEs than protecting multinational corporations, for good reason: SMEs everywhere account for an overwhelming share of employment and job creation. Yet they aren't getting the financing opportunities they deserve.

To turn things around, businesses need financing vehicles tied to product development. One idea is debt-based funds offering bonds with more predictable returns based on revenue from new products. These funds could be structured to distribute risk among a variety of projects or sectors, which might make them more attractive to investors who avoid high-stakes venture financing. This kind of funding would also enable much closer alignment between investors and innovative projects.

Companies with proven track records, technical skills, experienced management teams, and established sales channels are sources of innovation that no country can afford to squander. The limitations of the current financing regime mean that countries are letting opportunity pass them by. Despite few ready avenues for product commercialization, the world's companies, research institutes, and university and government laboratories together spend more than $1 trillion on R & D annually. Without a new approach to product financing, most of what they discover will remain on the shelf.

The author, former chief architect at Microsoft, is founder and chief technology officer at Intellectual Ventures