Despite maintaining the Chinese government's debt rating at Aa3, Moody's cut the outlook on China from stable to negative on Wednesday, a move that means it could downgrade China's credit rating in the medium term. But defying the lowered outlook on China, the yuan's exchange rate remained stable and Asian stock markets ended positive on Wednesday. In fact, the Shanghai Composite Index ended up 4 percent to more than 2,800 points.

The operation of modern financial markets and their regulation depend highly on credit rating agencies, and financial regulation is aimed at creating favorable conditions to strengthen market discipline. But the precondition of effective market discipline is full information disclosure based on unified accounting criteria and credit rating instruments.

Because of their status in the global credit rating circle and the impact of their rating results on the global financial market, credit rating agencies such as Moody's and Standard & Poor's usually cause a country's stocks and exchange markets to tumble and fuel panic by downgrading its sovereign credit rating. If the downgrading involves a major economy, such panic usually spreads to other countries in the region, even beyond.

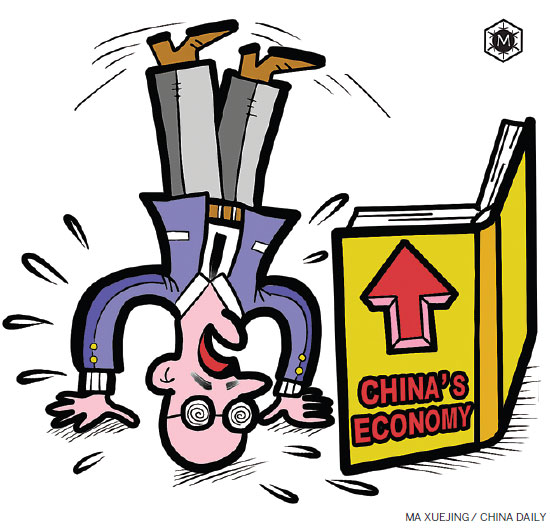

The muted market response to Moody's negative outlook on China reflects the credit rating agency's weakening influence on the market, especially because its ratings may not be based on objective standards. Owing to its misperceptions on China, Moody's has failed to win extensive endorsements for its negative outlook on the country. Even the most risk-sensitive securities portfolio investors have reacted coldly to its announcement.

Moody's said its negative outlook resulted from China's rising government debt, its declining foreign reserves and growing uncertainties over reforms. But this perception of Chinese government's rising debt is wrong.

China is very different from the United States, European countries, Japan and other emerging economies in terms of sovereign debt, because a large part of its government expenditures have gone into investment. This means the Chinese government's debts are correspondingly linked to assets. As a result, even the same ratio of government debts will be a lighter burden on and less of a security concern for China, compared with other countries.

I’ve lived in China for quite a considerable time including my graduate school years, travelled and worked in a few cities and still choose my destination taking into consideration the density of smog or PM2.5 particulate matter in the region.