Call to adjust interest rates

Updated: 2012-01-30 09:24

By Zhao Huanxin (China Daily)

|

|||||||||||

Legislation 'best way' to deal with mass incidents

BEIJING - A former senior legislator has proposed that the authorities adjust interest rates to prevent inflation from eroding savings.

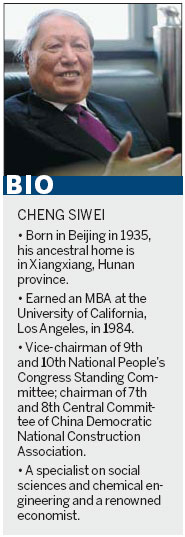

Cheng Siwei, former vice-chairman of the Standing Committee of the National People's Congress, the top legislature, also said that the government must use legislation to resolve an increasing number of mass incidents, or protests, rather than trying to "stifle" them.

There have been negative real interest rates for the last 23 months, the longest period in a decade. Inflation last year was up 5.4 percent from 2010, much higher than the 3.5 percent one-year deposit rate, according to the National Bureau of Statistics.

"China has maintained the lowest interest rate among major developing countries," the prominent economist told China Daily.

"Banks have fluctuated loan rates but not for deposits, and thus they are raking in huge profits while the people are not."

The statistics agency said that the consumer price index (CPI), a key gauge of inflation, rose 4.1 percent in December, the lowest growth in 15 months, sparking some rosy predictions.

"For this year we expect CPI to moderate further," Reuters quoted Dongming Xie, economist at OCBC Bank in Singapore, as saying. "The negative real interest rate is likely to be corrected in the second quarter of this year."

But Cheng said he anticipated that China's inflation rate would remain above 5 percent in 2012, citing surging oil prices, rising labor costs and, particularly, money supply as factors.

Although the government is pursuing a prudent monetary policy in 2012 it may not tighten money supply too much as it has to sustain development of smaller and micro businesses while completing a large number of ongoing projects, he said.

This means inflation will be higher than interest accrued on bank deposits.

"The banks should feel embarrassed by earning money this way," Cheng said. "Just like they are fluctuating loan rates, banks should make interest rates variable."

India was the first to have market-oriented interest rates among developing countries, Cheng said. "If deposit interest rates fluctuate, there will be more intense competition among banks to attract clients."

Cheng, however, highlighted a dilemma: while raising benchmark deposit interest rates helps subdue inflation and reverse negative interest rates, it could also put enterprises and local governments in dire financial straits.

And rising interest rates would also attract an inflow of "hot money", speculative capital.

"China's economy has seen a slowdown, but banks are still making huge profits. It is time for the government to consider fairer distribution between banks and people," Cheng said.

Wei Jianing, deputy head of the macroeconomic research department at the Development Research Center of the State Council, attributed local government debt risk to the locked interest rates mechanism.

"Negative interest rates restrain effective capital resource allocation and boost the illegal private lending market," Wei said.